Malvinder Mohan Singh, better known as Malav, has put on weight, especially around his tummy, since we last met a few months ago.

Malvinder Mohan Singh, better known as Malav, has put on weight, especially around his tummy, since we last met a few months ago.

And the blue jacket he is wearing is unable to hide the bulge, though the buttons and the holes are in a perfect embrace without any sign of a struggle. Life after Ranbaxy has been gentle on him, I remark. The added kilos he got, says Malav, thanks to a Ranbaxy cricket match some months ago in which he injured a ligament and has, hence, not been able to exercise.

Otherwise, says he, there is no let up on work. We are at The Chambers in Taj Man Singh. Our table is next to tall glass windows. There is a sprawling view of South Delhi to see: Raj era bungalows big enough to house an army battalion, a Jewish cemetery, government-constructed blocks of houses and lots of trees.

And in the midst of it all, stands an ugly block of government offices. The monsoon rains have been scanty, yet the greenery looks fresh and washed. From a height, Delhi looks almost perfect. God wouldn't come to know if something ever went wrong in the city.

Malav takes off his jacket. We settle for vegetarian Chinese fare -- stir fried vegetables for starters; a tofu and greens gravy in soya sauce, noodles and rice for the main course. Before that, some coconut water for both of us -- zero on taste, low on calories but a good appetizer. Malav, incidentally, has been initiated into the Radhasoami Satsang -- so anything that can fly, walk or swim cannot make it to his dining table.

I had first met Malav several years ago in the Ranbaxy office at Nehru Place, the commercial slum of New Delhi. I was with Vinay Kaul, the then CFO, when an executive walked in, took his instructions and left. "Bright fellow," Kaul had remarked.

It was, of course, Malav. Parvinder Singh, Malav's father, had appointed D S Brar as his successor and Malav was being put through the paces. In the years that followed, he rose rapidly in Ranbaxy, replaced Brar, did a string of acquisitions to expand the company, saw profits plummet, sold the company and recently exited the company.

"What made you sell," I ask. Malav's friends say the patent litigations switched him off pharmaceuticals; such litigation can be expensive and nerve wracking.

Malav says he realised in 2005 that the going could get tough. Prices of generic medicine had seen a precipitous fall in the US and other developed markets. Big Pharma, aware of the dry pipeline for new products, began to flex its muscles. On its target were companies like Ranbaxy which had launched patent challenges against blockbuster drugs.

Malav says he responded by moving the company towards emerging markets where Big Pharma was not well-entrenched. He also de-risked the business by tying up with other pharmaceutical companies to manufacture drugs. But, says he, the signals were clear that the fight would be tough and benefit nobody. The best solution was to collaborate with Big Pharma.

Soon thereafter, Malav began to talk to Big Pharma to settle the patent rows. The response was positive. Uncertain windfalls were converted into predictable cash-flows.

Analysts have said that the Lipitor settlement with Pfizer could yield Ranbaxy as much as $1.5 billion and the Nexium deal with AstraZeneca some $1.3 billion -- all within six months of the expiry of patents on these drugs. Most of this money will go straight to the company's bottom-line.

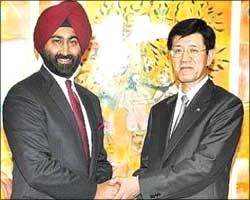

Around the same time, Ranbaxy hived off its new drug discovery-arm in order to induct a partner. Malav says he spoke to several companies. Daiichi Sankyo of Japan showed the greatest interest.

"Once we started talking, they wanted to know if Daiichi could buy a minority stake in Ranbaxy. From minority, they next asked for a majority stake. And that was not possible without us selling out," he says.

But what is it that Daiichi saw in Ranbaxy? "Daiichi got in Ranbaxy a strong generic portfolio, a presence in emerging markets, a low-cost production base in India and a foothold in biotech." (Ranbaxy owns biotech firm Zanotech.)

"Didn't it bother you at this point to sell your stake? After all, this is the company your father and grandfather had built from scratch," I intervene. Ranbaxy for long has been associated with the Singh family. Bhai Mohan Singh, Malav's grandfather, would often call it his fourth son.

Insiders would often say the company got its aggression and drive from its Sikh promoters. All of a sudden in August last year, it had a Japanese parent. "It did strike me," says Malav, "But this was in the best interests of the company and my stake should not have come in the way."

Malav's friends say that, in the last few years, he has been mentored by telecom czar Sunil Mittal -- a hard-nosed businessman who has partnered with various global telecom firms over the years. Did Mittal in any way influence the stake sale? "We are close and I have a lot of respect for him," is all Malav says.

Malav also does not get drawn into any conversation on Ranbaxy's current problems with the US Food & Drug Administration -- it has blacklisted two Ranbaxy factories, crippling its business in that country. "It is for Ranbaxy to comment," says he. What is significant is that Malav had forged a score of partnerships with other drug makers to outsource production in the last couple of years. Was he aware of the impending crisis?

In pharmaceutical industry circles though, the story has been doing the rounds that a US rival wanted to buy Ranbaxy after the deal with Daiichi had been signed. It even spoke to the Japanese company for it.

But when it came to nought, it decided to teach a lesson to the Daiichi-Ranbaxy combine. Malav focuses on his food. There is also a suspicion that Malav's departure from Ranbaxy was a message to the USFDA that Daiichi will turn things inside out, the hefty severance cheque notwithstanding.

This might not be the last one has heard of Malav in the pharmaceutical industry, though. He has signed a two-year cooling-off with Ranbaxy. Will he get back to pharmaceuticals after that? "Who knows after that? If there is a good value proposition, why not," says Malav.

At the moment, it is Fortis Healthcare and Religare -- both listed on the stock exchange -- that have grabbed his attention. The strategy is somewhat similar to that of Ranbaxy -- fast growth, organic and inorganic, to become the market leader. "We want leadership in both the categories and want to create institutions of excellence," says he.

The main course is over. We don't want dessert but fresh mangoes are a temptation too hard to resist. Malav is talking about his plans. Fortis, says he, is at the moment, second to Apollo with 20 hospitals and some 3,000 beds.

He wants to make it number one through acquisitions, new projects and management contracts. "We know it is just a matter of time." After that, he wants to branch out of India to other parts of Asia.

But it is when he talks about Religare that excitement begins to show. Religare started off small in 2001 but now operates in the fields of life insurance, asset management, broking, venture capital and private equity. It has already done three acquisitions:

Lotus Asset Management, Maharishi Housing and British broking firm Hitchens Harrison. More could follow. It is in the race with Macquarie to buy AIG Investments which has assets worth $95 billion. Malav wants to make it a global finance company. He may be out of Ranbaxy, but global ambitions haven't left Malav.

Image: Malvinder Mohan Singh, CEO and MD, Ranbaxy, and Takashi Shoda, president and CEO, Daiichi Sankyo Company Ltd. | Photograph, courtesy: Ranbaxy