Place your bets only on cities where you can easily monitor and where there is visible growth.

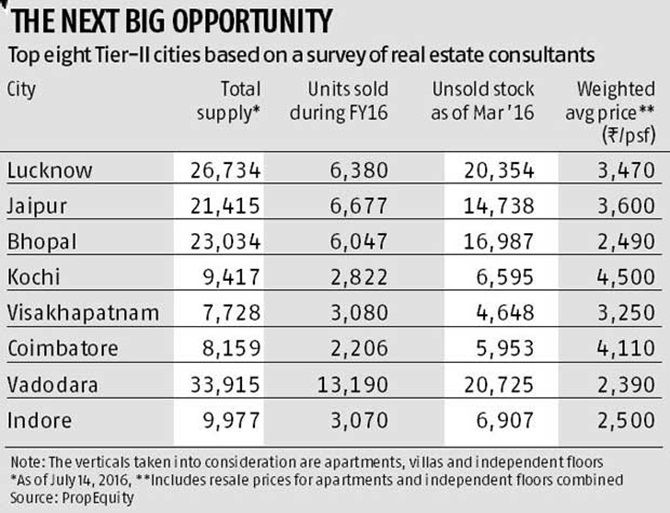

Today there's a strong case for investors to look at property in Tier-II cities.

Residential real estate prices in some of these cities have seen a correction in the past few quarters, according to the Reserve Bank of India's (RBI) House Price Index.

Moreover, many of these cities could grow at a faster pace compared to the metros if the country's economy grows at over seven per cent annually.

Then, there's the government's smart city project. If successfully implemented, it has the potential to transform many Tier-II towns into metros.

"With infrastructure improving in these cities, more industries are coming up. This is leading to migration from adjoining areas to Tier-II towns, resulting in their expansion," says Santhosh Kumar, chief executive officer - operations and international director, JLL India.

Investment opportunity

While real estate prices are stagnant in metros, some in Tier-II cities have seen a correction.

The index of Tier-II cities such as Jaipur, Kanpur and Kochi have seen 7.40 per cent, three per cent and eight per cent correction, respectively, in the January-March quarter compared to the previous quarter, according to RBI data. Prices have also fallen year-on-year.

One reason for the fall in price is the slowdown in real estate prices in metros.

The negative sentiment has gradually percolated down to these cities.

"Non-resident Indians (NRIs) usually invest in these non-metros either for their families or to create an asset that they can use if they decide to come back to India. With the global economy under pressure, there has been a slowdown in NRI investment," says Kumar.

However, with India's economic growth expected to remain robust, these cities are likely to continue expanding.

The International Monetary Fund expects India to grow at over seven per cent yearly in 2016-17 and 2017-18.

"Globally, we have seen that there are always a few Tier-II cities that grow much faster than metros, as economic activity and infrastructure developments happen there. In India, for example, there were originally four metros. Now, we have the big eight, which include Pune, Bengaluru, Hyderabad and Ahmedabad," says Shrinivas Kowligi, partner, smart cities, EY.

Real estate experts feel that the government's smart city project could provide a fillip to property prices in Tier-II cities.

Explains Kowligi: "The government wants these cities to do area-based developments and offer better mobility solutions, more public spaces, better services and connectivity, walkability, etc."

There's also an element of real estate in it, he added. The government also offers higher floor space ratio in such areas.

Typically, these are existing areas that are spread out between one sq km and four sq km. Investors can look at investing in those areas within Tier-II cities that have been selected for development.

Identifying the next boom town Tier-II or metro periphery?

Property investors are usually faced with an option-either to invest in an upcoming city or buy real estate in the periphery of a metro.

As metros continue to expand, many areas that look far off today will become part of the city in future.

Experts say the selection between the two depends on the investment expectations you have.

"The rate of return could be higher in Tier-II cities but the investment tenure needs to be long - at least a decade. If you have a shorter investment horizon, city's periphery makes sense. You will make stable but limited returns," says Kumar.

Where you choose to invest should also depend on how deep your pockets are.

Though distant suburbs of a major city are cheaper compared to buying a property in the metro, they might be more expensive than Tier-II cities.

Experts say on an average, an individual can get a two-bedroom flat for Rs 30-40 lakh in the heart of a Tier-II city with markets, school and hospitals in the vicinity.

If they want similar infrastructure in the periphery of a metro, they would need to shell out 50-100 per cent more.

Identifying opportunity

Most of the cities that have grown rapidly were educational hubs that offered talent to industries that were setting up base in these cities.

"Typically, industries come first to these cities, followed by company offices and then commercial real estate development follows," says Surabhi Arora, associate director, research, Colliers India.

Also, watch for population growth, a city's growing prominence. Infrastructure development, such as a national highway or a zonal hub for business, is another factor that can help a Tier-II city grow rapidly.

"But, these developments need to be visible in the area that you have chosen. Don't rush to buy merely on the basis of announcement," adds Arora.

"Also consider political factors that can influence the city," says Gulam Zia, executive director - advisory, retail & hospitality, Knight Frank India.

He explains: Bhubaneswar has all the elements to be the next metro city but it lacks proper political heft.

On the other hand, many companies and real estate investors are firming up plans to invest in Ahmedabad after Narendra Modi became Prime Minister.

Kumar of JLL says you could earn better returns by opting to invest in plots rather than in ready-to-move-in houses in Tier-II destinations.

Not all rosy

Not all rosy

Investing in Tier-II cities carries its own share of risks.

You should only put money in towns where you can monitor your investments or have relatives who can take care of it.

There have been umpteen cases of plots being encroached upon, or the tenant refusing to move out, taking shelter under the Rent Control Act.

"Always opt for a city that's not more than three-four hours from the place you live in," says Zia.

If you are opting for a plot, spend money on doing proper title search.

If ready-to-move-in houses interest you, do your own research on the developer by logging on to its website and visiting completed projects.

Investing in Tier-II cities is like investing in mid-cap stocks.

Have an exit strategy in place, in case your investment doesn't seem to be yielding desired results.