'To create a corpus of Rs 5 crore, the monthly investment required is of Rs 80,000.'

Omkeshwar Singh, head, Rank MF, (external link) a mutual fund investment platform, answers your queries:

Gadiraju S N Varma: Am investing in the following for the past 9 months.

1. SBI smallcap direct growth MF - Rs 10,000 PM

2. SBI Focused Equity Direct Growth MF - Rs 3,000/ - PM

3. Mirae Asset Emerging Bluechip Direct Growth MF - Rs 5000 PM

4. PGIM MIDCAP Direct Growth - Rs 10,000 PM

5. PGIM Flexicap Direct GrowthMF - Rs 3,000 PM

6. Quant Large & Midcap MF direct Growth - Rs 6,000 PM

7. Parag Parikh Flexicap MF Direct Growth MF - Rs 4,000PM

Total Rs 41,000 PM. I will invest up to Dec 2036 to build a corpus.

Please suggest on the above.

Omkeshwar Singh: Please carry on, use step up if required.

Srini K: I am 52 years old and can invest Rs 50,000 per month. Want to create some retirement fund. Could you please advise me which MFs I should invest in?

Omkeshwar Singh: A basket of Diversified Equity Fund and Hybrid should be considered (all growth options):

- Parag Parikh Flexi-cap fund

- Samco Flexi Cap Fund

- Edelweiss Balanced Advantage Fund

- ICICI Pru Balanced Advantage Fund

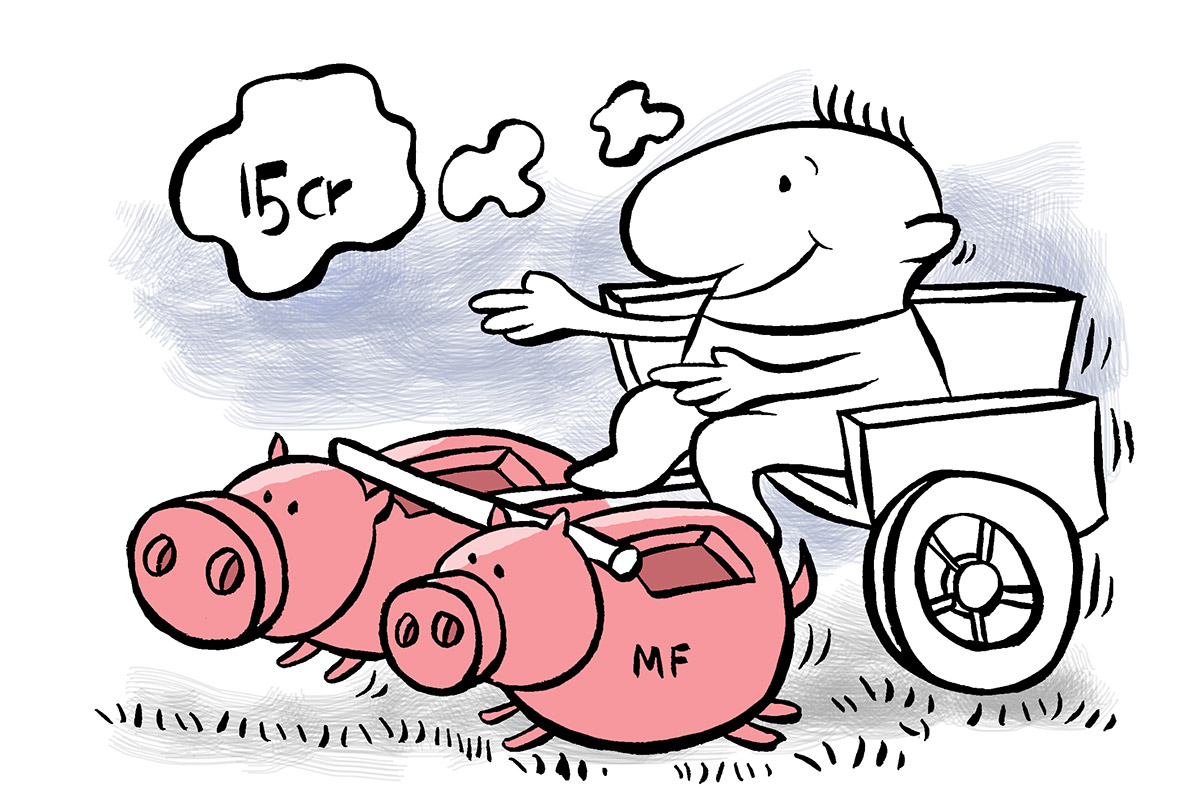

Shrishti Sahu: I am 25 years old. I have been investing from last year. I invest around 50,000 in ppf every year and in MFs:

Mirae Tax Saver-5000/month

PGIM Midcap direct growth – 10,000/month.

Other than this I have some saving in RD. I want to make a corpus of Rs 5 crore in 15 years only with MF.

Please help me with more funds and amount how much to be invested.

Omkeshwar Singh: To create a corpus of Rs 5 crore the monthly investment required is of Rs 80,000.

- Parag Parikh Flexi-cap fund

- Samco Flexi Cap Fund

- HDFC Index Fund – Sensex plan

- UTI Flexi cap Fund

Mukharjee Nadendla: I am from Hyderabad. I have started SBI focussed equity fund 5K month from last 1 year for my retirement plan. I am doing monthly payment of 10k as Jeevan labh for my kids marriage and protected with insurance too. I have to pay 10 k per month in 16 years but maturity after 25 years and relaxing period for 9 years.

I have completed 3 years now. My kid age is now 4 years old and doing icici prulife smartkid plan 1 lakh/ year and paid 4 years. The maturity will be after 7 years but would go for kids' higher education after 15 years of age.

Could you please suggest for my retirement fund thereby to increase in next 15 years.

Omkeshwar Singh: Rs 5000 in 15 years can create a corpus of Rs 30 lakh, therefore, as per your target corpus you can increase the monthly contribution.

Joydeep Mukherjee: Dear Sir, I am investing Rs 2000 each in UTI flexi cap Regular and Parag Parikh flexi cap Direct plan, Rs 1000 each in JM flexi cap and ABSL Digital India Fund since last 5 years in SIP mode. I am 36 years old.

I want to accumulate 40 lakh for children education after 18 years and Rs 5 crore for my retirement fund at the age of 60. I want to add an Index fund in future. Will it be possible to achieve my target with this allocation?

Omkeshwar Singh: Rs 5 crore in 24 years would require a monthly installment of Rs 22,500 this would suffice for both goals.

Divyansh Misra: Hello sir, I am 31. I am looking for a corpus for my daughter's education by the age of 46 i.e. when she turns 18 and I am looking for retirement corpus of at least Rs 2 crore by the age of 55. My current portfolio includes:

1) PARAG PARELH FLEXI CAP- 3000

2) SBI SMALL CAP-2000

3) NIPPON SMALL CAP-2000

4) AXIS LOND TERM EQUITY DIRECT(ELSS)-1500

5) MIRAE ASSET EMERGING BLUECHIP FUND -1000

6) UTI NIFTY 50 INDEX FUND-1500

7) NAVI US TO TOTAL STOCK MARKET-500

8) NAVI NIFTY 50 INDEX FUND-500

9) TATA DIGITAL INDIA FUND -1000

10) NIPPON INDIA SILVER ETF FoF-500

11) UNION LONG TERM EQUITY FUND(ELSS) -2000

Omkeshwar Singh: Funds are good however too many.

With Rs 15,500 monthly Investments the portfolio that can be created in 15 years is Rs 95 lakh and in 24 years Rs 3.7 crore

Pritam Das: I am 38 years old; I need your advice on how much corpus can be made with the following investments after 20 years; also please advise whether I need to stop/switch/step up any of the following mutual fund investments for next 20 years, below is my investment portfolio:

1. PPF every month 12500 (started on Apr 2017)

2. Sukankya Samriddhi Yojana every month 12500 (started on May 2018 but for FY 2018-19 only Rs 20000 was deposited, after that from Apr 2019 onwards, Rs 12500 is deposited every month)...this is for my 4 year old daughter

3. Mutual funds (Started in Nov 2019): Rs 20000 SIP monthly, following 10 funds: Rs 2000 each

3.1 Axis Bluechip Fund -Regular Plan - Growth, total amount invested so far RS 29000

3.2 Canara Robeco Blue Chip Equity Fund, total amount invested so far RS 29000

3.3 MIRAE ASSET EMERGING BLUECHIP REGULAR GROWTH, total amount invested so far RS 24000

3.4 HDFC Multi Cap Fund - Regular Plan - Growth Option, total amount invested so far RS 24000

3.5 HDFC Developed World Indexes Fund of Funds - Regular Plan - Growth Option, total amount invested so far RS 24000

3.6 ICICI Prudential NASDAQ 100 Index Fund - Growth, total amount invested so far RS 24000

3.7 L&T INFRASTRUCTURE FUND, total amount invested so far RS 29000

3.8 PARAG PARIKH FLEXI CAP FUND -REGULAR PLAN, total amount invested so far RS 29000

3.9 UTI NIFTY 50 INDEX FUND-REGULAR PLAN-GROWTH, total amount invested so far RS 24000

3.10 TATA DIGITAL INDIA FUND-REGULAR PLAN-GROWTH, total amount invested so far RS 24000

4. HDFC Life click 2 wealth Investment Rs 5000 monthly with discovery fund for 10 years (started in Nov 2019), total amount invested so far RS 45000

Omkeshwar Singh: There sufficient diversification as far as asset allocation is considered.

In mutual funds the schemes are also fine, but too many!

The corpus that will get created by mutual funds in 20 years with monthly Investment of Rs 20000 is Rs 2.6 crore.

Sagar Singh: I am 35 years old. I want to build a corpus of 2-3crore over a period of next 10 years. Currently I am investing Rs 42,000 every month. Could you please suggest my current SIP is good or not and also if further investment required?

My current SIP:

1. Parag Parikh Flexi Cap Fund Direct Growth - 9000.

2. Mirae Asset Emerging Bluechip Fund Direct Growth - 9000.

3. Axis Midcap Direct Plan Growth - 7000.

4.SBI Multicap Fund Direct Growth - 6000.

5. Axis Bluechip Fund Direct Plan Growth - 6000.

6. Nippon India Flexi Cap Fund Direct Growth - 5000.

Please suggest and help.

Omkeshwar Singh: With investment of Rs 42,000 per month the corpus that can get created is Rs 1.1 crore in 10 year.

No need to add any new funds, you can increase investment in same schemes or do annual step up .

Susanta Har: Greetings. Hope you are doing well and in great health. I'm 40 years old and started investing in mutual funds from 10 years ago. Presently my portfolio value is Rs 63 lakh.

My MF portfolio (SIPs):

Axis Focused 25: Rs8000

HDFC Mid-Cap Opportunities: Rs 5000

Canara Robeco Small Cap: Rs 5000

(all funds are in Direct plan, Growth option)

I want to accumulate Rs 10 crore in next 25 years. Awaiting your suggestion, for any addition or modification in my portfolio.

Omkeshwar Singh: Very decent portfolio and is adequately diversified, for a Rs 10 crore corpus you would need to double the investment and in 25 years the objective can be achieved.

Gaurav Khosla: I read about this service called "Ask MF Guru" in an article online. I wanted you to please review my existing portfolio & help me design it better to achieve my goals listed below.

I do realise that my portfolio is not diversified amongst asset classes. I want to start investing in Gold (SGB) on a regular basis. I am 38year old & my risk profile is "High" for another 10 years.

Please suggest what amendments I should make & how much more I should invest to achieve my targets.

My current investments & savings:

I appreciate your support, thank you.

Omkeshwar Singh: The portfolio and the asset allocation for your profile seems fine. Presently 10 SIPs of Rs 57,000 are ongoing, lets attach the SIPs to respective goals:

- Daughters' Higher Education: SIP worth Rs 12500 will create a corpus of Rs 75,00,000 in 15 years

- Daughter's Marriage : SIP worth Rs 5000 will create the required corpus of Rs 1 cr in 23 years

- Retirement : In 22 years Remaining SIP of Rs 39,500 will create a corpus of Rs 7 crore, plus through NPS the corpus that can be accumulated is @10% Rs 50 lakh ,plus through EPF @8.5% Rs 75 lakh, Through Stocks Rs 3.65 crore, therefore appx 12 crore can be created, for 25 crore the investment in MFs and Stocks needs to be doubled.

If you want Mr Singh's advice on your mutual fund investments, please mail your questions to getahead@rediff.co.in with the subject line, 'Ask MF Guru', along with your name, and he will offer his unbiased views.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this QnA or an attempt to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Read more of Omkeshwar Singh's responses here.

Note: The questions and answers in this advisory are published to help the individual asking the question as well the large number of readers who read the same.

While we value our readers' requests for privacy and avoid using their actual names along with the question whenever a request is made, we regret that no question will be answered personally on e-mail.