Can Infy spring a surprise in a subdued second quarter?

Will Infosys, India’s second largest software exporter, spring a surprise when it announces the second quarter results on Friday?

Analysts expect Infosys to cut its revenue guidance for the second time this financial year owing to the termination of contract by the Royal Bank of Scotland and worsening macroeconomic conditions.

The company had reduced its full-year revenue guidance to 10.5-12 per cent for FY17 in constant currency terms from 11.5-13.5 per cent, which it had predicted in the beginning of the year.

'Although we expect higher sequential growth in the second quarter to two per cent against 1.7 per cent (in constant currency terms) in Q1, the annual guidance is likely to be revised downward (further),' said brokerage Motilal Oswal.

The Indian IT services sector as a whole is projected to see modest margins due to pricing pressure, project ramp-downs and cancellations due to uncertainty, mainly with the banking and financial services customers. The full impact of the fallout of Britain’s decision to exit the European Union is still unravelling.

WHAT ANALYSTS EXPECT

TCS

a) Expected to report 2.4 per cent revenue growth (in constant currency terms)

b) Margins likely to improve by 45 basis points on sequential basis largely led by normalisation of wage hike rolled out in the previous quarter

Infosys

a) EBIT margin is expected to improve by 50 basis points on normalisation of wage hikes and visa costs partly offset by cross currency headwinds

b) Expected to see steady progress in client metrics

Wipro Ltd

a) Revenue growth estimated to be (in constant currency terms) 0.5 per cent

b) IT services EBIT margin is likely to decline 120 basis points due to full quarter impact of wage hike and cross currency headwinds

HCL Technologies

a) IMS is expected to drive growth

b) EBIT margin expected to decline by 100 basis points largely due to wage hikes for a section of employees and cross currency headwinds

Based on Kotak Institutional Equities’ forecast

At least two sector analysts have forecast that Infosys’s earnings before interest, taxes, depreciation and amortisation (Ebitda) margin to remain flat on a sequential basis between 24 and 26 per cent. This can be attributed to a subdued revenue growth momentum for the past two quarters. Motilal Oswal has predicted that the company’s net profit for the second quarter is likely to be down by 2.6 per cent at Rs 3,346.8 crore.

Emkay Financial Services has forecast a further 1-1.5 per cent cut in its FY17 revenue guidance.

'A 100-150 basis points cut in Infosys’ FY17 revenue guidance is nearly baked into the stock and Street expectations after the RBS contract cancellation and management commentary that Q2 was not faring as well as the initial expectations. However, we believe that the Street would be looking forward to cues on near-term margin expectations, especially in the context of revenue headwinds and the management’s long-held view on pricing pressure in the traditional piece of business,' a note by Emkay said.

The company’s stock price was up 1.67 per cent to Rs 1,029.55 on the BSE on Wednesday. However, compared with its peers, Infosys is projected to lead the growth in the July-September quarter, which is considered to be one of the strongest season for the industry.

In a recent report, Kotak Institutional Securities stated: ‘Infosys would lead the pack with constant currency growth of three per cent followed by HCL Technology with 2.6 per cent, TCS with 2.4 per cent, and Wipro with 0.5 per cent.’

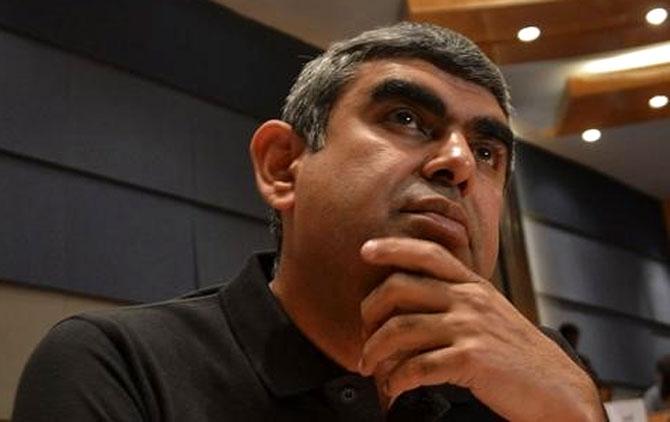

Image: Infosys CEO and managing director Vishal Sikka. Photograph: Danish Siddiqui/Reuters