After every corporate announcement, check your demat and bank accounts for necessary credits.

It’s common that investors who own stocks forget to check whether the latest dividends or bonus announced by the company has actually been credited to their accounts.

It’s common that investors who own stocks forget to check whether the latest dividends or bonus announced by the company has actually been credited to their accounts.

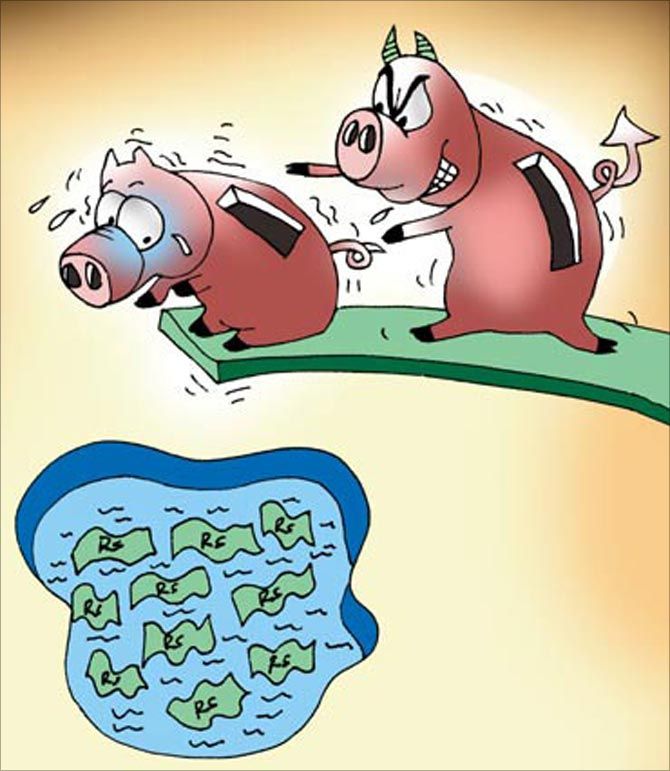

Many times, the amounts are so small so people don’t care. But, as the Sharepro scam has shown, investors could lose out heavily because of this.

Recently, Asian Paints filed a complaint against its share transfer agent Sharepro for illegally transferring dividends and shares to fraudulent accounts.

Aptech and Britannia Industries, too, have filed similar complaints against Sharepro.

According to an investigation by the Securities and Exchange Board of India (Sebi), as much as Rs 21.7 crore was transferred to the accounts of relatives of senior management of Sharepro and unauthorised entities over a period of 10 years.

Currently, around 250 companies are employing the services of Sharepro.

“Whenever there is any corporate activity, within 48 hours, the share, bond or money should be credited to your account. Many a time, shareholders are not even aware of how much dividend is paid or due to them. People don’t even read emails,” says Hiren Dhakan, associate fund manager, Bonanza Portfolio.

The only way to keep a track of such frauds is to be self-vigilant and review your portfolio often even if you are not trading actively.

“These days, whenever a company announces a dividend or bonus issue, the shares or money is electronically credited to shareholders' account. Always keep track of your demat account and the bank account linked to it," says Shriram Subramanian, founder and managing director, InGovern Research Services.

Once the record date is announced, keep track of whatever the corporate action is and how much money is supposed to come into your account, Subramanian adds.

He cites the case of Max India, which split into three different companies, but shares of the new companies are yet to be credited to investors’ accounts.

Frauds include dividend not being credited or not being credited in full, transactions getting settled in other accounts, or fees being hiked suddenly without informing shareholders.

In such instances, the first point of contact for complaint is always the company.

Each company has a dedicated investor cell where you can lodge your complaint. Every company has to publish a list of complaints it receives from shareholders once a quarter.

If the complaint is not resolved by the company, then you can lodge a complaint with the regulator.

You can lodge a complaint through Sebi’s grievance redressal platform, SCORES, which is a centralised online system for lodging and tracking complaints.

“If the shares are not credited to your account, they can even be misused by intermediaries for pledging or lending to someone else. Then there could be two people who have rights over the shares, the original shareholder and the person to whom it has been pledged,’’ says Feroze Azeez, deputy CEO at Anand Rathi Private Wealth Management.

Today, you can get consolidated statements of all your demat accounts from depositories.

This is a very useful feature and investors must keep track of it at least on a quarterly basis, if not monthly.

Many a time, brokers don’t transfer the money or shares to their clients’ accounts and instead keep it in a pool account, as it makes it easier to sell and the client can avoid the additional paperwork and documentation required for the transfer.

“But, this is not a wise thing to do and shareholders must always insist on the shares and money being transferred to their accounts,” Azeez adds.

In case of Sharepro, the matter came to light because it involved a big company like Asian Paints. But, there could be several other cases involving smaller companies.

“The regulator has to impose severe punishment for such frauds. There is still a gap between the scam being discovered and the order being passed,” Dhakan says.