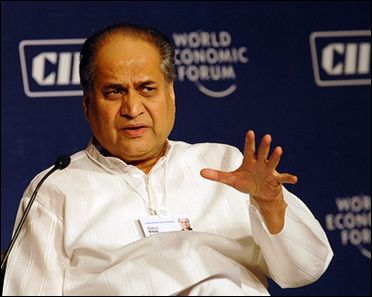

India's GDP growth of 7.1 per cent achieved last fiscal is not as encouraging as it might seem despite the expansion rate being better than all developed countries, according to Bajaj Auto Chairman Rahul Bajaj.

Impact of lack of significant investments in the last 4-5 years; inability of private sector to put in fresh capital with availing of loans becoming an issue due to rising NPAs of banks, along with demonetisation were mainly responsible for dampening growth, he said.

"I thought of starting with encouraging news about India's economic growth in 2016-17. But as I started looking at the latest evidence, it didn't seem as encouraging as I believed it might be," Bajaj said in his address to shareholders in the company's annual report for 2016-17.

He said in its latest advance estimate, the Central Statistical Organisation has pegged India's real GDP growth for last financial year at 7.1 per cent.

"No doubt it is better than all developed countries and most emerging markets including China. However, it is not as good as the 7.9 per cent GDP growth achieved in FY2016," Bajaj said.

While the country has grown, the veteran industrialist said, "We possibly have a longer way to go to attain a steady state annual growth rate between 7.5 per cent and 8 per cent, which is what we need to create a launch-pad for greater employment, a more significant global economic presence and accelerated poverty reduction."

Elaborating on three factors that have played a role in dampening growth, Bajaj said there has been a lack of significant investments over the last four to five years.

"Of late, there has been a serious effort at government investments in some key infrastructure areas. But that takes time to translate into additional income and employment. And truth be told, there is hardly any private sector investment worth the name," he said.

Underlining the impact of rising bad loans and its impact on private sector investments, he said the non-performing assets (NPAs) of 27 public sector banks were estimated at Rs 6,47,759 crore, or 88 per cent of the total recorded NPAs across all banks.

This represents a 140 per cent increase over what it was two years earlier, and constitutes 12 per cent of total loans and advances, he added.

"With these banks being badly stressed, there seems to be no appetite for advancing term loans without which it is virtually impossible to envisage the kind of investment spends needed for getting us securely on to a higher growth path," Bajaj said.

The third factor, according to Bajaj was the "shorter term aberration" and "temporary negative effects" of demonetisation of Rs 500 and Rs 1,000 notes announced on November 8 last year.

"Although the estimates for October-December 2016 show no appreciable dip in either real GDP or GVA, there seems to be enough evidence on the ground that removing over four-fifth of the value of currency in circulation almost overnight and substituting it with a much slower injection of the new Rs 500 and Rs 2,000 notes created constraints across various sectors of the economy," he claimed.

While it remains to be seen what the overall effect of this will be on growth for the first half of FY2018, Bajaj said: "If at all, I hope it will be moderate."

Commenting on the company's performance, he said Bajaj Auto "could have possibly done better, but given the circumstances, it has done reasonably well to be where it is."

The company's net sales declined by 3.5 per cent to Rs 21,374 crore and profit after tax (PAT) also dipped by 2.6 per cent to Rs 3,828 crore in 2106-17, he said.

He said the company was also affected even worse by "external factors" of poor economic conditions and severe foreign currency constraints in some of key importing countries in 2016-17 than 2015-16.

"Motorcycle exports de-grew by 16.5 per cent; and three-wheeler exports fell by 31.2 per cent," he said, adding that in terms of rupees Baja Auto's exports fell by over 19 per cent to Rs 7,880 crore while in US dollar terms they shrank by 23 per cent to USD 1.09 billion.