Inflation pegs down currency value, re-allocates resources, reduces potential economic growth and leads to the attrition of gross domestic savings

Sustained increases in price are often due to rising demand for existing production, when the former outpaces the productive capacity of an economy. With high money circulation, one has more money to spend and invest, but production is unable to expand in response. Prices must now rise to bring equilibrium to the market, by incentivizing producers to increase production.

If the economy is already at full capacity of output, employment and production increase becomes difficult. In order to employ more workers, wages must rise, which increases the incomes of workers, who then become better off and contribute to a further increase in demand, and the cycle continues. Unless the central bank intervenes, or another external factor brings in moderation, the process is exacerbated.

However, if the economy is not functioning at full capacity, the price rise due to excess demands puts an upward pressure on production- supply rises to meet demand and price increases gradually. But, this might lead to outright price decline as well. A drop in price would imply that the demand is too little to meet the current increased output levels. This would then result in downsizing, less money in the hands of employees, hence less disposable income for consumers, leading to even lower demand, hence price cuts.

So the see-saw of demand and supply keeps moving the prices up and down!

In the short run, inflation is about the shifts in aggregate demand with respect to aggregate supply; in the long run, inflation is a function of the Central bank’s policy measures and discretion in conducting fiscal policy.

By definition, inflation refers to a persistent rise in the general level of prices in an economy. By gauging the rate of inflation or deflation (a negative rate of inflation, referring to a decline in the level of prices, which occurred in the previous example when supply outpaced demand, and may culminate in depression) present or anticipated, producers and consumers are given the means to measure the cost of production and living.

Most often, inflation refers to price inflation, as opposed to monetary inflation which refers to the significant increase in the money supply. Consumer Price Index (CPI) is the key measure of inflation in India.

CPI measures the cost of consuming a standard basket of goods and services over a particular period. Through this index, one can evaluate the cost of living in a particular economy. For example, if the weighted average of the basket in 2013 was 200, and 206 in 2014, the rate of inflation in 2014 would be 3 per cent.

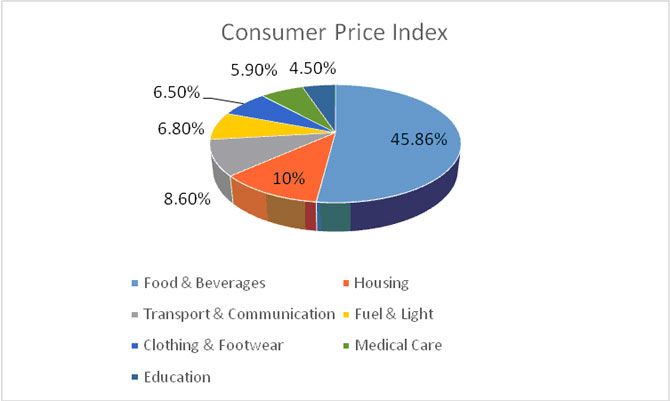

The standard basket includes food, clothing, shelter, fuel, transport, healthcare and other day-to-day purchased goods and services for rural, urban and combined groups. The weights for each component of the Consumer Price Index basket is determined by their importance, as surveyed by consumers’ total spending on that item (See Chart 1).

Chart 1: Components of Consumer Price Index

Source: tradingeconomics.com

CPI is a rather stable index. It is not susceptible to large changes, and its basket items are constant, reflecting the standard items consumed by domestic households.

As such, inflation pegs down currency value, re-allocates resources, reduces potential economic growth and leads to the attrition of gross domestic savings, with less capital formation in the economy. But how are individuals really impacted by the inflation?

High inflation leads to higher interest rates; people in need of loans and mortgages find it difficult to borrow with increased costs of borrowing. For example, banks increase rates on existing borrowers of home loans during times of inflation. As home loans are mostly taken at floating rates, most customers are wont to pay more EMI per month.

When saving for retirement, education, housing, or any other plan in the foreseeable future, the rise in cost is a massive risk: buying may cost more in the future than today. Inflation distorts future goals and savings.

A bigger (if not the biggest) risk of higher inflation is posed to the lower and fixed income families. Prices for food and utilities such as water and fuel rise at a rapid rate. Usually, being short of cash, more people use credit cards and get into a debt trap, having to take personal loans- more EMI to pay; and budgets are incisively cut for most of the lower and middle classes.

The issues associated with inflation form a double-edged sword: while prices are higher, declining one’s buying price, non-fixed income groups can benefit from increases in income (however, if income increases at a rate less than the rising price rate, buying power still declines).

This is why economically worse-off individuals bear the most significant brunt of high inflation, as they are less able to insulate themselves and hedge against the risks and uncertainty posed during inflation.

Investors in debentures and fixed-interest securities, bonds, etc. lose substantially during inflation. Similarly, retail investors with stocks in inflation-sensitive companies such as automobiles are likely to see stock prices decline as people prefer to not spend discretionary money.

Inflation is known as the Worst Tax because its effects often go unnoticed with the focus on nominal earnings rather than real earnings. If inflation is rising at 9 per cent, and one earns 6 per cent in a savings account, one may feel 6 per cent richer, when in fact one is 3 per cent poorer. Real incomes of wage earners sharply decrease, especially when wages do not rise at the same pace as the general price level, thus increasing the real cost of living.

As the value of national savings drops with less money to save now as people spend a greater part of their disposable income, individuals are left with little money to spend on any other activities.

In recent years, inflation has been perceived as a serious problem owing to public confusion about what inflation is and how to make adjustments for it. However, what is certain is that Inflation makes it difficult to make decisions about future expenditure, investment, and production with respect to current prices.

Anisha Sircar is a student at the Flame University, Pune and Nupur Pavan Bang is the Head of Analytics at Insurance Information Bureau of India, Hyderabad