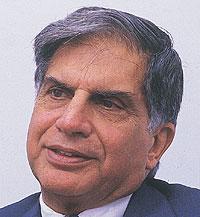

At the age of 69, Tata Sons Chairman Rata Tata, a licensed pilot, still occasionally flies the company plane. In the auction for Corus Group, Tata displayed similar flamboyance by quoting a price as much as 34 per cent higher than what he had first quoted.

In the process, he also dispelled age-old notions that the group may be too cautious to win such a battle. His high energy level was evident today as, having stayed up all night for the auction, he still went through a hectic schedule of press conference and interviews with customary poise. He shares with Kausik Datta and Suveen Sinha his views on a range of issues. Excerpts:

Indian companies have of late been making a large number of acquisitions overseas. What are the issues that they face in such endeavours?

I have always believed that if you really want to be a global company, you have to dismiss your notions of a single nationality and treat yourself as a truly global company operating in global markets having operations in different geographies.

In fact, you should have the look and feel of a local company in that geography. When we undertake to acquire a company, we spend a lot of time prior to that convincing ourselves that the cultures of the two companies are similar, because nothing can be more destructive than to have conflicting cultures.

Therefore, in most of our acquisitions, you will find that the management of the company we have acquired, or bought into, remains with the company and over time integrates itself with the Tata Group. It is true about Tetley, Daewoo Motors and many others that we have acquired. So there are challenges with different nationalities and with different work systems but by and large it has worked reasonably well.

As one of the senior-most businessmen in the country, what would be your advice to other companies, your colleagues in India Inc, as they aspire to clinch overseas acquisitions, especially big ones like the one you have just clinched?

As one of the senior-most businessmen in the country, what would be your advice to other companies, your colleagues in India Inc, as they aspire to clinch overseas acquisitions, especially big ones like the one you have just clinched?

When we made our first bid to acquire the company (Corus), many thought it was an audacious move ... an Indian company making a bid for a European company much larger in size. I believe that this will be the first step in ensuring that the Indian industry can in fact go outside the shores of India in an international market place and, in fact, acquaint itself as a global player.

Why was Corus so important to you? In spite of stating repeatedly that you would be realistic about the price, you are paying one that is seen as high by many, including the stock market. What would you tell the stakeholders?

The acquisition of Corus was a very important strategic decision, but not a do-or-die one. It was not a decision based on making Tata Steel a much larger company, but an important strategic move. Corus is a unique opportunity for Tata Steel in terms of the scale, its location and its culture.

Tata Steel saw a strategic fit with Corus in the UK and the Netherlands, which would give it a global reach in Europe and synergies with low-cost intermediates in India.

Coming to the auction, which started last night and went through the night, we were able to win the auction away from