EPF allows partial withdrawal to meet situations like house construction, medical emergency, and so on, reports Bindisha Sarang.

The Employees Provident Fund Organisation (EPFO) has announced that the interest rate on EPF deposits for 2020-21 will remain 8.5 per cent, the same as in 2019-2020.

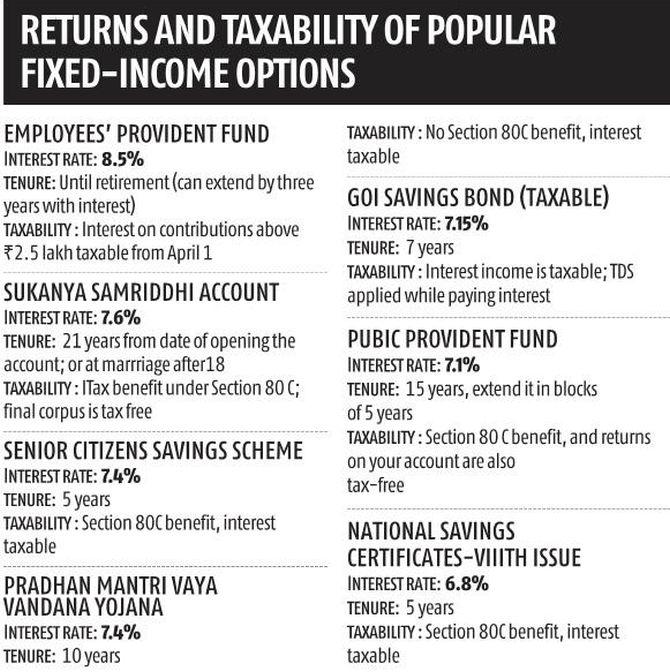

Among government-backed fixed-income instruments, EPF pays the highest interest (please see table).

Apart from offering high returns, EPF also provides considerable liquidity.

Subscribers can withdraw the entire EPF corpus when they retire or when they have been unemployed for over two months.

Partial withdrawals can also be made under certain circumstances.

Conditions for partial withdrawal

EPF allows partial withdrawal to meet situations like house construction, medical emergency, and so on.

According to Prashant Singh, business head -- compliance and payroll outsourcing, TeamLease Services: "Around 95 per cent of advance withdrawals are made to purchase a house, or to construct one, which includes acquisition of the plot."

Subscribers can withdraw up to 36 times the monthly basic salary plus dearness allowance, or the total cost, whichever is lower.

Employees can also withdraw from their EPF corpus to meet medical emergencies.

Here, the limit for withdrawal is six times the monthly basic salary or the employee's total contribution plus interest, whichever is lower.

Withdrawal can also be made to meet an offspring's marriage expense.

The limit in this case is up to 50 per cent of the employee's contribution, but the employee must have completed seven years of service.

Up to 50 per cent of the employee's contribution can also be withdrawn for a child's post-matriculation education.

For home renovation, the withdrawal limit is up to 12 times the monthly wages and dearness allowance, or employee's contribution with interest, or total cost, whichever is the lowest.

Many people also make a partial withdrawal before retirement.

They can withdraw up to 90 per cent of the accumulated balance with interest after turning 54.

Anil Lobo, independent consultant -- retirement and employee benefits, says: "Partial withdrawal of PF accumulations is allowed within one year before retirement, provided the age criterion is also met. This is allowed to enable the individual to plan his retired life."

Covid advance

To enable subscribers to deal with the financial distress caused by the Covid-19 pandemic, EPFO allowed a one-time non-refundable advance in March 2020.

Singh says, "This advance can be up to 75 per cent of the total balance or three months' basic wage of the employee, whichever is lower."

Lobo adds: "While this was extremely helpful, some employees also took undue advantage of this provision. They availed of this facility multiple times and were left with low balances."

Keep corpus with EPFO after retirement

You can choose to leave your funds in your EPF account even after retirement.

Balwant Jain, tax and investment expert, says, "Subscribers should avail of this option to benefit from EPF's high rate of return."

However, one needs to watch out for one thing.

Says Kiran Telang, Mumbai-based certified financial planner: "If an employee leaves her funds with EPFO, interest will be credited for 36 months after retirement. Thereafter, balance can be maintained for an unlimited period but no interest will be paid."

The taxation of this interest income changes, Jain says.

"When you are an employee, the interest income is tax-free. But once you retire it becomes taxable."

Employees also need to declare this income in their income tax returns.

As for whether you can make partial withdrawal from EPF after retirement, Singh says that is not permitted.

Finally, utilise the liquidity provisions that EPF provides judiciously so that you have adequate money left for your post-retirement life.

Feature Presentation: Aslam Hunani/Rediff.com