Recently, the government relaxed foreign direct investment (FDI) norms for the space sector by allowing 100 per cent FDI in manufacture of components, systems or sub-systems for satellites, ground segments, and user segments.

It also permitted 74 per cent FDI in satellite manufacturing and operation as well as satellite data products and 49 per cent in development of launch vehicles and spaceports.

Following this, stocks of related companies saw an uptick on the bourses.

Among the lot, Mishra Dhatu Nigam, MTAR Technologies, Data Patterns, Astra Microwave Products, Centum Electronics, Walchandnagar Industries and Paras Defence have risen 4-25 per cent since the announcement on February 21, albeit with some intermittent profit-booking.

“The development is positive and will allow domestic players to gain access to advanced technologies and expertise due to foreign tie-ups

"But given the current valuations and fundamentals, we suggest avoiding fresh buying while existing investors can stay put,” said Sanjay Moorjani, research analyst, Samco Securities.

Most stocks in the defence and space sectors have been on a one-way rally in the last one year, giving handsome returns like 367 per cent, driven by the government’s push for indigenisation of defence manufacturing.

Valuations wise, most are trading at price-to-equity (PE) multiples ranging between 50 and 100 times on a 12-month trailing basis, data from BSE shows.

Apollo Micro Systems commands a PE of 152 times, among the highest.

Relaxing FDI norms, analysts believe, will help listed defence companies sharpen their focus on space as a revenue segment and improve scalability, which has remained limited for them.

“FDI norms relaxation will help companies sharpen focus on the space segment from hereon as it is a niche area that requires high research to match global standards.

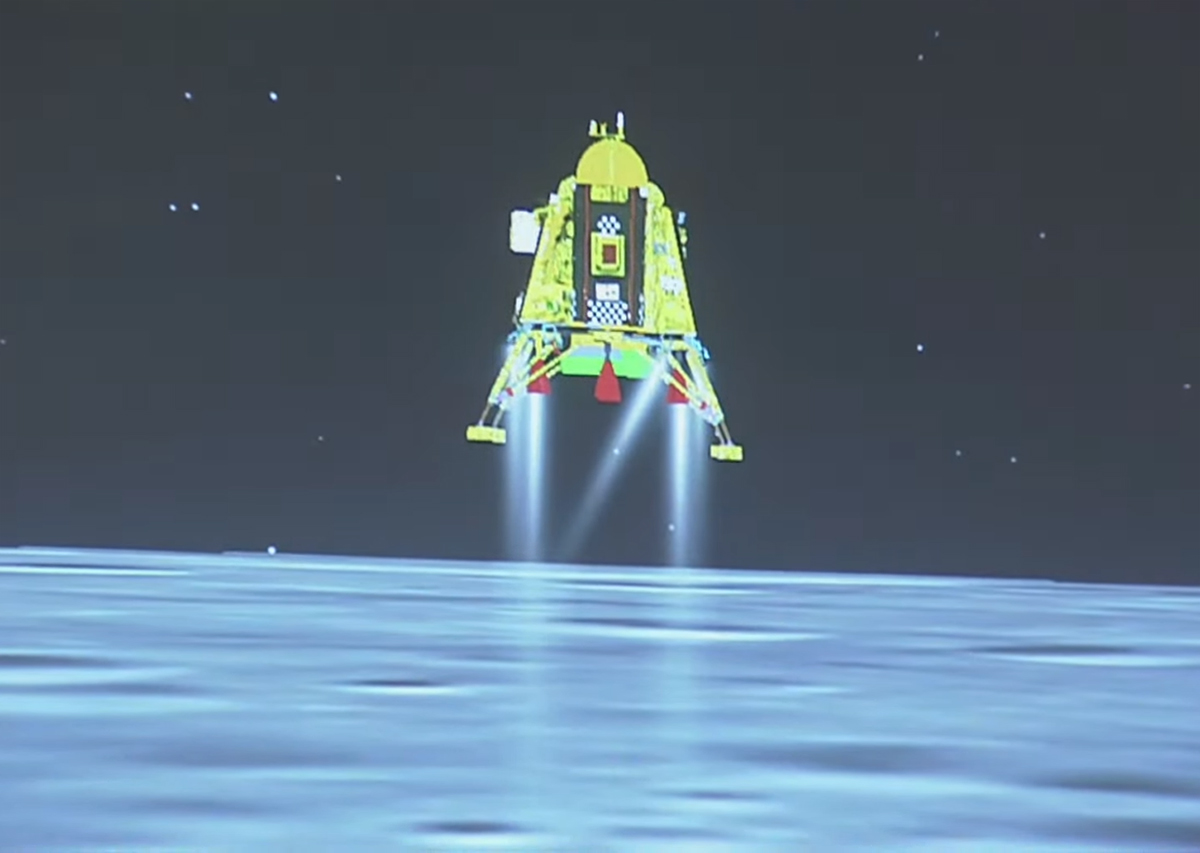

"Many players were already involved in the Chandrayaan project but scalability has been limited as Isro has remained their major customer.

"But with the easing in FDI, companies can now participate in global missions too.

"They can increase their revenue as scalability and customer base go up,” said Kranthi Bathini, director, equity strategy at WealthMills Securities.

Investment strategy.

While the Street seems bullish on these counters, analysts suggest that investors remain stock specific as the recent development alone should not be a trigger for fresh buying given the high valuations.

Bathini, for instance, suggests evaluating companies based on their specific research domains related to space activities and the level of expertise in them.

PTC Industries, Walchandnagar Indus-tries, BEL, and HAL remain his top bets from the defence and aerospace themes.

The first three companies were among several firms that had supplied crucial hardware for the Chandrayaan-3 mission.

HAL primarily caters to the Indian defence forces, but has been involved in space-related activities, partnering Isro for various space missions.

Its cryogenic engine facility caters to rocket engine manufacturing for Isro and it has also supplied key infrastructure for the Gaganyaan mission.

Among other players operating in this segment, MTAR Technologies earned 5 per cent (Rs 23 crore) of its total revenue from the space segment in April-December 2023.

Of its order book of Rs 1,179 crore as on December 31, 2023, this vertical held 11 per cent share.

The company, in its latest earnings’ call, said it expects space and aerospace revenue to grow sharply to Rs 150 crore in FY25 from the current base of Rs 45 crore.

Astra Microwave's revenue in 9MFY24 had a 4 per cent contribution from the space segment, while it has 11 per cent share in the total order book of Rs 1,813 crore.

The company said it is increasing focus on the satellite space in a significant manner, especially in communication systems.

It has incorporated a new subsidiary to scale up space technology as it sees strong growth prospects in the space segment.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.