Keki Mistry, vice-chairman and chief executive of Housing Development Finance Corporation, isn't perturbed by the gloom and doom theory doing the rounds.

Keki Mistry, vice-chairman and chief executive of Housing Development Finance Corporation, isn't perturbed by the gloom and doom theory doing the rounds.

There is a strong enough reason for that: India's largest mortgage lender, which announced its latest earnings on Thursday, saw its loan portfolio grow 21 per cent year-on-year in the first nine months of the financial year.

The firm's asset quality also improved for the 28th consecutive quarter in October-December.

"Everyone has been worried about the slowdown and high interest rates and their impact on our growth.

"We have not seen any significant impact so far.

"Perhaps the property market in Mumbai has slowed down, maybe it has slowed down marginally in one or two other places, but overall there is no impact on our growth," Mistry says.

Corporate India's numbers show why Mistry is bang-on. It's only a handful of companies that are influencing the aggregate figures.

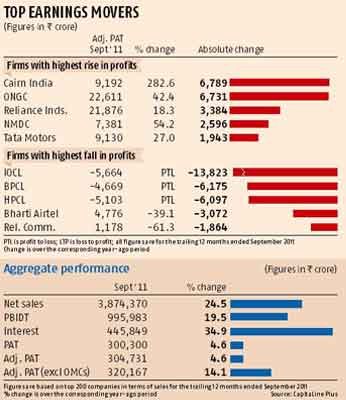

Consider this: while the aggregate growth in adjusted profit after tax of the top 200 companies by sales is just 4.6 per cent, it is strongly influenced by the performance of the three public sector oil marketing companies, which reported a loss of Rs 15,436 crore (Rs 154.36 billion) for the 12 months ended September 2011 as against a Rs 10,660-crore (Rs 106.6 billion) profit in the corresponding year-ago period.

Click here for Rediff Realtime News!

Excluding these three companies, the growth in adjusted PAT of the remaining 197 companies is 14.1 per cent.

In the oil and gas space, oil producing and refining companies did quite well (see table).

The story is the same in most sectors. Take automobiles.

Take automobiles.

Just two of the top seven companies have shown a decline in profits in the same period.

The aggregate net profit of these companies grew 14.6 per cent.

But if one excluded Maruti and Ashok Leyland, the growth would have been 20.8 per cent.

On an aggregate level, only nine of the 200 companies showed a fall of over Rs 1,000 crore (Rs 10 billion) each in their adjusted net profits, while 18 showed an increase of over Rs 1,000 crore each.

Interestingly, the latter companies represent a larger range of sectors including oil and gas, auto, natural resources, capital goods, power, banking, FMCG and pharmaceuticals.

Industry leaders and bankers thus feel the fear of economic crises eating into India Inc's earnings growth and the cascading impact on banks' asset quality has been blown out of proportion.

It is more of a crisis of confidence that has led to stock market underperformance, currency depreciation, and declining investment appetite, they say.

"There is a very deep mood of negativity right now. My feeling is only 20-25 per cent investments, that were ought to happen, probably were throttled.

"The impact on the feel-good sentiment is, however, disproportionate, probably 50-60 per cent," K V Kamath, chairman of ICICI Bank and Infosys, says.

Market pundits echo a similar view. Deven Choksey, chairman and managing director, K R Choksey Securities, says, "There is a slowdown in growth rates; actual numbers have not come down.

"It's certainly not a case of a complete slowdown. It's a case of slower intake of orders."

He points to various issues haunting India Inc, including the Land Acquisition Bill, and delays in infra and industry projects, which is why there is a slowdown in sectors like power, mining, construction and industrial projects.

Gaurav Dua, Head Research, Sharekhan, says the market is down for not one reason, but several.

Global uncertainty, a tough macroeconomic environment, a lack of policy action (a key reason), and weak financial health of the government are some.

Along with these, earnings growth is slowing down, led by monetary tightening and slowing consumer demand.

The worry is many investment-driven and interest rate-sensitive companies are feeling the heat.

Choksey says a sector that has clearly seen a slowdown is infrastructure (mainly construction, power and roads).

In capital goods, for example, L&T, Bhel and Crompton Greaves are facing pressures on either growth, profitability or order inflow fronts.

Some examples of individual companies faced with high debt and seeking debt restructuring from banks are KS Oil, GTL Infrastructure and GTL.

Beyond the slowdown in growth rates in select pockets, some companies are witnessing huge pressures. Aviation companies are a clear example.

The worst is, of course, Kingfisher Airlines.

While the pessimism about a general slowdown appears exaggerated, bankers and industry analysts say certain sectors like aviation, power, real estate, telecom and textiles need to be monitored closely to prevent the crisis of slow economic growth from intensifying.

For power generation companies, the problem is with procurement of coal and other raw materials.

A number of state electricity distribution companies in Haryana, Punjab, Tamil Nadu, and Rajasthan are in various stages of discussion with banks to recast their loans.

However, most banks and industry analysts refuse to consider that these sector-specific concerns may affect domestic economic growth and business activity in the long run.

"We are optimistic in the medium term, over the next 18-24 months. We have seen many cycles like this in the past.

"The positive side is that rural consumption is still good and keeping the economy up.

"We think calendar year 2013 will be a better year," says Neeraj Swaroop, regional chief executive of Standard Chartered Bank in India and South-East Asia.