Markets have closed lower for fifth straight session and hit near 3-month low due to sell off among oil exploration companies like Reliance Inds and ONGC after OPEC policy meeting on Friday ended without an agreement to lower production.

Markets have closed lower for fifth straight session and hit near 3-month low due to sell off among oil exploration companies like Reliance Inds and ONGC after OPEC policy meeting on Friday ended without an agreement to lower production.

Besides, sell off among metal shares tracking weak China trade data also dampened the sentiments.

The S&P BSE Sensex ended at 25,310.33, down by 219.78 while the Nifty50 settled at 7,701.70, down by 63.70 points.

Sensex has hit its weakest level since September 29, 2015.

Among broader markets, BSE Midcap and Smallcap indices were down 0.5%-1%.

According to Ravi Shenoy, AVP- Midcap Reseach, MOSL,"Indices closed down by 0.85% on last hour selling in stocks as the Parliament was adjourned on the requirement of Congress leaders having to appear in Court for the National Herald case.

Midcaps and Small caps have been hammered more with indices lower by 1.2% to 1.5%. Another factor that weighed heavy on markets today was the China trade data that came in below estimates and caused a sharp correction in Energy and Metals counters."

He further adds, "Larger Midcaps in capital intensive sectors such as Infrastructure and Power crashed by 4% to 10%. We have been recommending caution on Mid/Small cap companies as we have seen valuations move up sharply with large number of circuit hitters and “tip” counters.

Such overheating of markets usually is followed by cooling off of the market."

In the currency front, the rupee was trading lower by 10 paise at 66.83 against the dollar on sustained foreign fund outflows amid increased demand for the US currency from importers.

Among overseas markets, Chinese stocks led decline in Asian markets after China reported weak trade data for November 2015.

Energy and materials sector stocks led losses for US equities yesterday as global crude oil prices tumbled in the wake of a decision late last week from the OPEC to keep crude production running at current levels. Hang Seng, Nikkei and Shanghai slipped between 1%-2%.

Back home, GAIL India was the top Sensex gainer, up over 5%. The company has decided to shut down the coal-based power plants near metro cities and switch to cleaner gas as a source of electricity generation.

Metal shares reeled under selling pressure due to weak Chinese trade data for the month of November. Hindalco, Vedanta, Tata Steel and Coal India fell between 3%-5%.

Coal India might eventually end the financial year with a shortfall of 10 million tonnes (mt), or nearly 2%, of its marked output. Shares of Coal India dropped by almost 3%.

Oil exploration companies were trading lower after crude oil tumbled to its lowest level in nearly seven years. RIL, ONGC, Cairn India and Oil India dipped between 1%-6%.

On the gaining side, Tata Motors gained over 1% after the total Jaguar Land Rover (JLR) retail sales rose 27% to 46,547 versus 36,621 units a year ago.

Select IT majors ended marginally positive due to weak rupee against US dollar. ITC rose almost 1%. The company has acquired 87% equity share capital of group firm Classic Infrastructure and Development.

Shares of public sector undertaking (PSU) banks were under pressure with four state-owned banks – Allahabad Bank, Bank of India, Canara Bank and Corporation Bank have touched their respective 52-week lows on the BSE.

Donear Industries was locked in upper circuit for the second straight day, up 20% at Rs 24, also its 52-week high on the BSE.

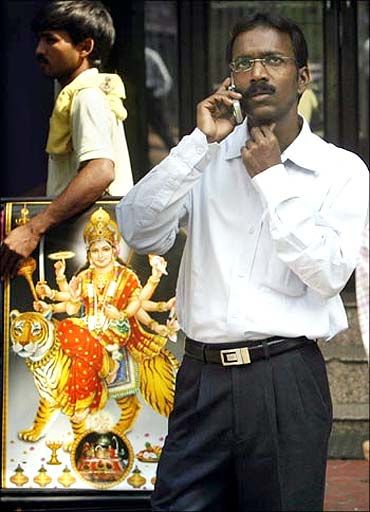

Image: A man speaks on a his mobile as he looks at a large screen displaying India's benchmark share index. Photograph: Arko Datta/Reuters