The net non-performing assets (NPAs) or bad loans of 40 listed banks in India jumped by 38 per cent or around Rs 35,424 crore (Rs 354.24 billion) in the first six months of current financial year ended September 30, 2013, according to a study done by NPAsource.com, a portal, which focuses on resolution of stressed assets.

Take a look at banks with highest NPAs…

ING Vysya Bank

Mar-2013: Rs 9 crore (Rs 90 million)

Sep-2013: Rs 62 crore (Rs 620 million)

Amount Change: Rs 53 crore (Rs 530 million)

Change: 584.8%

Top public sector banks like State Bank of India, Bank of Baroda, Punjab National Bank, Central Bank, IDBI Bank and Union Bank have all reported more than 30 per cent rise in net NPAs during this period.

...

Bank of Maharashtra

Mar-2013: Rs 393 crore (Rs 3.93 billion)

Sep-2013: Rs 1,535 crore (Rs 15.35 billion)

Amount Change: Rs 1,142 crore (Rs 11.42 billion)

Change: 290.7%

As on March 31, 2013, net NPAs of 40 listed banks were Rs 93,109 crore (Rs 931.09 billion), which rose to Rs 1,28,533 crore (Rs 1.28 trillion) as on September 30, 2013.

...

Syndicate Bank

Mar-2013: Rs 1,125 crore (Rs 11.25 billion)

Sep-2013: Rs 2,547 crore (Rs 25.47 billion)

Amount Change: Rs 1,422 crore (Rs 14.22 billion)

Change: 126.4%

Out of the total forty listed banks, fourteen banks have reported more than 50 per cent jump in net NPAs during these six months.

...

United Bank

Mar-2013: Rs 1,970 crore (Rs 19.70 billion)

Sep-2013: Rs 4,385 crore (Rs 43.85 billion)

Amount Change: Rs 2,415 crore (Rs 24.15 billion)

Change: 122.6%

According to analysis done by NPAsource.com, the share of the top ten banks in net NPAs has come down to 67.8 per cent in September from 70 per cent in March 2013.

...

Corporation Bank

Mar-2013: Rs 1,411 crore (Rs 14.11 billion)

Sep-2013: Rs 2,668 crore (Rs 26.68 billion)

Amount Change: Rs 1,257 crore (Rs 12.57 billion)

Change: 89.1%

NPAsource.com analysis also shows that net NPA of seven banks was higher than 3.5 per cent as on September 30, 2013 as against none as of March 31, 2013.

...

South Indian Bank

Mar-2013: Rs 250 crore (Rs 2.5 billion)

Sep-2013: Rs 440 crore (Rs 4.40 billion)

Amount Change: Rs 190 crore (Rs 1.9 billion)

Change: 76.3%

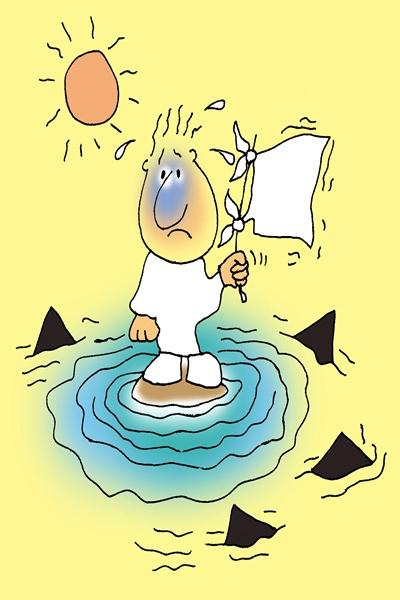

Devendra Jain, CMD of Atishya Group, the owner of portal NPAsource.com said, “Net NPAs in the banking system is likely to touch Rs 1.5 lakh crore by March 2014 as two more quarters are remaining in the current fiscal year and the situation is worsening every quarter. With interest rates expected to remain high at least for the remaining fiscal and Indian economy and corporates in poor shape, banks have a tough road ahead. Further pressure on NPAs will come in next two quarters as many restructured loans of last year will get converted to NPAs.

...

Kotak Mahindra Bank

Mar-2013: Rs 311 crore (Rs 3.11 billion)

Sep-2013: Rs 547 crore (Rs 5.47 billion)

Amount Change: Rs 236 crore (Rs 2.36 billion)

Change: 75.8%

Gross NPAs as on September 30, 2013 stood at Rs 2,29,007 crore (Rs 2.29 trillion), 27 per cent higher when compared to Rs 1,79,891 crore (Rs 1.79 trillion) as of March 31, 2013 for these 40 listed banks.

IDBI Bank

Mar-2013: Rs 3,100 crore (Rs 31 billion)

Sep-2013: Rs 5,174 crore (Rs 51.74 billion)

Amount Change: Rs 2,074 crore (Rs 20.74 billion)

Change: 66.9 %

“It may be noted that the growth rate of net NPAs at 38 per cent has been significantly higher than the 27 per cent growth rate for gross NPAs,” added Jain.

...

HDFC Bank

Mar-2013: Rs 469 crore (Rs 4.69 billion)

Sep-2013: Rs 767 crore (Rs 7.67 billion)

Amount Change: Rs 298 crore (Rs 2.98 billion)

Change: 63.6%

According to NPAsource.com, gross NPAs of listed banks have doubled since September 30, 2011; while net NPAs have risen by 2.4 times or 140 per cent during the same period.