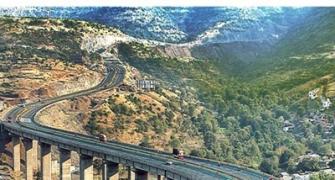

The funding need for building India’s infrastructure is large

India needs a huge Rs 31 lakh crore (Rs 31 trillion) in the next five years for building its infrastructure, a report said on Thursday.

India needs a huge Rs 31 lakh crore (Rs 31 trillion) in the next five years for building its infrastructure, a report said on Thursday.

The funding need for building India’s infrastructure is large, said a White Paper on Infrastructure Financing by Crisil Ratings and industry body Assocham.

"We need close to Rs 31 lakh crore (Rs 31 trillion) over the next five years to provide uninterrupted power supply to our homes and factories, and improve our roads, telecom, transport and other urban infrastructure," it said.

This translates into more than Rs 6 lakh crore (Rs 6 trillion) of investments every year or around Rs 1,700 crore (Rs 17 billion) every day from April 2015 to March 2020, it said.

Among the key lenders, banks have played a critical role in infrastructure financing, it said, adding that they also need gigantic capital to lend.

On the other hand, the new norms for raising external commercial borrowings will make things easier for companies to borrow overseas.

"But, here the catch is that they come with currency risks, and the tools to counter them need to evolve.

“That leaves the bond market, whose role in meeting this financing requirement will be crucial," it said.

It said large investor in bond markets like pension and insurance funds have huge investible surpluses but there is a challenge in tapping these funds.

"Bond market investors are generally risk averse and prefer to invest only in high safety paper, whereas infrastructure projects carry a certain amount of risk.

“There is, therefore, a need for innovative credit mechanism that can create a bridge to allow issues/ projects with moderate credit worthiness to access the bond market," it said.