Auto stocks were the top losers with Tata Motors hitting an 18-month low intraday on persistent concerns over China's growth slowdown.

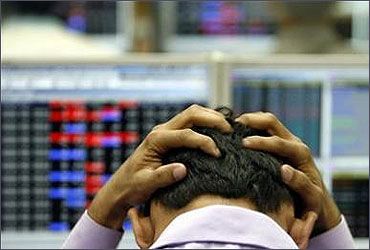

The Sensex erased all gains of 2015 after weak factory growth from China raised concerns about global growth slowdown while the weakening rupee rekindled worries over foreign capital outflows.

The Sensex erased all gains of 2015 after weak factory growth from China raised concerns about global growth slowdown while the weakening rupee rekindled worries over foreign capital outflows.

The S&P barometer BSE Sensex ended 242 points down at 27,366 and the CNX Nifty barely finished at 8,300, down by 73 points.

The Sensex had ended at 27,499.42 on December 31, 2014.

In the broader market, the BSE Mid-cap and Small-cap indices ended at 0.9% and 0.6% down respectively.

The market breadth is extremely weak with 1,806 losers against 1,009 gainers on the BSE.

Market outlook

Ravi Shenoy, AVP-Midcaps Research, Motilal Oswal Securities in an email presented his views on markets outlook.

He says, "Indian Indices closed the week lower by more than 2% as international market developments weighed heavy on Investor sentiments.

The depreciation of the INR presents a positive opportunity in the Exporters space – IT and Pharma should be gainers due to this. We would recommend investors with a 6 month perspective to look at accumulating stock in this space."

He further says, "Markets have closed close to crucial levels. We would be nimble footed in the next week and play as it comes."

Global economy

A private survey on China’s manufacturing sector highlighted that factory sector growth in China shrank to a six-and-a-half year low in August, thus consolidating the deepening concerns of a slowdown in China.

A private survey on China’s manufacturing sector highlighted that factory sector growth in China shrank to a six-and-a-half year low in August, thus consolidating the deepening concerns of a slowdown in China.

The slowdown in world’s second largest economy could drag on global growth owing to which, the Asian markets fell to its lowest level since February 2014.

China's Shanghai Composite tumbled over 4% while Japan's Nikkei slipped over 3%.

Once again Greece is back to hog the limelight as its PM Tsipras has put down his papers and called in for fresh elections after his bailout package met with intense opposition from lawmakers.

The European markets open 1% down on increasing global growth fears.

Further, investors became jittery over rising fears that a Fed rate hike could be just round the corner.

Crude Oil

Oil is heading towards its eighth straight weekly decline in Asia today, as sharp falls in equities added to worries that a lacklustre global economic growth could hurt energy demand in a market that is already plagued by the supply glut problem.

Rupee

The slide in the rupee continues as the Indian currency hit a fresh low at 65.88, sliding by another 35 paise against the American currency on sustained capital outflows by foreign funds even as the US currency weakened overseas.

Besides, the weakness in the local equities also weighed on the currency that is heading towards 66 against the US dollar.

Sectors and stocks

Sectorally, rate-sensitive sectors ended down between 1.3-2.5% while IT sector gained 0.4% on the back of a declining rupee.

Metal shares continue to lose sheen as a slowdown in Chinese manufacturing activity has put pressure on metal and mining stocks. JSW Steel, Tata Steel and Vedanta ended down between 2-3.5% each. Hindalco witnessed profit –booking and ended with over 1% gains.

Oil shares also witnessed pressure.

The falling crude prices could not aid the oil marketing companies as the slide in rupee negated the impact.

OIL, IOC, HPCL, BPCL slipped between 0.1-1.5% each while the oil producing companies such as ONGC (0.1%), RIL (1.5%), GAIL(2.6%) also edged lower.

In the financial space, ICICI Bank, HDFC, Axis Bank, HDFC Bank, SBI ended weak between 1-1.8% on concerns that demand for additional credit would remain subdued.

Maruti Suzuki has increased prices for the first time in 22 months in the range of Rs 3,000 to Rs 9,000 across models, except the newly launched S Cross.

However, the stock dropped 1.5%.

Tata Motors hit an 18-month low intraday on persistent concerns over Chinese slowdown.

The company also lost about 5,800 JLR vehicles in China’s port blast.

The stock dipped nearly 3% on the Sensex Bharti Airtel has tied up with taxi-hailing app, Uber to provide free 4G internet on its app.

The stock, however, lost 2.5% on the Sensex Other notable losers on the Sensex are Bajaj Auto and Hero Motocorp, both down by more than 3%. On the flip side, HUL, Infosys, Cipla and Sun Pharma have gained between 0.4-1.2% each in an otherwise weak market.