The liquidity-driven market rally since September, which has seen about $2 billion of inflows into the Indian equity markets, has propelled the benchmark the S&P BSE Sensex to a new high after about six years.

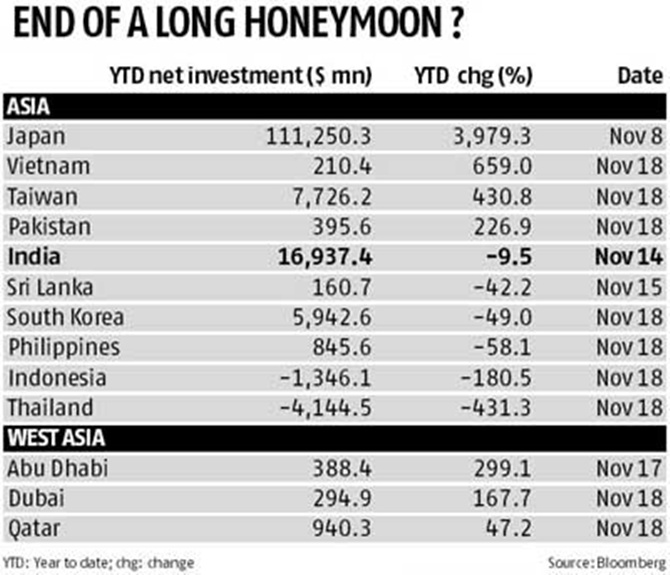

Foreign institutional investors (FIIs) have invested about $17 billion in Indian markets till early November.

However, the amount is about 10 per cent lower compared to the corresponding period last year, data show.

Thailand, Indonesia, the Philippines, South Korea and Sri Lanka are the other markets that have seen lower inflows so far this year compared to the year-ago period.

…

Andrew Holland, chief executive of Ambit Investment Advisors, says, “We had a scare between May and August, when FIIs looked for more attractive investment destinations compared to India, given the US Federal Reserve’s tapering of the bond-buying programme.”

Nick Paulson-Ellis, India head, Espirito Santo Securities, says, “This year, the main difference has been tapering tremors over June, July and August, all of which saw FII outflows. Given the macroeconomic challenges and uncertainty on tapering, the fact that FII inflows are as high as they are is remarkable.”

Peer group

Among India’s peers, Thailand, Indonesia, the Philippines, South Korea and Sri Lanka have seen FIIs flow come down compared to last year.

…

“Overall, emerging markets are slowing, with GDP (gross domestic product) growth now at a four-year low. All of these countries have seen sharp increases in private sector debt levels through the past decade. Therefore, with the threat of liquidity withdrawal by the US Federal Reserve (US Fed) on the horizon, there is concern about how this will expose their vulnerabilities. If it doesn’t cause a crisis, it will at least mean slower growth for several years,” says Paulson-Ellis.

Japan, on the other hand, has been an attractive destination, attracting inflows of $111 billion so far this year, a whopping 3,979 per cent rise compared to the year-ago period. Vietnam, Taiwan, Pakistan and Abu Dhabi are some of the other regions that have attracted more flows so far this year compared to the year-ago period.

…

While ‘Abenomics’ and stimulus have played a key role in Japan, in Taiwan, the economy now appears to be losing steam, with GDP growth in the third quarter nearly flat compared to the previous quarter, analysts say.

“Pakistan, the UAE and Qatar are benefiting from investors increasing willingness to look at ‘MSCI frontier markets’, which have been performing much better than emerging markets this year, up 17 per cent versus a fall of five per cent for emerging markets,” says Paulson-Ellis.

The road ahead

Most analysts do not expect the liquidity tap to run dry for emerging markets, especially India. “I don’t think FIIs’ fancy for emerging markets, including India, is over yet. Over the next year, Indian markets will continue to attract its fair share of flows and I expect this to be in the range of $25 billion next year, with flows accelerating in the second half,” says Holland.

...

Paulson-Ellis says, “At some point over the next year, liquidity is going to be withdrawn. The change comes at a difficult time for emerging markets, with slowing growth and debt issues in several markets. Even a well-managed exit is likely to shift flows towards recovering developed economies. Bond outflows will be sharper, but as we saw in June/July/August, it is hard to envisage no contagion to equity flows as well.”

“The outlook for flows into India is broadly positive, but it is likely to remain volatile on a month-on-month basis: Positive because the outlook on the rupee is reasonably stable and economic growth is close to bottoming out, volatile because of the likely tapering by the US Fed in first half next year, the Indian state and general elections and a possible mismatch between reality and expectations in economic and corporate performance,” says Nikhil Johri, managing director and chief executive, BNP Paribas Mutual Fund.

...

“Currently, emerging markets is the biggest problem for asset allocators. We are neutral because valuations in some markets are very cheap (notably Korea, Russia and China) and Chinese growth has stabilised. But we believe current account issues have not disappeared and more activist-central banks (in Indonesia, India or Brazil, for example) are likely to trigger slower growth. This suggests a selective approach, with overweights on structurally strong emerging markets (Korea and Taiwan) and those that have done most to tackle their problems (Indonesia and Turkey), but underweights on the most challenged (India and South Africa),” says Garry Evans, global head of equity strategy, HSBC.

In a recent report on Asia strategy, Jonathan F Garner of Morgan Stanley said, “We continue to prefer Japan. Funding gaps, negative earnings revisions and slow progress on structural reform will likely exert further pressure on emerging markets. Meanwhile, Japan should benefit from further yen weakness, global market share gains, domestic asset reflation and microeconomic reforms. Among the larger countries, we remain overweight on China, Hong Kong and Russia and underweight on South Africa, Mexico and Indonesia.”