Rs 1,000 now buys $13.5 against $14 a year ago.

Krishna Kant reports.

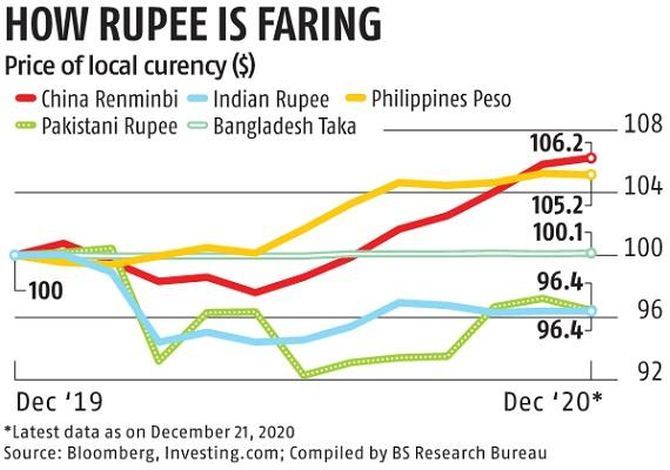

The rupee is likely to end calendar year 2020 as the worst performing currency in Asia, even underperforming minor South Asian currencies such as the Pakistani rupee and Sri Lankan rupee.

In contrast, most Asian currencies have either appreciated against the US dollar in the last 12 months or retained their value.

The rupee was down 3.6 per cent during the year so far against appreciation of other Asian currencies such as the Chinese renminbi, Philippines peso, South Korean won, Malaysian ringgit and Thai baht.

The rupee closed around Rs 73 to a dollar on December 31 against Rs 72.2 at the end of December 2019.

In other words, Rs 1,000 now buys $13.5 against $14 a year ago.

In comparison, the Sri Lankan rupee and Pakistani rupee are down 3.5 per cent each against the dollar in the current calendar year so far.

India's South Asian neighbours are the worst performers after the Indian rupee.

They are followed by the Indonesian rupiah that has lost 1.9 per cent of its value against the dollar in the current calendar year so far.

Taiwan's dollar is the top performing currency in Asia this year and is up 6.4 per cent against the US dollar.

It is followed by China's renminbi that is up 6.2 per cent against US dollar.

They are followed by the Philippine's peso that has appreciated by 5.2 per cent during the year, South Korean won (up 4.2 per cent), and Malaysian ringgit (up 1.0 per cent).

The Thai baht, Bangladesh taka and Vietnamese dong, on the other hand, either maintained their value or appreciated marginally against the dollar in the last 12 months.

The Indian currency lost purchasing power against major currencies despite record investment by foreign portfolio investors (FPIs) in the domestic equity market.

Strong FPI inflows generally result in currency appreciation.

"Macroeconomic factors such as strong capital flows, a weak dollar, low crude oil prices and decline in imports favour an appreciation in Indian rupee against major currencies. These tailwinds, however, have been undone by record decline in India's GDP in FY21 and high retail inflation," said G Chokkalingam, founder & managing director at Equinomics Research & Advisory Services.

According to data from National Securities Depository, FPIs have stocks and shares (on a net basis) worth $21.7 billion since January this year.

Nearly 70 per cent of this inflow came in the last two months, pushing stock prices to record highs.

This is the highest investment by FPIs in a year since 2012 when they had pumped in $24.4 billion into Indian equities.

Globally, the dollar has been on a weak wicket in the post-pandemic environment, lifting the fortunes of emerging market currencies.

'The dollar is weaker, the US yield curve steeper and equities, commodities and commodity-linked currencies have gained,' wrote Abhishek Goenka of India Forex Advisors.

The Dollar Index, however, jumped as investors sold risky assets such as emerging market equity, leading to fall in the value of Asian currencies, including the rupee.

The Dollar Index is, however, still down nearly 6 per cent in the last 12 months, losing value against major currencies such as the euro, Japanese yen, British pound, Canadian dollar and Swiss franc.

This also provided tailwinds to emerging market currencies, including those in Asia.

India's currency, however, missed the party due to a big economic hole dug by the pandemic.

"FPI inflows in 2020 are largely filling the pit rather than raising the ground level, given the economic contraction suffered by India due to the pandemic. India's GDP in FY22 may still be lower than that in FY19. This is unlike China that is likely to grow in the current year as well as the next," said Chokkalingam.

GDP growth is a key factor in currency movement and a faster economic growth is associated with currency appreciation.

FPI inflows into equity have also been partly neutralised by a selloff in the bond market due to inflation concerns.

According to NSDL data, FPIs have been net sellers in the Indian bond market to $14 billion in 2020 so far.

Feature Presentation: Aslam Hunani/Rediff.com