'In any organisation, a continuous line of leadership, is required.'

'All R&D will be of focus. All the way from Active Pharmaceutical Ingredients to R&D in formulations, to biologics, NCEs, trans-dermals, and vaccines.'

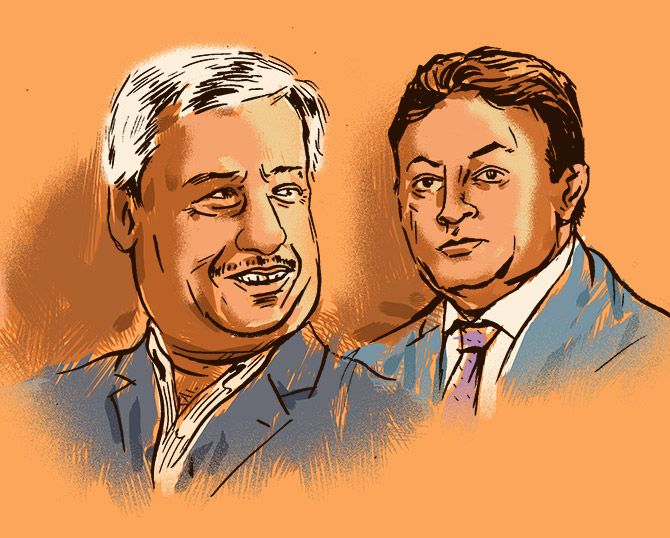

Illustration: Dominic Xavier/Rediff.com

Sohini Das chats with the MD of Zydus Cadila Healthcare, Pankaj R Patel, and his son Sharvil Patel.

When did you decide to finally pass on the mantle?

Pankaj: That the baton would be passed on one day was known from Day 1, when he joined. We have discussed this many a time among ourselves.

When he joined, he was given the project of touching $1 billion annual revenue for the company and that gave him the opportunity to work with teams across the board.

He got familiar with the company, got to learn the business.

There were 70 projects all across under the $1-bn project, in research, marketing, commercialisation, finance, HR (personnel).

After that, I was gradually giving him responsibilities and now I do not have many left to me.

This was done very smoothly, step by step.

He is now touching 40, the right time to pick up full responsibility.

For the next 20 years, the energy of a young man would be given to the organisation; I would be there to mentor.

In any organisation, this is required, a continuous line of leadership.

What is the next project you will work on? How apt is the timing, now that you are doing well in the US?

Sharvil: The next project is this company itself. We hope to do well in the US. I am not euphoric, I am pragmatic.

There would be headwinds for the US market.

We have a good pipeline coming through and the next couple of years look good for us.

Going forward, the challenge in the US is to make sure we build some other line of business, beyond generics.

That's where I'd like to put some more effort.

We made an acquisition at the beginning of this year (Sentynl Therapeutics); we need to make sure we build on that organically as well.

That is, make sure good products come through, especially in the speciality segment.

Your father built his empire through the inorganic route. Would you like to pursue the same strategy or consolidate?

Sharvil: Currently, we would consolidate but we also have to be opportunistic. If we get a good opportunity, we cannot let that pass by.

We have identified areas where we want to work.

As I said, the US is one area where we'd look to differentiate the portfolio, front-end presence.

We have some gaps in the emerging markets portfolio, not very significant but some gaps.

We would like to strengthen that if we get something at the right price.

And, in India, we are confident because we have a large presence and established marketing practices and businesses.

So, if we get some good brand opportunities or in-licensing opportunities, we would definitely work on that.

But, currently, we do not have a very large M&A (merger and acquisition) plan.

We don't think we need to do it right now. We need to consolidate on what we have built so far.

You had taken over at Zydus Wellness a few years earlier. How has that experience prepared you for today's role?

Sharvil: They are very different businesses and cannot be compared.

But, what happened at Zydus Wellness is that we had reached a size and scale when we needed to change the way we were doing things.

While we made that change, we struggled for two years to bring growth back into the business.

So, while we did well on margins and profits, our growth was subdued. We made some mistakes on the way as well.

Going forward, everything is aligned well. Sales and marketing is doing well.

We have a good leadership position there and the leader is very motivated to drive the business forward.

Putting the right people in place has been a good learning for me at Zydus Wellness.

We are very keen to do M&As in this business now.

If something works out, we would like to do it in the next one year. It has good RoI (return on investment), good cash flow.

Sharvil, coming from a research background, how different or similar are your approaches to running the company?

Sharvil: I have seen my grandfather (Ramanbhai Patel, who co-founded the entity in the 1950s); he was a man of science.

When he (father) took over, though the businesses did very well, nobody understood the R&D (research and development) efforts the chairman had put in.

It is always underplayed.

We have made significant efforts in R&D under his leadership, especially since 2000, when we built our R&D centres in biologics, NCE (new chemical entities) and vaccines.

The foundation has been laid by him, and his contribution to research is the most significant in terms of the portfolio we will now build over the next five years.

Commercialisation is something that I will have to ensure we do well.

It was very hard to build an R&D set-up in India, with issues of talent and capabilities.

Now that we have that in place, we need to make sure we drive this engine well.

I never had the impression that the chairman had commerce on his mind; he has always had science on his mind.

Commerce, obviously, did well.

In R&D, which area is your key focus -- biologics, vaccines, NCE?

Sharvil: All R&D will be of focus. All the way from Active Pharmaceutical Ingredients to R&D in formulations, to biologics, NCEs, trans-dermals, and vaccines.

The challenge is to make sure we have good clinical data to take the programmes forward.

We have great opportunity, as these are unmet medical needs. The focus is not only on R&D but also compliance (with good manufacturing practices).

To sustain our business, we have to be compliant.

How will life change, if at all?

Sharvil: Nothing significant. I guess the chairman would now have more time to look at strategy, opportunities and have a detached view.

He can guide us in the right direction.

Will you focus on investing in start-ups, on your other businesses like hospitals, etc?

Pankaj: Yes, I have my hands full. I have work as Ficci chairman.

Then, there is the hospital business. Sharvil will only look after Cadila Healthcare; the rest I will have to look into.

I do not yet invest in start-ups but am seriously thinking about it.

The idea is that I would spend some time with entrepreneurs, mentor them, both advice and financial investments. No concrete plan as of now.

Have you set yourself any targets, in terms of revenues or otherwise?

Sharvil: No targets. What the chairman says is, focus on the inputs, not the outputs.

Everybody does it the other way round. If we do all that we plan to, the revenue will follow.

We should look at what type of milestones we are hitting on R&D, approvals, etc.

That would make investors understand that revenue will come if we continue to have the right products at the right place.

I am trying to ensure the input parameters are established. We want to build emerging markets as the third pillar of our business.

We have India and the US. Currently, it is five per cent of our turnover.

We will look at in-licensing where we have gaps, and look at M&As in a few geographies.

Vaccines and biologics are going to play a key role. We also have to focus on India, which (their market here) is estimated to grow at 12 per cent.

Not many markets are growing at that rate. We need to look at the right products, intellectual property-led products, in-licensing opportunities here, etc.

Pankaj: The handover process has started. I was looking into human resources, finance, vaccines and NCE; now, I need to hand over these verticals to him.

This will take around a month or so. I had a team and most of them have retired. When he (Sharvil) came in, I knew that most of these people would retire in 10 years or so.

That's how I prepared the human resources plan, that by the time this team goes and I go, Sharvil would have built his team.

The new team is in place, the old team has retired.

We have a new head of manufacturing, new head of HR, new head of India business, new head of US business, new head at Wellness, new chief financial officer.

Only the head of the animal health business is an oldtimer.