Economic growth, which we are taking for granted, slows for a completely different set of local or global factors and the Modi premium vanishes, observes Debashis Basu.

Last week I was chatting with a retired banker who has his savings invested largely in stocks.

Like many thoughtful people hoping to see a just and equitable society he was concerned about 'what's going on in the country'.

He wants a change for the better. Then, he hastened to add with a tinge of alarm, 'Of course if (Narendra) Modi does not come back to power, I am sure 20 per cent of my portfolio will be wiped out.'

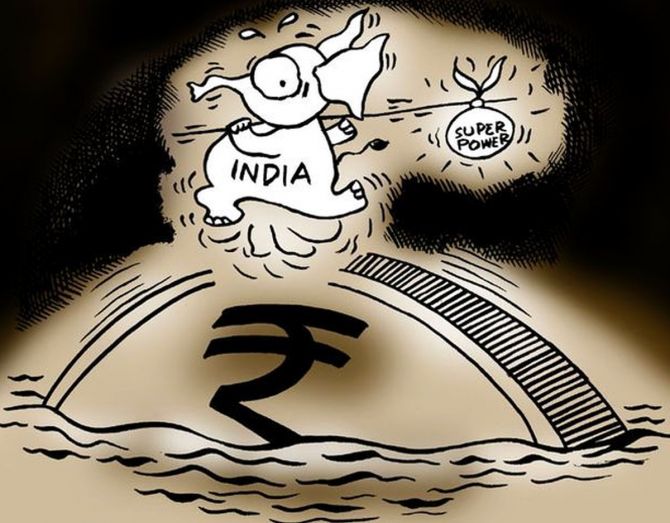

The Indian stock markets are carrying what can be called a Modi premium.

Our retired banker is not alone in acknowledging the Modi premium.

In the absence of a clear alternative leader, the same thought would perhaps dominate the minds of millions of people, whether or not they support the current regime.

Over the past few years, tens of millions of new investors have entered the capital market.

In September alone more than three million new demat accounts were opened, the same number as in August.

Cumulatively, India has more than 130 million demat accounts now, with two-three million accounts added every month.

This wildfire growth has been a result of a fortuitous set of factors such as the ease of opening accounts, record-breaking IPOs, aggressive account acquisition campaigns by brokerage firms, impact of social media, and the extremely strong performance of small and mid-cap stocks over the past three years.

As a result, the total demat accounts in India jumped from 40 million at the end of FY20 to 130 million at present.

Imagine the enormous implications of these numbers. Compulsory dematerialisation was introduced in 1996.

Over the next 24 years, the number of demat accounts went up to 40 million.

Then, in just three-and-a-half years, that jumped by more than 3.25 times to 130 million.

This means that 90 million new investors, 2.25 times the total demat population developed over 24 years, have entered the market in the past three years or so.

They have only known a bull market, one that has constantly climbed over a wall of worries such as a pandemic, high inflation, high oil prices, and global disruption including the Russia-Ukraine war, high US interest rates, the Israel-Hamas war, and a global slowdown in trade.

Not only have these 90 million newbie investors never faced a crushing bear market, they have no memory or understanding of economic and market cycles.

Most are young investors, who view market dips as buying opportunities.

They have no idea that periodically, sometimes for many years at a stretch, the main stock market indices give you almost no returns.

During such times, smallcap stocks, which are the main beneficiaries of the current bull market, can get decimated.

Remember, from January 2018 to August 2019 -- under the same Modi regime -- the Nifty smallcap index was down 40 per cent. It can happen again.

Such dips and crests used to happen fairly regularly in the past, but the general assumption today is that India has changed fundamentally.

We are on an uninterrupted growth track, fuelled by higher government revenues, which are funding investment in urban infrastructure, railway modernisation, and a large defence budget that is helping local companies due to the indigenisation of defence production.

On the other side, the youth has more money to invest, and is attracted to the stock markets.

A combination of economic growth, larger household and corporate surpluses, and a new attitude to risk-taking by investors makes for a long-term bull market.

Interestingly, while GDP growth of a 7.6 per cent in the second quarter is being celebrated, sales growth for the Nifty500 companies was just 3.5 per cent.

According to our research, the current euphoria over smallcap stocks and IPOs leaves no room for error; most small companies are now being quoted at their historically peak valuations.

Valuations matter for future returns. Returns are low when valuations are high.

Then there is the Modi premium. To put it differently, some attribute our economic growth and the consequent bull market entirely to him.

While our banker friend is worried about 'one-sided media coverage, rising intolerance, lies spread through social media and the brutal State power unleashed on the selected few' and would like this to change, it will be possible only with a regime change.

But will a new regime deliver higher economic growth? There is no such indication, because most Opposition leaders never talk about economics or policy, it is only about subsidies.

We have forgotten that the United Progressive Alliance was voted out because of policy paralysis and corruption.

We don't know if the ordinary voter who has not seen the same benefits as investors will think like our banker friend. And then there is also another possibility: Economic growth, which we are taking for granted, slows for a completely different set of local or global factors and the Modi premium vanishes.

After all, there was no growth worth talking about between 2014 and 2020.

Debashis Basu is editor of moneylife.in and a trustee of the Moneylife Foundation.

Disclaimer: These are Debashis Basu's personal views.

Feature Presentation: Rajesh Alva/Rediff.com