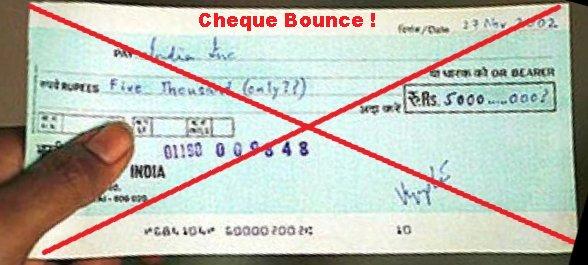

In a case of bounced cheque, it is not necessary to complain specifically against the company if the managing director is the sole proprietor.

In a case of bounced cheque, it is not necessary to complain specifically against the company if the managing director is the sole proprietor.

It is enough if the managing director alone is made the accused under the Negotiable Instruments Act, the Supreme Court stated in its judgment, Mainuddin Abdul Sattar vs Vijay Dalvi.

Bombay High Court view opposed to this was wrong and it was set aside by the apex court.

In this case, real estate firm Salvi Infrastruture Ltd could not provide a flat to its customer, and the customer wanted the money back.

The MD issued a cheque to discharge the liability but it was dishonoured by the bank, leading to a criminal complaint before the magistrate.

He dismissed the complaint as the complaint was only against the MD and not against the firm.

This view was upheld by the high court.

The Supreme Court held that both the courts were wrong.

There was no necessity for the payee to prove that the MD was in charge of the daily affairs of the company, by virtue of the position he held in this case.

Therefore, he was ordered to be taken into custody immediately to undergo five months’ simple imprisonment.

He was also asked to pay compensation which would be double the cheque amount with nine per cent simple interest.

Paper mills using jute waste get discount

The Supreme Court last week ruled that paper mills using jute gunny bags as raw material are entitled to concessional excise duty as it was a non-conventional material for paper manufacture.

According to a 1994 notification, mills using non-conventional raw materials for paper production were given five per cent concession.

According to the notification, concession was available 'if such paper and paperboard or articles made therefrom have been manufactured, starting from the stage of pulp, in a factory, and such pulp contains not less than 75 per cent by weight of pulp made from materials other than bamboo, hard woods, soft woods, reeds or rags.'

M/s Coastal Paper Ltd received three show cause notices from the revenue authorities.

The firm challenged the demand arguing that jute waste was a non-conventional raw material and therefore it was entitled to the concessional rate.

The authorities rejected the argument. The tribunal accepted the argument of the authorities.

However, the Supreme Court set aside the tribunal’s view and ruled that the firm was entitled to the benefit.

HCL gets customs relief for printing units

The Supreme Court last week allowed the appeal of HCL Ltd and ruled that risograph machines, commonly used in offices, were entitled to lesser customs duty as it was a screen printing machine and not a duplicating machine.

The issue arose as the machine was not found in any of the tariff lists under the Customs Act.

Therefore, the court was called upon to decide the nature of the machine.

The court traced the long history of printing from Gutenberg till the present decline in its importance due to electronic devices and laid down the principle in assessing the duty on such imports.

The judgment said: “If there is a small printing machine like letterpress, lithographic or offset printing machine, which does the printing work and also, at the same time, performs duplicating work with stencils or otherwise and even photocopying work, it would still be treated as a printing machine and not duplicating machine.”

Orders shall be properly served

An order of adjudication must be served on an authorised person to be valid, the Supreme Court stated last week in its judgment, Saral Wire Craft Ltd vs Commissioner of Excise.

In this case, the order was served allegedly on a ‘kitchen boy’ employed on daily wages, and was avowedly not authorised to deal with communication to the company.

As a result the company was not aware of the order and the time to appeal expired. Because of this defect, the company’s appeals were dismissed by all legal forums.

Therefore, it appealed to the Supreme Court.

It pointed out that it is the basic principle of law that 'if the manner of doing a particular act is prescribed under any statute, the act must be done in that manner or not at all.'

The inspector who ostensibly served the copy of the order should have known the requirements of the statute and therefore should have insisted on an acknowledgement by its authorised agent.

The main complaint of the company was that it was denied certain excise benefits for setting up units in Uttarakhand.

That moratorium/exemption has been granted by the Central Government with the objective of giving a fillip to the industrialisation of the newly created State of Uttarakhand.

The dispute was whether the company’s unit is situated on land which is covered by the notification.

The order of the authorities, against the claim of the company, was not properly served.

Therefore, it could not argue its case as the courts below held that its appeals were time-barred.

The Supreme Court allowed its appeal and directed the court below to hear the company on merits of its case.

It held that since the order was not served properly, there was no delay and the case should be fully heard before taking a final decision.

Contracting parties cannot choose court

Parties to a contract cannot agree to confer jurisdiction on a court which has no jurisdiction, the Delhi High Court has emphasised in its judgment, Pcp International Limited vs Lanco Infratech Ltd.

In this case, Pcp was awarded a contract for erection, testing and commissioning of boiler units at the Lanco Vidharbha Thermal Power Project in Maharashtra. The office of Pcp is at Chandigarh and that of Lanco at Gurgaon, Haryana.

The contract was not executed in Delhi nor was it to be performed at Delhi. Payment was not made under the contract at Delhi.

However, Pcp moved the high court for arbitration of its disputes with Lanco on the basis of the general conditions of contract which gave exclusive jurisdiction to the courts at New Delhi.

However, the high court dismissed the petition stating that it has no territorial jurisdiction to try this petition inasmuch as “merely because a party chooses a contractual clause to give them jurisdiction at Delhi, this court would not have territorial jurisdiction once the cause of action wholly or in part does not arise within the territorial jurisdiction of this court.”

The court explained that merely because the venue of arbitration is in Delhi, the high court would not have territorial jurisdiction.

The image is used for representational purpose only