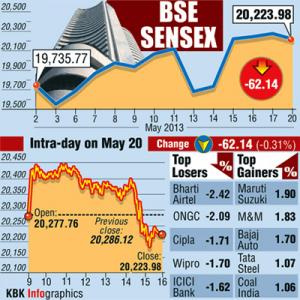

Markets ended lower on Tuesday, amid weak European cues, after profit taking in late trades was seen in autos and select bank shares.

Markets ended lower on Tuesday, amid weak European cues, after profit taking in late trades was seen in autos and select bank shares.

The 30-share Sensex ended down 112 points at 20,112 and the 50-share Nifty closed 43 points lower at 6,114.

Brokerage firm Barclays Capital today lowered India's growth forecast to 6% for 2013-14, from earlier projection of 6.2%, citing 'recent disappointments' in economic activity.

The brokerage firm further cautioned that there is a possibility of further downside risks to growth, especially in the near term as RBI's policy interest rate cuts in recent months has not been translated into reduction in bank lending rates.

Asian markets ended mostly on a listless note in trades on Tuesday as investors remained jittery about the potential for the tapering of asset purchases ahead of Bernanke's testimony to Congress.

The Nikkei and Shanghai Composite ended with marginal gains while the Hang Seng and Straits Times ended 0.3-0.5% down.

The dollar edged higher, gold steadied and European shares remained near five-year highs on Tuesday as investors wait to see if the US Federal Reserve will give any signal on the future of its stimulus programme.

Having hit a five-year high on Monday, European shares opened 0.3% lower as investors cashed in on some of the recent gains.

The CAC-40 and DAX were down over 0.5% each while the FTSE-100 was marginally down.

The BSE Realty index was the top loser down 2.6% followed by Auto, Power, Healthcare, Capital Goods, Bankex, FMCG and Metal indices

Auto stocks continued to remain the top losers in the Sensex after

Other Sensex losers include, SBI, HDFC Bank, ITC, NTPC and ONGC which ended down 1-2% each.

IT shares firmed up amid a weak rupee. Among Sensex gainers, Infosys and TCS ended up 1% each.

Coal India ended up 2% at Rs 307 after reporting a nearly 90-percent jump in standalone net profit at Rs 2,320.61 crore for the fourth quarter ended March 31.

Among other shares, Adani Power has surged 12% to end at Rs 61, extending its around 11% rally in past two trading sessions after the company said its promoters have releases majority of pledge shares lying with lenders.

Styrolution ABS (India) has dipped 9% to end at Rs 475 after its parent company has fixed the share sale price at Rs 400 per share. The floor price is 23% discount to Monday’s closing price.

Akzo Nobel ended up 8% at Rs 1,133 after its board recommends a total dividend of 800% or Rs 80 per share including special dividend for the financial year 2012-13.

Divi’s Laboratories has dipped 7% to end at Rs 1,008 after reporting 17% year-on-year (yoy) decline in its consolidated net profit at Rs 181 crore for the fourth quarter ended March 31, 2013 , due to foreign exchange loss during the period.

Omaxe has tanked 7% to end at Rs 152 after the promoter of real estate firm has fixed the floor price for proposhare sale at Rs 148 per share. The floor price is 10% discount to Monday’s closing price of Rs 164.

The BSE Mid-cap slipped 0.6% and Small-cap index ended down 0.4%.

Market breadth was weak with 1,429 losers and 940 gainers on the BSE.