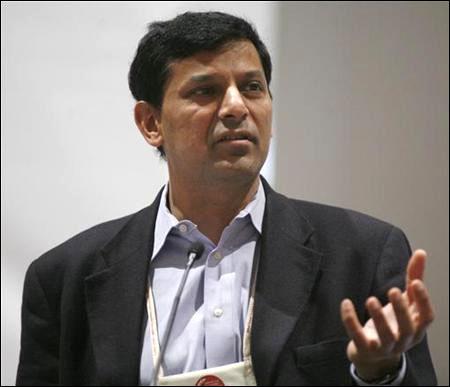

Even as Standard & Poor's and Fitch have warned India's sovereign ratings could be cut to junk level, the government's chief economic advisor, Raghuram Rajan, says there is no point in grudging that India's ratings are on a par with debt-ridden European nations.

He tells Business Standard that India should convince these agencies that it is an investment-grade country and would remain so.

Click NEXT for edited excerpts:

The rating agencies have put India on a par with the debt-ridden economies of Europe. The finance ministry always objects to that. What is your take on these parameters?

There are many things a rating agency takes into account.

We can pick one or two and say we object to this or that.

But, the task is to convince them on taking the entirety of the Indian picture that we are an investment-grade country and will continue to be so.

So, the objective is not to say, you rate Country A on this parameter and us on that o#8800 how can you be so unfair?

Whatever be the reasons, our job is not to question their job.

Our job is to say, look, we are a healthy country for so and so reasons; look at how we are over the medium term and that is what you should be thinking about when you rate us.

. . .

Despite foreign direct investment reforms and measures to rein in the fiscal deficit, S&P has cut India's growth forecast from 6.5 per cent to 5.5 per cent for 2012-13. Do you think the reforms undertaken by the government have not convinced it?

S&P lowered the growth forecast partly because it was at 6.5 per cent, while most private investment banks have already lowered it to 5-5.5 per cent.

So, S&P was an outlier.

At first glance, it does not appear that S&P lowered the numbers because of the new information that came in.

It was basically trying to update its forecasts.

Don't expect people to upgrade forecasts of their growth dramatically for this year.

We should give them an incentive to see growth coming in the medium term.

. . .

India's GDP growth declined to 6.5 per cent in 2011-12, lower than the 6.7 per cent in the crisis period of 2008-09. This financial year, the growth is not looking any better. Are we back to the crisis period?

The potential for damage in 2008 was greater because of the fears that the world economy would be tanking, that we will again see a great depression.

The level of anxiety in 2008 was higher than now because it was not clear how bad things would get.

Lots of the 2008 effects were because of external factors; this time, it is a combination of external and internal.

This time, probably, policy has to do more.

Then, you could just try to stabilise the financial sector because there was pressure on it. The fundamental growth impetus was quite strong that time.

You saw it in the recovery.

. . .

And, what factors will you include in domestic reasons?

The most worrisome is that corporate investment has fallen considerably.

Both public and private sectors have seen a slowing in the number of projects initiated.

It is a source of worry.

How do you get investment sentiment up so that people start putting in projects?

Obviously, part of the answer is you have to remove the bottlenecks they are worried about -- permissions, land acquisitions.

First, you have to get existing projects going which have stalled, sometimes because of coal linkage, sometimes for other reasons.

But down the line, you also have to create an environment where new projects will start in much greater volume.

For that, we need to give investors more confidence.

Some measures taken will help and, hopefully, clearing the path for old investments will also convince them.

. . .

The policy changes being attempted -- be it on GAAR or retrospective amendments -- might give a positive signal to investors.

But these measures were defended in Parliament and changing these in between might also give signals that India would attempt policy changes midway whenever there is pressure.

I don't think, these moves necessarily imply a change in policies.

I think the big concern about measures like GAAR was that investors want clarity as to how it would apply, when and who it would apply to.

What we are trying to do is to give them more certainty about the circumstances, the time when it would apply, etc.

I don't think there is, anyway, a desire to basically reverse the whole thing.

So, think of it as a process of clarifying what the government intent is and giving the international investor more certainty.

. . .

The policy changes being attempted -- be it on GAAR or retrospective amendments -- might give a positive signal to investors.

But these measures were defended in Parliament and changing these in between might also give signals that India would attempt policy changes midway whenever there is pressure.

I don't think, these moves necessarily imply a change in policies.

I think the big concern about measures like GAAR was that investors want clarity as to how it would apply, when and who it would apply to.

What we are trying to do is to give them more certainty about the circumstances, the time when it would apply, etc.

I don't think there is, anyway, a desire to basically reverse the whole thing.So, think of it as a process of clarifying what the government intent is and giving the international investor more certainty.

. . .

Your predecessor, Kaushik Basu, has advised you not to waste your energy on small issues and matters. In fact, he's said, be prepared to lose, but dig in your heels quietly but firmly on a few matters which are important.

There are various ways of taking it.

My own sense is that there are lots of small things that can be done, which can together add up to very big things.

At the same time, my job as a chief economic advisor is to tell the government very clearly what I think economics says and when it is at odds substantially with politics, my job is to emphasise economics.

The decision will ultimately have some political elements to it.

By dig in your heels, what he means is, when there are big economic consequences of decisions, make that very clear.

That is very good advice.