While growth and policy paralysis also loom, strategists are looking at risks that are likely to upset financial markets, says Malini Bhupta.

After an unprecedented correction, financial markets are back in the green, thanks to the continued dovish stance of the US Federal Reserve.

However, the risks continue to loom. Strategists are looking at the top five of these that are likely to roil the financial markets.

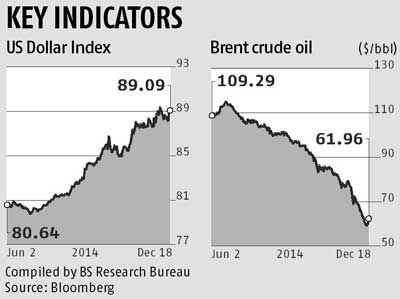

Severe dollar strength

If the dollar rises further against the world's currencies, it would lead to volatility in world markets.

For, a depreciation of other currencies would lead to a risk-off rally in equities and erode returns from bonds of emerging markets (EMs), such as India.

The greenback might rise further in 2015 if the Fed starts to raise rates and its monetary policy stance deviates from the rest of the world.

Already, Bank of America Merrill Lynch's fund manager survey suggests the consensus view is now for going long on deflation, the dollar and cash.

However, a further strengthening in the dollar will result in a sharper sell-off in commodities. This would impact commodity exporters in EMs such as Brazil and Russia.

Oil price spike

While cheap oil is great for equities, the market prefers a balanced decline, not a sharp rout or a spike.

If the oil producers’ cartel cuts production by a million barrels a day, it could see oil prices increase from the second half of 2015.

This would have a commensurate impact on the balance of payments situation for countries like India which are large energy importers.

The 40 per cent fall in oil prices has automatically given a stimulus to the Indian economy, equivalent to two per cent of the gross domestic product, in the form of savings.

If oil reverses sharply to $80/barrel and above, it would impact EMs like India, which are expected to see growth revival from FY16. If oil spikes, then energy stocks will make a comeback and the dollar strengthens further. Neither would be good for EMs such as India.

Liquidity black holes

The world's financial markets for long have been oiled by easy money.

If any of the above risks play out or deflation becomes a more prominent risk for the world economy, liquidity might suddenly dry up. Strategists term this 'liquidity black holes'.

If this happens, markets which are dependent on capital flows from outside would see a sharp pullback. Credit Suisse expects capital flows in 2015 to halve from the $16 billion seen in 2014.

Global recession

The global economy could slip back into recession if stimulus plans do not either play out or do not have the desired impact on growth.

With little ammunition left to resuscitate growth, the markets would revert to a risk-on and risk-off mode in a short span.

This would lead to a sell-off in risk assets and lead to flattening of yield curves across the world, says HSBC Global Research.

Saumya Kanti Ghosh of State Bank of India says declining crude oil prices, weak performance of the Chinese economy and a sudden spike in interest rates by Russia is dragging down EMs, on renewed concern of a global economic slowdown.

Also, several Western banks have substantial exposure to Russia.

A risk, as Russia might find it difficult to refinance this debt, as most banks have suspended dollar/rouble quotes.

And, a sharp drop in oil prices will lead to Russia (a large oil exporter) turning in a current account deficit this year.

Conflicting monetary policy moves

The fall in world commodity prices, especially oil, is leading to divergent impacts on different economies.

While cheap oil is good for the world economy at large, a free fall could impact oil producers negatively and low prices would lead to automatic production cuts.

This stress in commodity markets has already spilled over into currency markets.

More pain is expected from the credit quality across the world, especially for banks that have lent to oil firms.

Credit Suisse says: “Among the major EMs, we previously identified Korea, India, South Africa and Turkey as main beneficiaries of lower oil prices (Emerging Markets Quarterly) and we have updated our estimates in this publication (The EM Economic Impact of Lower Commodity Prices)."

However, a number of oil producing economies look vulnerable, in particular Venezuela, Russia and, to a lesser extent, Malaysia."

"As with the US energy sector, as well as the direct economic impact, markets have raised questions over credit quality at both the corporate and sovereign level.”

Photographs: Reuters