'We have a clear mergers & acquisitions strategy and we know how much cash we need.'

'The structure is there and the team is also very stable.'

'The number of people that is required in the lower end of the pyramid is going down.'

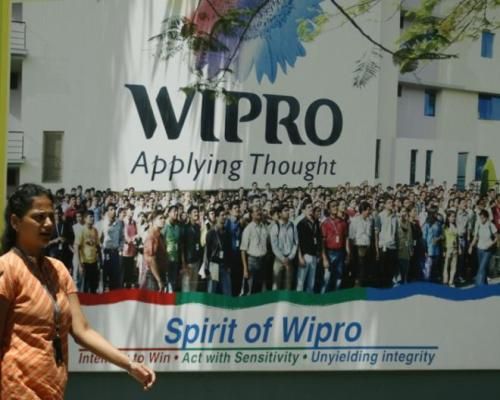

While larger rivals Tata Consultancy Services and Infosys have already stolen the thunder with their performance in FY16, Wipro on Wednesday reported in-line financial numbers.

The Bengaluru-headquartered company’s chief executive officer, Abidali Neemuchwala, below, left, tells Bibhu Ranjan Mishra and Raghu Krishnan the company will now focus on execution.

Excerpts:

Wipro has announced buyback of up to 40 million shares. Is it a validation of the company’s faith on its growth aspects under the new management?

Absolutely.

Primarily, it is also an opportunity to look at the cash that we can give back to the shareholders.

We have a clear mergers & acquisitions strategy and we know how much cash we need.

So, I wouldn’t read too much into this.

Can you tell us how is the company progressing towards achieving the 2020 goal?

We have the ingredients in place.

I think the structure is there and the team is also very stable.

By March 31 (2016), we have set target and objectives for the entire team; now they are putting their heads down and executing it.

What challenges are you expecting in 2017?

Those kinds of business challenges continue to be there.

We are seeing a good traction in consumer and health care segments; we have done well in manufacturing.

There is softness in banking in Europe and in energy & utilities.

We know the reasons.

Customers have projects they can spend on only when there is certainty of the price of oil.

Now there are budgetary changes every month.

What really is the problem in the banking, financial services and insurance segment?

If you look at Europe, some of them are public announcements that banks have made.

Some of them are also our clients.

This is a short-term phenomenon.

When there is a spending cut, you see some projects stopped.

In the long term, because we’re such a strong partner, we have the ability to actually help them achieve redesign their overall cost structure and health.

You’ve been talking about ‘as-a-service’ model. What kind of traction are you seeing for this?

For all of these things, we are not breaking the revenue model.

It is important to make investments upfront and the revenue stream will be annuity-based, for an ongoing basis.

This is key for us.

For all the productivity benefits, artificial intelligence, hyper automation you put in there, the benefits accrue to you.

You charge on a per-transaction basis.

Wipro’s profit margin was flat despite its huge focus on automation. Is there some pricing pressure?

Wipro’s profit margin was flat despite its huge focus on automation. Is there some pricing pressure?

I don’t see a pricing pressure.

We did an acquisition; the acquisition had its own margin impact. We take into account the amortisation.

In spite of the acquisition, our margins have remained flat which means there is an upside somewhere to offset the downside.

There are lots of levers that we can use for improvement of margins.

It’s a call choosing bottom-line or investing for the future. Our call is obvious -- investing for the future.

But, you have got only four years to show 23 per cent operating profit margin from the current level of 20 per cent. Is it possible?

Everything will not be focused on keeping in mind the four-year target.

Some of the investments would be for the future.

Four years is just a station in the journey.

Since you are expanding setting up physical infrastructure in developed markets, will it impact your cost structure?

Absolutely, the business model is changing across the board.

It will help in the costs if you are hiring locally; the visa costs are managed better.

In some cases, if your onsite and offshore mix changes, then margins also change.

Most of your larger industry peers are talking about reducing hiring going forward? What is happening on this front?

It’s very simple.

The number of people that is required in the lower end of the pyramid is going down.

Robots and bots are taking over. You will see a slowdown in hiring across the industry.

Also, earlier, you were sending a lot of people from India to onsite locations.

That’s changing by hiring locally at onsite locations.

Even though hiring will continue, the number of people being hired in India will be lower.

You recently completed one year in Wipro though initially you joined in a different role. How would you rate the journey so far?

There were certain things that I had mandate to do as chief operating officer and there are certain things that I have been mandated to do as CEO.

For both the roles, I am getting enormous support. We have moved with speed.

We had done the changes we were supposed to do. We have this strategy and leadership and customer-connect in place.

Now, the focus is on execution.

Do you think FY17 to be a better year for Wipro than FY16?

We don’t give annual guidance.

I think, Nasscom has already given the guidance for the whole industry. I see good traction if you have the right offering and services.

Those (companies) which have that will win the marketplace.

How has Wipro fared in local hiring in onsite locations?

Very well.

You have to build a brand in each of the places so that employees come to you.

Wipro has a good brand because of the trust and quality it enjoys globally.

Top image: People walk in the Wipro campus in Bengaluru. Photograph: Punit Paranjpe/Reuters