It was the RBI which destroyed our $-job economy. It is for the RBI to resurrect it by instituting news ways of managing the INR, says Sonali Ranade

It was the RBI which destroyed our $-job economy. It is for the RBI to resurrect it by instituting news ways of managing the INR, says Sonali Ranade

India's new chief of the central bank, Raghuram Rajan, is no stranger to markets in India and abroad. In fact he was one among those who warned of the banking excesses back in 2007 and what they implied for the credit cycle. So what I say will not be new to him. Nevertheless, here's worth listing out a few things in the Indian context.

- A rally in the dollar is now widely anticipated. Whether it goes from DXY 80 to 85.50 or 89, the change in valuation of other asset prices will be huge. All world currencies will be impacted. $-INR has to some extent anticipated the rally in the DXY and wisely so. But an extension to the DXY rally from 85.50 to 89 will be devastating. That has huge implications for India’s exchange rate management. We need to use the crisis to put our exporters on a sound footing. This is not the time for short-term fixes no matter how tempting they are. Let the INR find a sustainable level that keeps potential exporters afloat.

- The surge in the value of the Dollar comes amidst an interest rate cycle that is turning up. That means there will be PE compression across the board in every asset class be it equities or commodities. India has foolishly kept interest rates too high fighting a structural inflationary rise in food prices that were below world prices with high interest rates. That foolishness has tanked the economy and choked banking. At some time the RBI will have to ease interest rates in INR markets against the world trend. That means $-INR must account for that fact before hand.

- Tanking equity markets across the world will put unprecedented pressure on equity prices at home. The mess in the coal sector and power sector has clogged banks in cross-defaults. Growth will tank further unless the government sorts out the mess in jinxed coal mine privatisation and stalled power plants. Unrelated businesses must be insulated from cross-defaults for some time. Pick-up in growth will not be automatic since the fall is not cyclical but also structural. The RBI must highlight steps under an “emergency plan” that need to be taken immediately, election or not. There is time.

- FII flows will not dry up if we let markets function normally. We shouldn’t worry too much about the losses forced on FIIs. They understand the inherent risk in equity very well. Let the markets function and weed out those who don’t add value. That is a bit counter-intuitive to lay folks but absolutely essential to attract new money into the market. Industrials who weep over the high cost of the dollar should be told to earn some.

- Don’t curb any import except gold, that too strictly through punitive duties with a built in 12-month sunset clause. Make the sunset clause credible and built in so that smugglers don’t invest in beating the system.

Last but not the least, even if Nifty tanks to 4800, it is not the end of the world. As usual there will be a wall of cash waiting to invest at the right price provided we get the reforms back on rails. If FIIs have lost, it was a gain elsewhere. So there is dearth of cash for investment in the system as such. It was the RBI which destroyed our $-job economy. It is for the RBI to resurrect it by instituting news ways of managing the INR. China is a good place to learn the art from. And yes, get labour reforms through.

Gold: The yellow metal closed the week at $1312.20, more or less on, but just under its 50 DMA. Gold is in the process of confirming its near term bottom at $1179.40 made on June 28. The metal could move down towards the $1200 price area over the next few weeks. However, the metal is also building a base for the counter-trend rally to follow. So the price will be a tussle between these two underlying trends till the middle of September or so. All told, the metal is now a buy at dips, especially in any crash in risk assets, for a tradable rally to the $1550 price area.

Gold: The yellow metal closed the week at $1312.20, more or less on, but just under its 50 DMA. Gold is in the process of confirming its near term bottom at $1179.40 made on June 28. The metal could move down towards the $1200 price area over the next few weeks. However, the metal is also building a base for the counter-trend rally to follow. So the price will be a tussle between these two underlying trends till the middle of September or so. All told, the metal is now a buy at dips, especially in any crash in risk assets, for a tradable rally to the $1550 price area. The long-term trend however continues to be bearish.

Silver: Silver closed the week at $20.4070, a notch above the metal’s 50 DMA. Silver, like gold, appears to be in the process retesting the low of $18.17 as the new near-term bottom. With the close above 50 DMA, the probability of a dip to $14 now recedes. Silver too will fall in tandem with other risk assets and I would not take $18.17 as a “confirmed” bottom. However, the next low by middle of September would be the base from which a decent tradable rally in Silver ensues.

Silver: Silver closed the week at $20.4070, a notch above the metal’s 50 DMA. Silver, like gold, appears to be in the process retesting the low of $18.17 as the new near-term bottom. With the close above 50 DMA, the probability of a dip to $14 now recedes. Silver too will fall in tandem with other risk assets and I would not take $18.17 as a “confirmed” bottom. However, the next low by middle of September would be the base from which a decent tradable rally in Silver ensues. No change in the long term trend which continues to be bearish.

HG Copper: HG Copper spiked to a high of 3.3175, higher than its 50 DMA at 3.16 but below the 200 DMA now positioned just under 3.40. The spike came on higher than usual volumes. My sense is that the spike was just a one-off bear squeeze and there is no change in the underlying bearish trend. One would have to revise that view id the metal breaks above 3.40.

HG Copper: HG Copper spiked to a high of 3.3175, higher than its 50 DMA at 3.16 but below the 200 DMA now positioned just under 3.40. The spike came on higher than usual volumes. My sense is that the spike was just a one-off bear squeeze and there is no change in the underlying bearish trend. One would have to revise that view id the metal breaks above 3.40. However, barring a fallback to 3.20 to test it as the new support, the short-term trend in the metal is bullish. The metal will most likely reconfirm 3.0 as the new support zone along with other risk assets before moving on. That said, it is the strongest metal on the charts. Anything below 3.20 may be worth accumulating for the long-term.

Brent Oil: Brent closed the week at $104.87 after bouncing off its 200 DMA [positioned at $100] over the previous weeks. Brent could rally to $112 early next week but the commodity is all set to retest $100 or even lower over the next few weeks along with other risk assets. I would not bet on the rally’s base trend line holding up either. That said, Brent in unlikely to do anything below $90 and would be a screaming buy in any general commodity price crash.

Brent Oil: Brent closed the week at $104.87 after bouncing off its 200 DMA [positioned at $100] over the previous weeks. Brent could rally to $112 early next week but the commodity is all set to retest $100 or even lower over the next few weeks along with other risk assets. I would not bet on the rally’s base trend line holding up either. That said, Brent in unlikely to do anything below $90 and would be a screaming buy in any general commodity price crash. US Dollar [DXY]: The Dollar Index [DXY] closed the week at 81.17 after making a low of 80.89 during the week. As mentioned in earlier columns, the DXY is in the process of confirming a near-term bottom in the 80-81 price area before moving into a Wave V rally that could target 85.50 [at least] or even higher.

US Dollar [DXY]: The Dollar Index [DXY] closed the week at 81.17 after making a low of 80.89 during the week. As mentioned in earlier columns, the DXY is in the process of confirming a near-term bottom in the 80-81 price area before moving into a Wave V rally that could target 85.50 [at least] or even higher. I suspect the process of confirming is all but over and will most likely be completed next week. The following dollar rally could be explosive.

EURUSD: The Eur-Usd has been in a counter-trend rally to test the overhead resistance at 1.34 before heading down again to 1.27 over the next 2-3 months. What we see on the charts is a potential double top at 1.34 that is also reflected in the RSI and Stochastics. The currency pair closed the week 1.33442 after making a high of 1.34 during the week. Barring a possible pull-back to 1.34 or even slightly higher, I sense the pair will turn down to head towards 1.27 region over the next two months. First target for the pair lies at 1.32 which is its 50 DMA price area.

EURUSD: The Eur-Usd has been in a counter-trend rally to test the overhead resistance at 1.34 before heading down again to 1.27 over the next 2-3 months. What we see on the charts is a potential double top at 1.34 that is also reflected in the RSI and Stochastics. The currency pair closed the week 1.33442 after making a high of 1.34 during the week. Barring a possible pull-back to 1.34 or even slightly higher, I sense the pair will turn down to head towards 1.27 region over the next two months. First target for the pair lies at 1.32 which is its 50 DMA price area. USDJPY: The dollar broke through the 50 DMA line against the yen to close the week at 96.20. The dollar is looking pretty weak against the yen at the moment and could retest 94 early next week. But as mentioned with regard to the Dollar Index, the DXY is in the process of testing a Wave IV bottom close to 80 and in the process the yen appears very strong. While a trip down to 94 and the 200 DMA is not ruled out early next week, my sense is that the dollar can launch into an explosive rally any time next week and so shorts in UsdJpy are inadvisable. Expect enhanced volatility in the pair going ahead. I would look to play long dollar at the pair’s lows.

USDJPY: The dollar broke through the 50 DMA line against the yen to close the week at 96.20. The dollar is looking pretty weak against the yen at the moment and could retest 94 early next week. But as mentioned with regard to the Dollar Index, the DXY is in the process of testing a Wave IV bottom close to 80 and in the process the yen appears very strong. While a trip down to 94 and the 200 DMA is not ruled out early next week, my sense is that the dollar can launch into an explosive rally any time next week and so shorts in UsdJpy are inadvisable. Expect enhanced volatility in the pair going ahead. I would look to play long dollar at the pair’s lows. INRUSD: For a broad perspective on the value of the INR [in USD expressed as cents] I examine the reciprocal of the UsdInr chart with weekly prices to see how weak the INR is and to get a sense of where it could go.

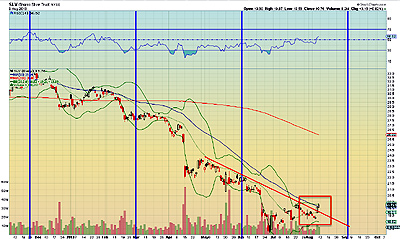

INRUSD: For a broad perspective on the value of the INR [in USD expressed as cents] I examine the reciprocal of the UsdInr chart with weekly prices to see how weak the INR is and to get a sense of where it could go.The INR started its current bout of devaluation/adjustment in July 2011, when its value was 2.3 cents. Yes, that’s our INR. Was 2.3 cents; currently is about 1.6 cents. Taking the simplest model, the first Wave A of the adjust took the INR down from 2.3 cents to 1.7 cents. That’s a depreciation of 0.6 cents or a 26 per cent devaluation from the value in July 2011.

In the normal course, one expects the corrective rally B from 0.17 in June 2012 to rally at least to 2.1 cents in April 2013 as shown by the yellow corrective arrow. The corrective rally got nowhere near that target and grossly under-performed, managing to get to just 1.9 cents. To me that is one very important measure of the structural weakness inherent in the INR.

We are in Wave C. How far can that take the INR? Note, Wave A took the INR down 0.6 cents. We would expect Wave C to be usually as destructive as Wave A though it can be much more than that. 0.6 cents down from 2.1 cents [the point to which INR “should” have rallied] is 0.15 cents which translates into a UsdInr rate of 66.667 to the dollar. But if you take the “revealed weakness” in Wave B into account, the INR falls from 19 cents to 13 cents giving an $INR rate of 76!

Note, these are gross approximations to reality; not reality. So we would expect Wave C to terminate somewhere between the $-INR 66 to 75 mark. That sort of correlates to the anticipated move up in the DXY from 80/81 level to 85.50 that I think will unfold in the next two to three months abroad. Note also that every other currency will take a battering against the dollar. It is not just the INR.

Raghuram Rajan, the new RBI governor should clean out the Augean stables, sort out the mess in exchange management, and start with a clean slate. Artificially propping the INR with stiff short-term interest rates hikes and trading curbs is the short road to disaster. The storms brewing abroad are beyond the control of central banks. The wise will profit, others will go down the tube. Export or perish, should be his blunt answer to MoF and industry. Don’t curb any other import except gold, that too strictly through punitive duties with a built-in 12-month sunset clause. Make the sunset clause credible and built-in so that smugglers don’t invest in beating the system.

DAX: I have bad news for DAX bulls. The index closed the week at 8338.31, well below the highest point hit during the week. Far more importantly, the index failed to rise to 8542.92, the high of the last rally. That means the index tips into a correction starting next week with a target of 7650.

DAX: I have bad news for DAX bulls. The index closed the week at 8338.31, well below the highest point hit during the week. Far more importantly, the index failed to rise to 8542.92, the high of the last rally. That means the index tips into a correction starting next week with a target of 7650.We now have to wait and see far down the index will correct. If this move takes the ensuing move takes the index below 7650, we are into the much anticipated intermediate correction already.

There is a small probability of the index pulling a surprise and making a dash for 8550. Use to exit if not done already. The dash will not change anything much. We are headed for the 7650 area in any case.

Shanghai Composite: The Shanghai Composite closed the week at 2052.24, below it 50 DMA. That was a huge surprise because the minimum one would expect from such a battered down index at this late stage in the bear market is to at least spike up to its 200 DMA 2170 price area. It could still do that but it is probably too late for that.

Shanghai Composite: The Shanghai Composite closed the week at 2052.24, below it 50 DMA. That was a huge surprise because the minimum one would expect from such a battered down index at this late stage in the bear market is to at least spike up to its 200 DMA 2170 price area. It could still do that but it is probably too late for that.What the failure to to rally to 200 DMA implies is that Shanghai too would follow the world indices into another correction which will probably test the low 1850. That then could be the trigger for an intermediate counter-trend rally within a bear market.

NASDAQ 100 [QQQ]: QQQ [a traded proxy for Nasdaq 100] 76.49. Nothing on the chart says it will not go on to make a new high during the course of next week. It probably will. But the advances are coming from poor breadth, poor volumes and from suspect sources. For instance, main line technology counters such as IBM are already in decline while stocks such as Apple propel the index via counter-trend rally within a long bear trend. Those are warning signs of an impending correction if not worse.

NASDAQ 100 [QQQ]: QQQ [a traded proxy for Nasdaq 100] 76.49. Nothing on the chart says it will not go on to make a new high during the course of next week. It probably will. But the advances are coming from poor breadth, poor volumes and from suspect sources. For instance, main line technology counters such as IBM are already in decline while stocks such as Apple propel the index via counter-trend rally within a long bear trend. Those are warning signs of an impending correction if not worse.Note, the failure in Shanghai and DAX, two of the major overseas markets, have in all probability already slipped into a correction. So be warned. A big move down to 68.90 on QQQ awaits. And that is the minimum target. If the rally from there disappoints or if the market overshoots it, we are headed down for a long while.

S&P 500 [SPY]: A new high on SPY, albeit not very far from 171, can’t be ruled out. Its value to bulls will be rather symbolic. And then a correction down to 156 or thereabouts should follow. If the market overshoots 156, we have an intermediate correction. If it falls short, the bull market remains intact. There is no way to tell a priori what will be the outcome. Volume, breadth, stocks in the indices, declining number of new highs all point to an intermediate top but time alone will tell.

S&P 500 [SPY]: A new high on SPY, albeit not very far from 171, can’t be ruled out. Its value to bulls will be rather symbolic. And then a correction down to 156 or thereabouts should follow. If the market overshoots 156, we have an intermediate correction. If it falls short, the bull market remains intact. There is no way to tell a priori what will be the outcome. Volume, breadth, stocks in the indices, declining number of new highs all point to an intermediate top but time alone will tell. NSE NIFTY: Nifty continued its correction by knifing through one support after the other. Even the long-term trend line support in place since 2003 was taken out and that has major implications for the Nifty.

NSE NIFTY: Nifty continued its correction by knifing through one support after the other. Even the long-term trend line support in place since 2003 was taken out and that has major implications for the Nifty.This is a weekly chart of the Nifty to put the current correction in perspective. If my wave counts are true [these are counts that have worked well so far], we are into the last stages of a correction for stocks that peaked in November 2010 [not January 2008] and these stocks comprise such things as private and public sector banks, finance companies, consumer staples, technology etc that make up some 50 to 60 pc of the Nifty’s market capitalisation. The chart makes it clear we are in the initial stages of a giant C wave [this is a weekly chart] whose target would well be to retest 4800. That’s huge bear move ahead.

Note, the move is coordinated not only with emerging markets but also the world’s leading equity markets. So the compression in PEs will compound the problems from a fall in value caused by declining profits. Worse, both will happen in the context of a tightening money markets world wide amidst an interest rate cycle that is turning up. Not to mention a general election that for once is questioning fundamental assumptions. I doubt if India has seen such a correction in its history before.

Be warned.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and no one should rely on them for any investment decisions.