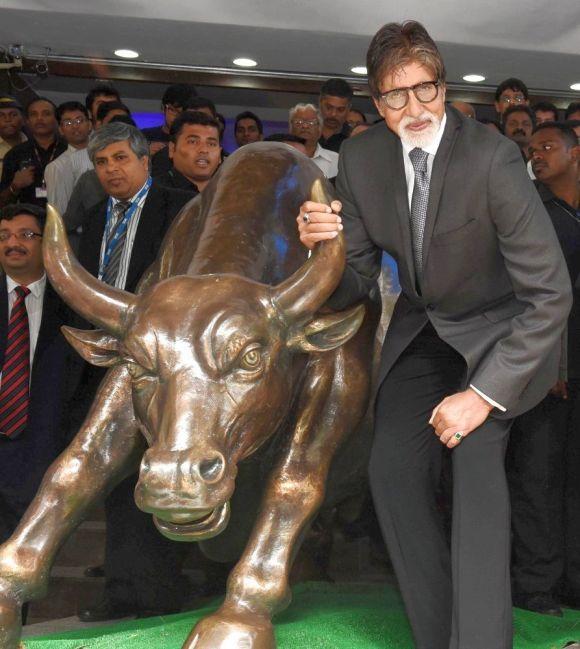

Having clocked year-to-date returns of 23 per cent, the market has high expectations from the Budget and hopes it will achieve a balance between implementing fiscal discipline and kick-starting economic growth.

Leading brokerages have highlighted steps that would cheer the markets further.

Citi Research, for instance, says a phased reduction in LPG/kerosene subsidies, raising income-tax slabs, increasing the savings limit for deduction, a higher mortgage tax break, subsidy cuts, divestment, manufacturing, an infra and agri-chain push, and overhaul of labour laws could be some such measures.

Among sectors, the spotlight is likely to be on oil and gas (increase production, cut subsidies), infrastructure (higher spending, tax breaks), financials (capital infusion in banks, insurance FDI, infra bonds) and real estate (REIT, low income housing, tax breaks).

Here are 10 stocks that research houses believe investors should watch out for.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

DLF

Clarity on land acquisition, industry status for real estate, guidelines and tax rates for real estate investment trusts and an increase in tax breaks on home loans will help the largest listed realty player.

Emphasis on affordable housing is expected to boost the prospects of the sector.

HDFC and other housing financiers such as LIC Housing and DHFL could benefit if the income-tax exemption limit for interest paid on home loans and for principal repayment is raised.

A thrust on affordable housing (tax benefits related to affordable housing, extension of interest subvention scheme) could provide impetus to housing loans.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

ITC

Though most analysts are expecting a hike in cigarette taxes (following duty hikes in the previous two Budgets), they differ on the quantum.

If excise duties on cigarettes are doubled, analysts estimate ITC’s volumes and profits could be hit anywhere between 20 and 30 per cent. A major risk in case of a steep hike is weakening of demand for cigarettes, which could impact ITC’s pricing power significantly.

If duties are raised by 15-20 per cent, it will have a marginal impact. And, if the hike is less than 10 per cent, it will be positive for ITC, notes Citi Research.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

Larsen & Toubro

L&T will benefit from all measures directed at improving infrastructure investments in the country.

A further increase in borrowing limits for infra bonds/higher tax exemption, increased FDI limits for railways, infra and construction, and a higher allocation for power transmission will bode well.

Infrastructure status and higher FDI in defence and clarity on defence export policy and tax benefits will help.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

ONGC

Further measures to cut subsidies on sales of diesel, kerosene and LPG should help cut under-recoveries.

Measures to incentivise investments in exploration and production are positives.

A hike in import duty on oil, though less likely, can benefit oil producers like ONGC.

Excise duty changes (from Rs 3.56/litre specific excise duty on diesel to ad valorem) may be negative.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

Power Finance Corporation

PFC will be a key beneficiary in the power sector if measures such as extension of a tax holiday on power plants, increased bank lending limits to the power sector, and coal and power distribution reforms are undertaken.

Apart from improving PFC's asset quality, these measures could also lead to higher credit demand from power sector players.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

Reliance Industries

Anti-dumping duty on PTA (purified terephthalic acid) will benefit integrated players like Reliance.

Lowering of polymer excise duty or levying cess on crude oil imports (though less likely) can benefit the company.

Possibility of the government extending the tax holiday on refineries and on natural gas production will also benefit the company.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

SBI

A key positive for public sector banks such as SBI will be the creation of a bank holding company, which would ease capital availability and governance issues to some extent.

The bank will also benefit from measures aimed at boosting private sector investments and economic growth.

These will help drive credit growth and improve asset quality.

SBI's life insurance business stands to benefit from a possible nod to a hike in foreign ownership limit in insurance companies to 49 per cent.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

Titan

The company along with other jewellery stocks stands to gain from a reduction in import duty on gold from 10 per cent to 6 per cent, say brokerages.

The duty cut will reduce domestic gold prices, which in turn will lead to higher demand for gold jewellery.

Relaxation of the 80-20 rule (whereby 20 per cent of gold imported needs to be exported) could be another positive as it will improve gold supply.

Proposals towards increasing disposable incomes and boosting economic growth will particularly enhance Titan’s prospects, given its exposure to various consumer segments.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

UltraTech Cement

The expected boost to infrastructure spending or incentives for the housing sector can provide a push to cement demand, benefiting UltraTech, which is among analysts’ preferred picks. Reduction and removal of excise duty on imported or pet coal can be beneficial for reducing costs.

However, any increase in excise duty on cement from the current 10 per cent to 12 per cent can translate into a Rs 5-6 a bag rise in cement prices and would be a negative.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15