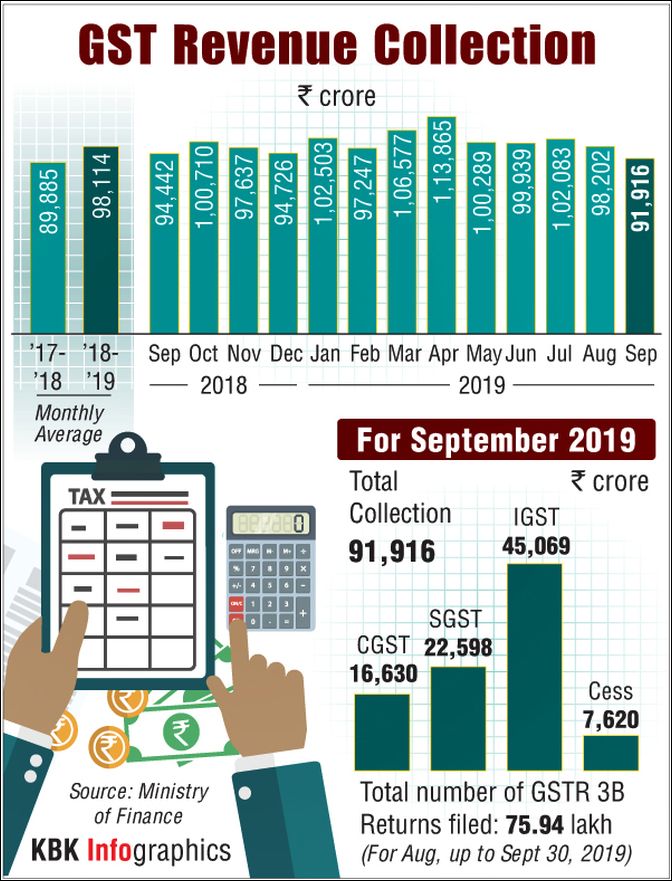

The revenue collection in the same month a year ago stood at Rs 94,442 crore.

Illustration: Uttam Ghosh/Rediff.com

The Goods and Services Tax (GST) collections dropped sharply to a 19-month low of Rs 91,916 crore in September, mirroring a widening slowdown in economy triggered by shrinking consumer demand.

This is the second straight month of decline in the GST collections, according to official data released by the finance ministry.

The tax collections at Rs 91,916 crore in September was lower than Rs 98,202 crore collected in August and Rs 94,442 crore mop-up in the same month a year back.

GST, which from July 1, 2017, amalgamated 17 different central and state levies, including excise duty, service tax and VAT, is a reflection of economic activity and a decline in collections indicated a downturn.

Experts, however, hoped for an upturn in October on the back of increased demand during the festival season.

The gross GST collections comprised of Rs 16,630 crore collection through Central-GST (CGST), Rs 22,598 crore in state-GST and Rs 45,069 crore through integrated-GST (IGST).

As much as Rs 7,620 crore was collected as cess levied on luxury and sin goods.

"The revenue during September 2019 declined by 2.67 per cent in comparison to the revenue during September 2018.

“During April-September, 2019 vis-a-vis 2018, the domestic component has grown by 7.82 per cent while the GST on imports has shown negative growth and the total collection has grown by 4.90 per cent," the statement said.

India's GDP slowed to more than six-year low of 5 per cent in April-June, prompting the government to take an array of steps to boost the economy, including a steepest ever cut in corporate tax rate which would cost Rs 1.45 lakh crore.

During April-September, the GST collections totalled Rs 6.06 lakh crore.

In comparison, tax collections in the same period of the previous fiscal were Rs 5.78 lakh crore.

Abhishek Jain, Tax Partner, EY India, said: "With the recently announced fiscal and economic measures coupled with the upcoming festive season, the demand and related GST collections may witness an increase in the coming months. Stricter controls on tax evasion and audits by the revenue authorities may also help in improving the collections."

M S Mani, Partner, Deloitte India: "The lower collections seem to be on account of the lower GDP growth numbers that we have seen as GST is a transaction tax that is immediately impacted by any decline in any economic activity. However, the subsequent festival season is expected to improve collections."

The finance ministry said returns filed for August were 75.94 lakh.

Returns filed during September would be known by end of this month.

Also, the government has settled Rs 21,131 crore to CGST and Rs 15,121 crore to SGST from IGST as regular settlement.

The total revenue earned by the central government and the state governments after regular settlement in September 2019 is Rs 37,761 crore for CGST and Rs 37,719 crore for the SGST, the statement said.

Niraj Bagri, partner, Dhruva Advisors said: "The September month GST collections of Rs 91,916 crores is a significant drop if one compares the last few months data.

“This could indicate a reduction in economic activities. With the announcement of income tax reforms, any further dip in GST collections would be a cause of concern for the government."

Parag Mehta, partner, N A Shah Associates LLP said GST collections in September are a cause of concern.

"It indicates a major economic downturn.

“Hopefully, the recent amendments in income tax act and decisions taken in 37th GST council meeting reducing rates and other measures to turnaround the economy should show results in the next two months.

"Further, with festive seasons setting it should revive the economy."