The Multi-Commodity Exchange (MCX) has started bearing the brunt of the commodity transaction tax (CTT), as well as the recent payment crisis at the National Spot Exchange Ltd (NSEL).

Both MCX and NSEL are part of the Financial Technologies group. According to industry sources, some brokers have withdrawn or reduced their bank guarantees to the exchange. Bank guarantees are given by brokers to the exchange to trade on the platform. Typically, a broker pays a guarantee of Rs 100 crore (Rs 1 billion) for a trading position of Rs 1,000 crore (Rs 10 billion) or more.

According to industry sources, some brokers have withdrawn or reduced their bank guarantees to the exchange. Bank guarantees are given by brokers to the exchange to trade on the platform. Typically, a broker pays a guarantee of Rs 100 crore (Rs 1 billion) for a trading position of Rs 1,000 crore (Rs 10 billion) or more.

Brokers have only kept guarantees for which they have open positions. According to sources, a number of brokers, including some leading ones, have taken this decision.

The managing director of a broking house admitted withdrawing bank guarantee early this week.

“The imposition of CTT has led to a sharp drop in our commodity volumes. So, it does not make sense to lock up bank guarantees. But we continue to do some business at the exchange with lower margin money,” he said.

At another broking house, an internal flash was sent to traders’ terminals, saying clients’ positions on MCX were being limited as part of internal risk-management systems.

Kedia Commodities Director Ajay Kedia says: “Our trading volumes on MCX have been adversely affected in the past few days, as our retail clients were worried about the NSEL payment crisis.”

In response to an email from Business Standard, MCX did not comment on the number of brokers that had decided to withdraw their bank guarantees. “We have already clarified to BSE that MCX and NSEL are totally different entities, with no financial commitments or exposure to each other.

MCX is an extremely sound corporate entity, regulated by the Forward Markets Commission (FMC). It has a strong debt-free balance sheet, with a net worth in excess of Rs 1,200 crore (Rs 12 billion) as on June 30,” said the emailed response.

However, industry players said brokers and clients with outstanding positions with NSEL were worried about their bank guarantees with MCX. Clients of a number of brokerages, including India Infoline, Motilal Oswal Financial Services, Anand Rathi and Geojit Comtrade, have exposure of over Rs 1,100 crore (Rs 11 billion) to NSEL.

On Monday evening, FMC had ring-fenced MCX and its finances by saying the commodity exchange would not do any financial transaction without its permission.

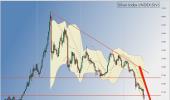

It’s not MCX alone. All players have suffered after the imposition of CTT. For instance, the daily volumes of CTT-levied commodities have fallen 42 per cent on MCX between July and August 6 (in comparison with June).

For others like NCDEX, NMCE and ICEX, the volume declines have been 19 per cent, 81 per cent and 90 per cent, respectively. But all these three players accounted for daily volumes of less than Rs 2,000 crore (Rs 20 billion). MCX, on the other hand, had volumes of Rs 48,000 crore (Rs 480 billion) from CTT-levied commodities.

In case of non-CTT-levied commodities, where MCX is a marginal player (Rs 260 crore (Rs 2.6 billion) of volumes in June), there has been a fall of seven per cent. In comparison, all other players have seen sharp spike. That is, NCDEX, a bigger player (Rs 2,200 crore (Rs 22 billion) in daily volumes in June), has seen a nine per cent rise; the volumes for NMCE and ICEX have risen 69 per cent and 473 per cent, respectively.

For the year ended March, MCX had reported net profit of Rs 298.64 crore (Rs 2.99 billion); for the quarter ended June, its net profit stood at Rs 60.12 crore (Rs 601 million).