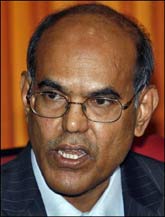

Reserve Bank Governor D Subbaro on Tuesday said there is scope for banks to lower lending rates further, but most top bankers maintained that interest rates will remain the same in the near term and could even rise after 3-4 months.

Reserve Bank Governor D Subbaro on Tuesday said there is scope for banks to lower lending rates further, but most top bankers maintained that interest rates will remain the same in the near term and could even rise after 3-4 months.

"Banks say that the demand for credit is picking up on the back of investment in projects. Banks have the scope to reduce the lending rates," Subbarao told in his customary post-credit policy press conference, justifying the bank's decision to keep the key rates unchanged.

The RBI Governor said bankers informed him that the demand for credit in certain segments like home and retail is picking up, which was a welcome sign.

Subbarao said he saw visible signs of economic recovery. However, he said, there are certain risk factors in the economy, especially in the farm sector, given the uncertainty over the monsoon.

He expressed concern that the performance of farm sector could have a spill over effect on the industrial sector as well.

Subbarao also felt that exports have not picked up, recording a slowdown for the last eight months. Though exports form only 15 per cent of the GDP, it could pose risks to the economic revival, he said.

Interest rates to remain same: Bankers

However, bankers meanwhile said that interest rates on home loans and retail borrowings are unlikely to go up immediately, but observed they could harden in the latter part of the fiscal when the credit growth improves.

Welcoming RBI stance on key rates in its quarterly review of monetary policy, they said liquidity position warranted that the apex bank keeps policy rates and ratio untouched.

"There is ample liquidity in the system. The rates will remain the same as long as liquidity is comfortable. As the credit growth picks up, there may be some pressure on rates," SBI Chairman O P Bhatt told reporters after the bankers' meeting with RBI Governor D Subbarao.

In its quarterly review of annual monetary policy on Tuesday, the Reserve Bank kept the key short-term rates and cash reserve ratio (CRR) unchanged and projected an economic growth at 6 per cent in FY 2010 with an upward bias.

Bank of Baroda's chairman and managing director M D Mallya also said that the rates will remain the same in the near term on the back of sufficient liquidity and weak credit demand.

"They (RBI) have done what they are supposed to do at this point of time. I think the interest rates will remain same (in the immediate future)," Mallya told PTI.

Announcing the policy, RBI said that there are signs of recovery in the economy in line with revival in global markets, which, the bankers said will help improve the credit offtake in the months ahead.

Union Bank of India CMD M V Nair said the RBI policy outcome was largely dependent on the prevailing liquidity situation. He said that the evolving market conditions will determine the interest rates in due course.

"I think that the interest rates will remain stable for some time," Nair said.

ABN Amro's India Head Meera Sanyal said RBI has taken an accommodative policy stance, primarily owing to the government's massive borrowing programme. She said the interest rates are likely to harden moving ahead in line with the pick up in credit offtake.

"We need to watch out on credit offtake. If it picks up, interest rates could harden," Sanyal said.

Kotak Mahindra Bank Treasuer Mohan Shenoy said Reserve Bank's status quo in repo, reverse repo rates was expected. Unless credit offtake picks up, the lending rates will remain at the same level, he said.

"Now the credit offtake is around 16 per cent. It has to go up to 22-23 per cent for the rates to rise," Shenoy said.