The Adani Group led in adding net fixed assets, which are up more than 90 per cent since September 2019 or before COVID-19.

Finance Minister Nirmala Sitharaman told the Parliament in December that companies are increasing investments for more new and other assets, helped by government incentives.

Business Standard analysed what large business houses have added as net fixed assets since the pandemic.

The analysis looked at the Adani, Mukesh Ambani, Tata, Aditya Birla, Mahindra, Godrej, Bajaj and the JSW groups.

It considered the change in net fixed assets of these business groups.

The analysis is an indicative rather than an exact proxy for investments, but provides a broad sense of the direction private capital expenditure (capex) is moving.

The Adani Group led in adding net fixed assets, which are up more than 90 per cent since September 2019 or before COVID-19.

The Mukesh Ambani group's net fixed assets were slightly lower in September 2022 than the September 2019 level, with additional investments going into spectrum-an intangible asset.

The Tata group marked down the value of assets, including in its auto and communications businesses (chart 1).

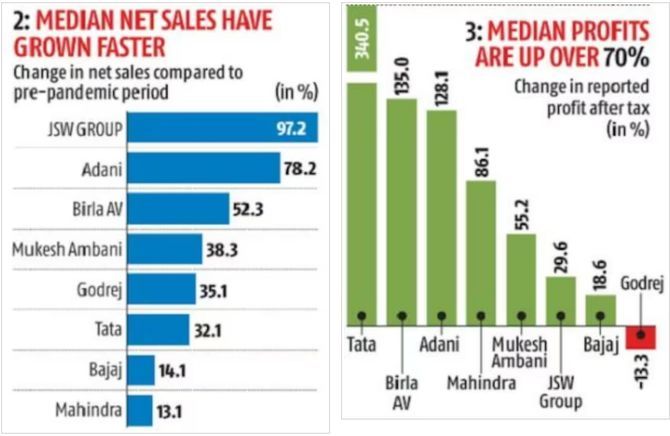

At most groups, net sales have grown faster than the addition of net fixed assets.

Five out of the eight groups had higher growth in net sales than growth in net fixed assets (chart 2).

Factories and other assets functioned below capacity to produce goods during COVID-19.

Capacity utilisation has been increasing lately and reached 72.4 per cent in June 2022, from under 50 per cent at the height of the pandemic, according to the Reserve Bank of India's numbers.

Median profit for all groups in this analysis increased 70 per cent since the year leading up to September 2019 to the corresponding period ending September 2022 (chart 3).

But the spectre of a global recession is hurting sentiment, and may decide whether the surge in profitability translates into a capex boom.