Among the gainers, Siddhartha Lal of Eicher group (net worth up 152 per cent) tops the list, followed by the Ruias of Essar Group (up 111.4 per cent) and Desh Bandhu Gupta of Lupin (up 104.5 per cent).

Among the gainers, Siddhartha Lal of Eicher group (net worth up 152 per cent) tops the list, followed by the Ruias of Essar Group (up 111.4 per cent) and Desh Bandhu Gupta of Lupin (up 104.5 per cent).

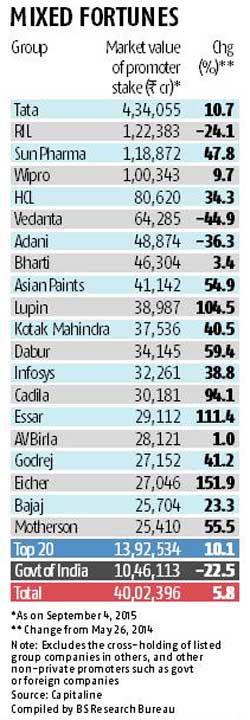

For India’s top business houses, the first 15 months of the Narendra Modi government has been a roller-coaster ride.

While the promoters of information technology, pharmaceutical and consumer goods companies have gained, those of old-economy businesses such as metals, energy, power and infrastructure have seen a sharp decline in their net worth since May 26 last year, the day the National Democratic Alliance government was sworn in.

Among the promoters of the country’s top businesses houses, Anil Agarwal of Vedanta has been the biggest loser, followed by the Adanis and Mukesh Ambani of Reliance Industries.

Among the gainers, Siddhartha Lal of Eicher group (net worth up 152 per cent) tops the list, followed by the Ruias of Essar Group (up 111.4 per cent) and Desh Bandhu Gupta of Lupin (up 104.5 per cent).

All three have more than doubled their net worth, thanks to a strong rally in the stocks of their group companies.

Anil Agarwal’s net worth is down 45 per cent to Rs 64,000 crore (Rs 640 billion) from Rs 1.16 lakh crore (Rs 1.16 trillion) on May 26, 2014.

A sharp decline in the stocks of his group companies has cost Agarwal the second spot on the list of top promoters.

He is now ranked fifth, behind the HCL group’s Shiv Nadar and marginally ahead of the Bharti group’s Sunil Mittal.

Gautam Adani, along with his family, is now worth Rs 49,000 crore (Rs 490 billion), down from Rs 76,690 crore (Rs 766.9 billion) last year, because of a sharp slide in the Adani Enterprises and Adani Power stocks in the past 15 months.

Reliance Industries Chairman and Managing Director Mukesh Ambani remains the country’s richest businessman, though with a reduced net worth (Rs 1.22 lakh crore or Rs 1.22 trillion, against Rs 1.61 lakh crore or Rs 1.61 trillion a year earlier).

His younger brother, Anil Ambani, has seen a steeper fall in net worth and is now out of the top-20 list. His net worth is down 55 per cent -- from Rs 45,122 crore (Rs 451.22 billion) to Rs 20,000 crore (Rs 200 billion).

The analysis is based on the market capitalisation of BSE 500 companies on May 26, 2014, and September 4 this year and their promoter holding on March 31, 2015, and June 30, 2015.

The calculation excludes the cross-holding of listed group companies in each other.

For instance, the Aditya Vikram Birla group promoter’s net worth excludes the Grasim majority holding in UltraTech Cement, the group’s most valuable company.

The Tatas, India’s top business group, have retained their top slot on the list and gained under the National Democratic Alliance government, thanks to a double-digit rise in the market value of Tata Consultancy Services during the period.

TCS’s market capitalisation is up 18 per cent since May 26, 2014, more than compensating for the decline in the market value of other major companies of the group such as Tata Motors, Tata Steel, Tata Power and Tata Global Beverages.

In all, the value of Tata Sons’ investments in the group’s listed companies is up 10.7 per cent at Rs 4.34 lakh crore (Rs 4.34 trillion).

Experts say the rise or fall in net worth depends on the portfolios of companies in various business houses -- those with diversified portfolios such as the Tatas and the AV Birla group have either gained or weathered the recent turmoil in the stock market.

“It’s all about portfolio.

"Currently, the market is rewarding service sector companies or low-capital intensive manufacturing companies, while punishing heavy manufacturing and high-leveraged ones.

"This favours some promoters and goes against others,” says G Chokkalingam, founder and chief executive of Equinomics Research & Advisory.

This explains the rapid rise in the wealth of the promoters of IT companies, automakers and pharmaceutical companies.

Siddhartha Lal of Eicher Motors is the biggest gainer, with a rise of two and half times in net worth.

Siddhartha Lal of Eicher Motors is the biggest gainer, with a rise of two and half times in net worth.

He is now worth Rs 27,000 crore (Rs 270 billion), compared to his net worth of Rs 10,735 crore (Rs 107.35 billion) on the day the Modi government was sworn in.

The Essar Group’s Ruia brothers have more than doubled their net worth to Rs 29,100 crore (Rs 291 billion) from Rs 13,772 crore (Rs 137.72 billion) last year, thanks to a sharp rally in the Essar Oil stock.

The net worth of Lupin’s Desh Bandhu Gupta doubled to Rs 38,987 crore (Rs 389.87 billion) from about Rs 19,000 crore (Rs 190 billion) last year.

The market’s love for fast-growing pharmaceutical companies also helped Dilip Shanghvi of Sun Pharma (net worth up 47.8 per cent) and Pankaj Patel of Cadila Healthcare (up 94 per cent).

Fortune also favoured the promoters of automakers and consumer goods companies, with high double-digit rises in the net worth of the Asian Paints promoters, Burmans of Dabur and the Godrej family.

By comparison, Sunil Mittal and Kumar Mangalam Birla just about managed to maintain their net worth during the period.

In all, the top 20 promoters are now worth Rs 13.9 lakh crore (Rs 13.9 trillion) compared with Rs 12.65 crore (Rs 126.5 million) on May 24 last year, a rise of 10 per cent.

Image: Reliance Industries Chairman and Managing Director Mukesh Ambani with Prime Minister Narendra Modi. Photograph: Reuters