In spite of seasonal weakness which may drag Q4 revenue growth in FY14, the sector is upbeat about future.

The recent pessimism shown by a couple of leading Indian IT services companies may have somewhat given the impression that the euphoria around the revival of the sector may have fizzled out.

However, there are not many takers for this argument. Industry observers say that there are enough indications to believe that the IT services sector, largely export-driven, is expected to log higher growth in FY15 than in the previous financial year.

Barring the cautious comments by Infosys, which is again believed to be specific to its own prospects, most industry leaders are expecting better results in FY15.

...

“The fundamental demand is quite strong and you will see some of the players such as Cognizant and TCS continuing to outperform,” says Partha Iyengar, vice-president and head of research at Gartner India.

“Having said that, some companies whose names I don’t want to mention have company-specific problems that are causing challenges.”

Recently, Infosys, India’s second-largest IT services company, painted a muted picture of its demand environment, something which the company said could restrict it to meeting only the lower end of its growth projections.

…

In fact, Infosys CEO S D Shibulal gave enough indications that the company is expecting this sluggishness to continue throughout the first half of FY15.

Soon after, industry leader TCS also sounded a note of caution, but that was more related to the current quarter (Q4 of FY14) because of the seasonality and drag in the Indian business, something the company has talked of earlier too.

While Infosys’ alarmist tone once again raised a question mark on the so-called company-specific issues it is going through, TCS was relatively more optimistic about the demand outlook in the coming financial year.

“Infosys lost its ability to predict the market almost three years ago,” says Iyengar. “Till then, whatever happened to the company tended to colour the market. But I don’t think that’s the case anymore.”

…

With 2013-14 drawing to a close, analysts are confident that most IT companies will show higher revenue growth than the previous financial year.

They expect 2014-15 to be better, as do the companies. This is backed by three important developments: there has been a pick-up in the deal pipeline, Europe is back on the growth path, and investments made in SMAC (social, mobility, analytics and cloud) portfolio are finally showing traction.

This year, Nasdaq-listed Cognizant, which relies heavily on its offshore delivery capabilities in India, has said that it expects growth in the range of 16-16.5 per cent (though lower than its CY13 growth). The industry expects average growth to be around 13 per cent, the same as predicted by industry body Nasscom.

…

A rosy year

For the coming year, Nasscom has pegged growth at 13-15 per cent. “As the Nasscom expectations and our overall takeaways indicate, FY15 is likely to be a better year than FY14,” say Ankur Rudra and Nitin Jain of Ambit Capital Research.

“In the longer term (FY14-20), we believe revenue growth to be closer to the lower end of the Nasscom guidance for FY15, that is 16 per cent. Even Nasscom’s aspirational target of export revenues of $300 billion ($225 billion, excluding Internet revenues) by FY20 implies CAGR (compounded annual growth rate) of around 13.5 per cent.”

FY15 will be a crucial year for SMAC adoption for the Indian IT services players because price appreciation in commoditised processes is difficult. According to a report by Edelweiss, these four technologies have the potential to support an incremental 2-3 per cent growth for leading players in FY15 on a conservative basis.

…

According to Samiron Ghosal, partner & leader, IT Advisory Services, EY, while demand appears rosier, it is likely to sustain only in the medium term, though the long term is more crucial for the Indian IT players as cloud and mobility are becoming the mainstay.

“The play is changing in terms of the need for global delivery and types of areas of global delivery. If somebody does not align to this, he may lose out in the race,” says Ghoshal.

Almost all the initial indicators point towards a much positive year ahead. To start with, client sentiment is much more positive at the end of FY14.

…

In a recent survey done by Offshore Insights, almost two-third of the respondents sounded more optimistic about the future.

“Compare this to the scenario in June 2013, when 50-55 per cent of the respondents were not confident of spends. Within six months, we have seen an improvement of almost 10 per cent, which is huge,” points out Sudin Apte, research director and CEO, Offshore Insights.

The survey was conducted among 410 business decision-makers from markets like the US (200 participants), Europe (100) and Asia-Pacific (100).

Apte also says that one of the biggest positives in the survey concerned the sentiment on budget cuts. “In the last two-three years, clients have been talking about budget cuts of 14-15 per cent. This has now come down significantly to just about 5 per cent or even lower.”

…

Spending on the rise

To add to this optimism, the share of offshoring spends is expected to increase, as evidenced by a 10 per cent climb between December 2012 and December 2013.

Plus, in terms of contracts and deals, analysts across the table and companies have reiterated that discretionary spends have seen a slight uptick.

According to the ISG Global Outsourcing Index for 2013, restructuring of deals rose 22 per cent for the year when compared with 2012.

The total count of deals that were restructured in 2013 was 357, up from 293 in 2012.

…

A recent report by Kotak Institutional Equities reiterated that several factors support a stronger FY15 for the industry.

These include strong, continued spending in North America, the largest market; timely closure of budgets and positive indicators on spending for 2014; recovery coupled with potential for acceleration in market share gains in Europe; and material investments by clients in front-end transformation.

“How much better FY15 can be will be determined by the pace of gains in Europe: this is an area where Indian IT tasted success recently,” the report said.

There are some who also believe that not all of this will translate into increases in IT spending. “While there has been euphoria in many quarters, we think overall IT budgets will increase only modestly, given that S&P 500’s revenue growth projections remain tepid,” says Ravi Menon of Centrum Equity Research in a report.

…

Growth prospects for the big five

TCS: Q4 revenue growth is expected to be weaker than in Q3, which is partly seasonal and partly due to decline in growth of its domestic business. The company expects around 2 per cent sequential growth in revenues in Q4

Infosys: Expects to be at the lower end of its FY14 expectations of 11.5-12 per cent revenue growth in dollars. This implies a 0.4 per cent decline in revenues on quarter-on-quarter basis. It expects weakness in retail and hi-tech segments, delay in ramp-ups due to skill mismatches, and project cancellations

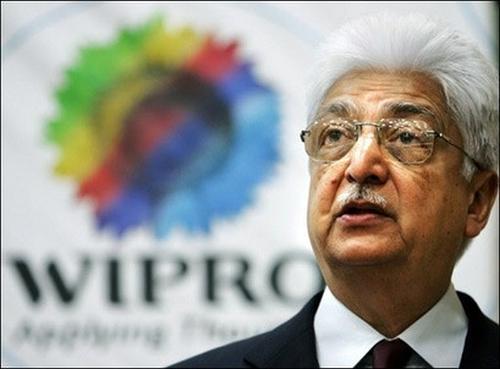

Wipro: Its revenue growth is expected to be around 3 per cent, which is towards the upper end of the company’s guidance of 1.8-3.6 per cent quarter-on-quarter growth

HCL Technologies: It is expected to report 3.2 per cent quarter-on-quarter dollar revenue growth in the January-March quarter of 2014, backed by deals that are already signed and dominance in the re-bid space. However, much of the growth will be driven by infrastructure management services

Tech Mahindra: Expects to see over 3 per cent quarter-on-quarter revenue growth in Q4 backed by strong deal closing (of around $1 billion in the last quarter)

Source: Analysts, brokerage reports