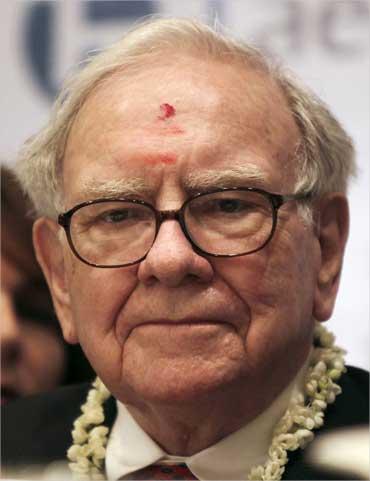

Legendary investor Warren Buffett feels that the US debt is still worth 'AAA' rating and if anything has to change, it may be his opinion about rating agency S&P rather than his view on US Treasury bills.

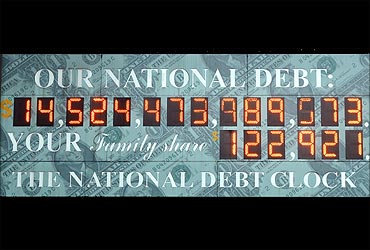

In an unprecedented move last Friday, S&P downgraded its credit rating of the US -- the world's largest economy to 'AA+' from 'AAA'.

"Our currency is not AAA, and in recent months the performance of our government has not been AAA, but our debt is AAA," Buffett told American business channel CNBC.

According to him, he would not be changing his mind regarding US Treasury bills on the basis of S&P downgrade.

"If anything, it may change my opinion on S&P," he said. And Buffett is putting his money where his mouth is.

At the end of June, Buffett-led Berkshire Hathaway had cash and cash equivalents worth about $48 billion. Out of that total amount, a significant chunk is reportedly invested in US government debt.

On Friday, Buffett had said that S&P's downgrade of US rating does not make any sense.

The historic downgrade has triggered fresh fears about the overall health of global economy and has also roiled stock markets worldwide.