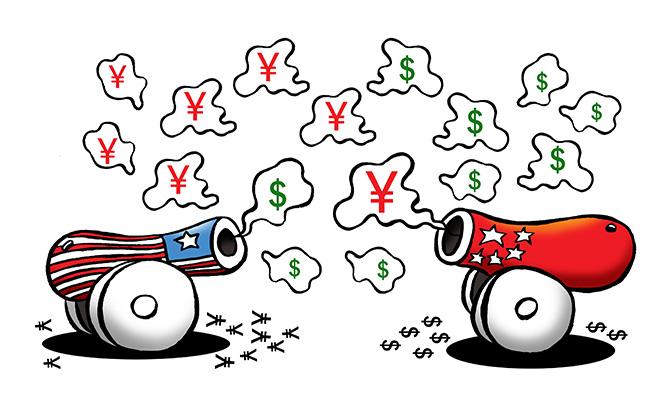

'The depreciation of the renminbi in recent weeks has raised fears that China is aiming to counter US tariffs by weaponising its currency.

'The initiation of a currency war could mark the opening of a new front in the US-China conflict over trade,' say Biju Paul Abraham and Partha Ray.

Illustration: Uttam Ghosh/Rediff.com

The trade war that US President Donald Trump initiated last year is morphing into new forms of economic conflict with far-reaching implications for the global economy.

On August 1, Trump announced that the US would impose a 10 per cent tariff on all imports from China which were not yet subject to the higher tariffs that he had imposed since March 2018.

On August 5, China allowed its currency, the renminbi, to slip below the psychologically important 7 renminbi to a dollar barrier.

Since this marks a 11-year low for the Chinese currency, various questions tend to spring up.

Are we witnessing a currency war as a fallout of the US-China trade war?

Or, is the emergence of a currency war in the current context inevitable?

Purely in terms of first principles, if we consider a two-country world, consisting a home country (say, the US) and a foreign country (say, China), then a trade war from the standpoint of the home country is perhaps intended to reduce the quantity by increasing the prices of exports from the foreign country.

There may be several ways to achieve such an objective.

Illustratively, weapons like tariffs, subsidies, import quotas, voluntary export restraints, local content requirements, and anti-dumping policies -- all can be employed for this purpose.

It may not be an oversimplification to note that the current trade war has -- until now -- primarily been fought in terms of a tariff war.

However, if on a parallel track the exchange rate of the foreign country’s currency is undervalued, then the efforts and weapons of trade war will be rendered ineffective.

Specifically, if the Chinese renminbi gets depreciated with respect to the dollar, then despite the tariffs imposed by President Trump, these imports can still continue to be cheaper in dollar terms.

Thus, faced with the possibility of a trade war, the foreign country can think of retaliating in terms of a currency war -- a possibility that Brazilian Finance Minister Guido Mantega flagged in 2010, in the aftermath of the global financial crisis.

Interestingly, the perceptions of the International Monetary Fund (IMF) and the US Treasury on the Chinese exchange rate regime differ quite a bit. Consider the following.

The US Treasury in its 2019 report on macroeconomic and foreign exchange policies of major trading partners of the United States noted that it continues to “have significant concerns about China’s currency practices, particularly in light of the misalignment and undervaluation of the RMB relative to the dollar.”

On the contrary, the IMF in its latest 2018 annual report on exchange arrangements and exchange restrictions has termed the Chinese currency as one of a group of currencies with “crawl–like arrangement”.

For a currency to be branded as falling within this group, its exchange rate “must remain within a narrow margin of 2 per cent relative to a statistically identified trend for six months or more (with the exception of a specified number of outliers) and the exchange rate arrangement cannot be considered as floating”.

More recently, the IMF in its External Sector Report of July 2019, has noted, “The large reduction in China’s current account surplus -- from more than 10 per cent of GDP in 2007 to 0.4 per cent in 2018 -- was accompanied by a cumulative 35 per cent real appreciation of the renminbi over that period”.

The depreciation of the renminbi in recent weeks has raised fears that China is aiming to counter US tariffs by weaponising its currency.

The US has declared China a “currency manipulator”.

The initiation of a currency war could mark the opening of a new front in the US-China conflict over trade.

President Trump has made increasing tariffs on China a major plank of his 2020 re-election campaign.

He has justified punitive US tariffs on China as an effective measure to force China to open up its domestic market to US firms.

This, he claims, would increase US exports to China, reduce the imbalance in US-China trade and create more jobs in the US.

From a purely domestic standpoint his approach may seem appealing.

US workers, worried about the loss of jobs to countries abroad, form the core of his domestic support base.

Besides, many US analysts have argued that the US was in danger of losing its position as the world’s leading economy unless it pressed China to open up its markets and stopped it from violating intellectual property rights of US firms.

The trade war, from this perspective, is a means to ensuring continued US dominance of the global economy.

While from a US perspective this strategy might seem logical, the implications for the rest of the world are perhaps alarming.

This US-China conflict has the potential to set-off counter-actions by other countries that could impact global trade and reduce global growth.

After all, other countries also have exports and domestic jobs to protect.

China is a major competitor to other large emerging economies in global export markets and any depreciation in the Chinese currency makes their products much less competitive.

If other emerging economies let their own currencies depreciate, we might see the emergence of a much wider currency war with unpredictable consequences.

The depreciating trend in the rupee in the recent period might even be an indication of what lies ahead.

Chinese currency devaluation in 1995 and the decline in exports from Southeast Asian countries triggered the Southeast Asian crisis of 1997.

The resulting economic crisis led to political unrest and regime change in many Southeast Asian countries.

The only silver lining, in the current context, could be China’s recent assurance that it would not use devaluation as a policy tool.

But can one accept such Chinese statements at face value? Or will the currency war escalate, drawing in other countries as well? Only time will tell.

Biju Paul Abraham and Partha Ray are professors at IIM Calcutta.