Customs and excise duty rates have been amended mainly to promote Make in India.

INDIRECT TAXES

While the country is awaiting the introduction of the Goods and Services Tax, the proposals under Finance Minister (FM) Arun Jaitley's third budget lay emphasis on the key initiatives of the prime minister, such as 'Make in India', ease of doing business in India, etc.

Some of the key indirect tax proposals of the FM towards achieving the above objectives are detailed below.

TAX RATES

A new cess, the Krishi Kalyan cess at the rate of 0.5% of the value of services, is proposed to be levied on all taxable services with effect from June 1, 2016. This levy is proposed to be creditable. The effective rate of service tax will therefore increase from 14.5% to 15% from this date.

No changes are proposed in excise duty rate, service tax rate and the peak rate of customs duty.

Infrastructure cess at the following rates is proposed to be levied on manufacture of motor vehicles falling under the chapter heading 8703. No input tax credit of such cess is available.

Petrol/CNG/LPG vehicles not exceeding 1200 cc: 1%

Diesel-driven motor vehicles not exceeding 1500 cc: 2.5%

SUVS, sedans and others: 4%.

'Clean Energy Cess' levied on coal, lignite and peat renamed 'Clean Environment Cess' and the rate of cess has increased from Rs 200 per tonne to Rs 400 per tonne.

MAKE IN INDIA

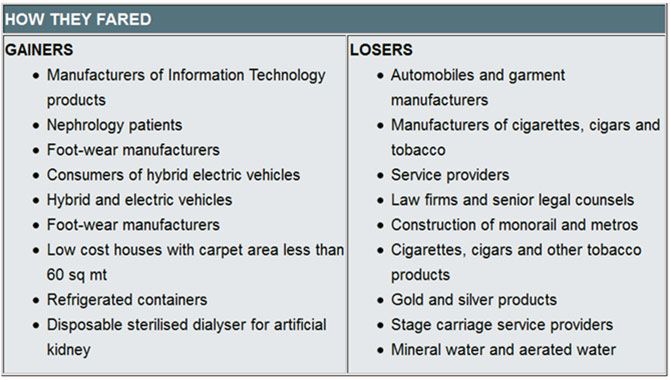

Various amendments in the rate of Customs duty and Central Excise duty mainly with a view to promote 'Make in India'.

Changes in customs and excise duty rates have been made on certain inputs to reduce costs and improve competitiveness of domestic manufacturers in sectors like IT hardware, capital goods, defence production, textiles, mineral fuels, mineral oils, chemicals and petrochemicals, paper, paperboard and newsprint, maintenance repair and overhauling (MRO) of aircraft and ship repair.

Excise duty on branded readymade garments with a retail price of Rs 1,000 or more is being levied at 2% without CENVAT credit or 12.5% with CENVAT credit.

Excise duty of one per cent (without CENVAT credit) or 12.5% (with CENVAT credit) is being levied on certain articles of jewellery. Higher threshold of up to Rs 6 crore in a year prescribed for such option.

Aim to reduce litigation

Eleven new benches of Customs, Excise and Service Tax Appellate Tribunal to be created to remove backlog of cases.

Indirect Tax Dispute Resolution Scheme, 2016, is proposed to be introduced. Under it, an assessee can pay duty, interest and penalty of 25% of duty in respect of cases pending before the Commissioner (Appeals), based on which the proceedings would be closed and the taxpayer would get immunity from prosecution. However, this scheme will not apply in certain specified types of cases.

Services by way of assignment of right to use the radio frequency spectrum by the government and subsequent transfers have been clarified to be under the service tax net.

Clarity on applicability of customs/excise duty vis-a-vis service tax on IT software. No dual levy applicable, duty exempted on the value of non-MRP software on media on which service tax is paid, and service tax exempted on value of MRP software on media on which customs/excise duty is paid.

Ease of doing business

Revision of Central Excise returns permitted by the end of the calendar month in which the original return is filed.

Central excise assessees to file only 13 returns, ie, one annual return and 12 monthly returns as against 27 returns currently.

Interest rates on delayed payment under Service tax, Customs and Central Excise rationalised at 15%. Interest rate in case of service tax collected and not deposited shall increase to 24%.

Deferred payment of customs duty shall be allowed to a specific class of importers/exporters. Details of class of importers/exporters to be notified.

Public and private bonded warehouses are no longer under the physical control of proper officers. These warehouses will now be record-based.

Manufacturers with multiple manufacturing units allowed to maintain a common warehouse for inputs and distribute inputs with credits to the individual manufacturing units.

Central Excise (Removal of Goods at Concessional Rate of Duty for Manufacture of Excisable and Other Goods) Rules, 2001 substituted with new rules providing simplicity, including allowing duty exemptions to importer/manufacturer based on self-declaration instead of obtaining permissions.

Period of warehousing extended for 100% EOU, EHTP, STPI - effectively results in no requirement to renew the bond for warehousing goods.

Value limit for power of arrest under service tax law proposed to be increased from Rs 50 lakh to Rs 2 crore.

Benefits of quarterly payment of taxes, payment of service tax on receipt basis extended to One Person Company (OPC) whose aggregate value of services is up to Rs 50 lakh in previous financial year.

The time limit for filing of service tax refund claims amended to one year from the date of receipt of payment, where services have been completed prior to receipt of such payment. In case of advance payment, time limit to be considered from the date of issue of invoice.

CENVAT Credit Rules

CENVAT Credit Rules, 2004 are amended to improve CENVAT credit flow, reduce the compliance burden and associated litigations. Some key points are provided below.

Credit of capital goods of value up to Rs 10,000 per piece to be availed as 'inputs'. Earlier CENVAT credit on such capital goods was to be spread over 2 years. CENVAT credit on such capital goods may be availed immediately upon receipt.

Scheme for reversal of credit in respect of inputs and input services used in manufacture of exempted goods or for provision of exempted services under Rule 6 is redrafted as follows:

* Activities excluded from definition of service considered as exempt service

* Where exempt and taxable services/goods supplied, two options provided:

* Pay 6% of exempt goods or 7% of exempt services; or

* Reverse proportionate common input services alone and avail credit of the remaining.

* Full credit of input or input services used exclusively in dutiable final products / taxable output services shall be available.

* Input Service Distributer can now distribute the input service credit to an outsourced manufacturing unit in addition to its own manufacturing units. Specified conditions/procedure to be followed for such distribution.

Resource mobilisation

Exemption from service tax has been withdrawn on the following:

* Construction, erection, commissioning or installation of original works pertaining to monorail or metro.

* Service of transportation of passengers by a stage carrier with effect from June 1, 2016.

* Services by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India.

Excise duty has been increased on pan masala, non-filter and filter cigarettes and tobacco and tobacco products.

Exemptions/benefits granted

To encourage exports, the duty drawback scheme has been widened and deepened to include more products and countries.

Exemption from service tax provided to housing projects where each unit is up to a carpet area of 60 square meters subject to specified conditions.

Service tax exemptions granted for specified life insurance services, general insurance, services provided by Sebi, Irda, EPFO.

Exemption has been restored on the following services:

* Specified services related to construction, erection, etc. provided to the government, local authority or a government authority

* Specified services related to construction, erection, etc. of original works pertaining to an airport and port.

GST

The finance minister merely stated that the government will endeavour to ensure the passage of the Constitutional amendments to enable the implementation of the Goods and Service Tax.

The industry was expecting the FM to provide more clarity on the proposed road map for GST. To recall the earlier proposed date of implementation of GST, ie April 1, 2016 is no longer feasible.

Other significant announcements/changes:

Annual returns introduced under service tax - to be filed by the 30th day of November of the succeeding year in the specified form.

Period of limitation for recovery of service tax short paid/not paid not involving fraud, collusion, suppression, etc. proposed to be increased from 18 months to 30 months. In case of Customs and Excise, this has been increased from one year to two years.

All services provided by government or local authorities to business entities are taxable in the hands of the recipient of services under reverse charge mechanism.