Chartered Accountant Nitin Kaushik's message to India's young workforce is clear: spend smart, save smarter and let money serve your goals.

For India's growing salaried class, 2025 has been a year of rising incomes but also rising temptations. A bigger pay cheque today is almost instantly matched by higher spending -- whether on premium holidays, frequent dining out or impulsive purchases on e-commerce apps. Against this backdrop, a viral post by Chartered Accountant Nitin Kaushik has struck a chord with millions.

His message is blunt: If you want to achieve financial freedom, you must play by nine tough but practical rules.

1. Live within half your means

Kaushik's sharpest advice is deceptively simple -- spend only 50 per cent of what you earn.

Raises, he insists, should not become excuses for lifestyle upgrades.

'Lifestyle inflation is the enemy of financial independence,' he warns.

The other half of one's income, he argues, must be channelled into savings and investments.

2. Multiple baskets, multiple protections

For that 50 per cent saved, Kaushik recommends diversification: Mutual funds for long-term growth, gold for stability, NPS and PPF for retirement, equities for wealth creation and cryptocurrency -- but only for those who understand the risk.

'Never put all your eggs in one basket,' he advises.

3. Build a second income

A single salary, Kaushik argues, is no longer enough in an era of inflation and automation.

From freelancing to content creation, consulting to online teaching, he encourages professionals to create parallel income streams.

This not only builds wealth but also cushions against job loss.

4. Insure before you invest

The CA highlights the importance of health and term insurance.

Unexpected medical expenses, he warns, can wipe out years of savings.

Financial discipline begins not with mutual funds but with risk protection.

5. Debt discipline

Kaushik draws a line between 'good loans' and 'bad loans.'

Education, affordable housing or small business loans can be wealth-building.

But loans for cars, gadgets or lifestyle luxuries are financial quicksand. 'Borrowing for depreciating assets is financial suicide,' he warns.

6. Curb lifestyle leaks

What truly erodes wealth, Kaushik says, are the hidden expenses -- daily coffee runs, frequent food delivery and retail therapy triggered by online sales.

He calls them 'lifestyle leaks,' small but deadly.

7. Avoid comparisons

Financial ruin, he observes, often begins with comparisons.

Keeping up with colleagues' foreign vacations or friends' luxury cars pushes people into debt.

'Comparison is the thief of both joy and savings,' he quips.

8. Plan for retirement early

Kaushik urges young professionals to start retirement planning in their 20s.

'The earlier you start, the less you need to invest monthly,' he explains, stressing the compounding effect of time.

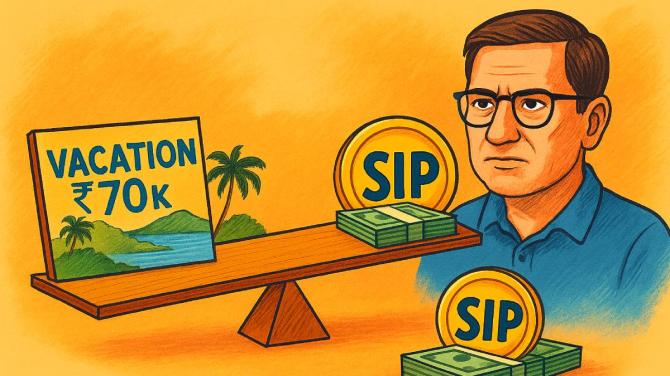

9. Experiences vs investments

His final example has gone viral: that a Rs 70,000 vacation could buy unforgettable memories today but a Rs 70,000 SIP can transform into lakhs tomorrow.

The choice, he says, defines financial destiny.

The larger lesson

Kaushik's nine rules are not about deprivation but about conscious balance.

In a consumer economy built on impulse and EMIs, his words serve as a reality check.

The message to India's young workforce is clear: Spend smart, save smarter and let money serve your goals -- not the other way around.