'We have a bull market across asset classes. However, the value of paper money depreciates, as it has done for the past 30 years. Whatever central banks do now, asset prices will depreciate against precious metals'.

'We have a bull market across asset classes. However, the value of paper money depreciates, as it has done for the past 30 years. Whatever central banks do now, asset prices will depreciate against precious metals'.

'If I were an Indian, I would buy property/real estate in resource areas especially near beaches. The one thing that will happen in India is that the domestic story will increase rapidly'.

'It doesn’t matter whether you invest now or later, I think the return expectations are low. One will not make a lot of money by buying stocks and bonds'.

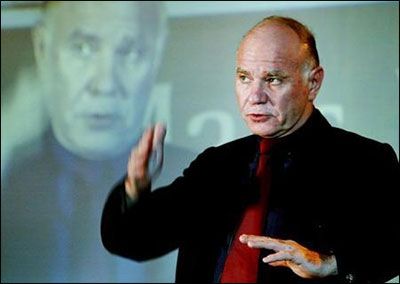

As global markets near all-time highs driven by liquidity, Marc Faber, bottom, left, the author of The Gloom, Boom & Doom report, suggests most asset prices worldwide are inflated. He tells Puneet Wadhwa the Indian economy has the potential to grow at five per cent. Excerpts:

How long do you see global central banks continue with easy money policies?

Asset purchases by major global central banks - the US Federal Reserve (US Fed), Bank of Japan (BoJ), European Central Bank (ECB) and the Bank of England (BoE) - have been increasing over time, though the US Fed has stopped now. My view is that asset purchases by BoJ and ECB will not stop.

The balance sheet of major central banks increased 16 times between 1998 and 2015. So, why can’t it go up another 20 or 100 times? Money printing is an unlimited action, until the system breaks down.

Will this bubble created by central bank liquidity across asset classes burst anytime soon?

The bubble can last a long time, one just needs to increase the size of money printing continuously. As a result, asset prices - stocks and real estate - go up phenomenally.

So, in essence, we have a bull market across asset classes. However, the value of paper money depreciates, as it has done for the past 30 years. Whatever central banks do now, asset prices will depreciate against precious metals.

What is your reading of the developments across Europe and Chinese economic data?

What is your reading of the developments across Europe and Chinese economic data?

Today, Britain is completely irrelevant for the world economy. What are relevant are growth rates in China and India. A number of analysts fail to understand that if India gets its act together, then it could have a growth rate of maybe five per cent per annum.

But we already are around that mark.

But we need that consistently. A consistent growth rate of five per cent is an incredibly high rate. We don’t have any growth in Europe and Japan. If we were to measure GDP correctly in the US, there would be no growth. And we are talking about a demographically attractive population.

What India needs is liberalisation of businesses and a reduction in government intervention. That apart, a number of things have to come into place. But, there is hope.

What are the factors working in favour of India as an investment destination?

Everyone is watching the reform process of the Narendra Modi-led government carefully, and whether he is able to reduce the incredible bureaucracy that India has.

This, I think, is an important factor. That apart, investors will also look at industrial production and corporate profits. If corporate profits rise and industrial production picks up, especially capital spending, which has been disappointing thus far, investors will favour India.

Are there any sectors that you find investment worthy in the Indian context?

Over time, the Indian consumer will become increasingly important. But then, the valuation of consumer stocks in India is quite rich. If I were an Indian, I would buy property/real estate in resource areas especially near beaches. The one thing that will happen in India is that the domestic story will increase rapidly.

As more and more people take vacations, tourism and tourist related investments, particularly in real estate, will do very well.

How are market valuations looking at this stage?

Worldwide, most asset prices are grossly inflated. In India, the bond market is less inflated as compared to other countries where there are negative interest rates. An asset class that became inexpensive at the end of last year was precious metals.

While they have rallied nearly 100 per cent since then, I think they are still reasonably attractive. If I compare their prices to stocks and real estate, I think precious metals are where I still find value.

They are exceptions to the rule that asset prices are grossly inflated. But, if we were to talk about asset price inflation in general, everything will go down in value - be it bonds, equities and collectables. But, precious metals will fall less than equities.

What's your advice to someone who wants to invest with a year's perspective?

It doesn’t matter whether you invest now or later, I think the return expectations are low. One will not make a lot of money by buying stocks and bonds. We also don’t know what the world will look like in five years - how crazy central bankers will become. Central bankers can buy all the government and corporate bonds.

As in the case of Japan, they can also become major shareholders in companies. So in essence, they can buy all the stock market. Through money printing, the world can move into state-ownership, socialism and communism.

So for the Indian stock market investor, is there money to be made in the next year?

The past few years, active fund managers, by and large, have been playing a lottery. Some have done well, and some haven’t. In general, active fund management has suffered at the expense of indexing. I believe we are moving into a period where small investors have a huge opportunity to make money, as they have a window to capitalise and take advantage of market inefficiency.

Index funds mostly buy large companies. As a result, it leads to undervaluation of smaller companies, and that’s where I see an opportunity for the individual investors.

By when do you see the US Fed raising rates?

I don’t think the Fed will increase rates in September, and not before the Presidential election. The Fed has grossly overestimated growth of the economy, and it appears that it the economic growth has slowed considerably. I think by December 2016, economic statistics will be even worse. So, no rate increases will happen then either.

Photographs: Danish Siddiqui/Reuters