Photographs: Manjulkumar/Wikimedia Commons

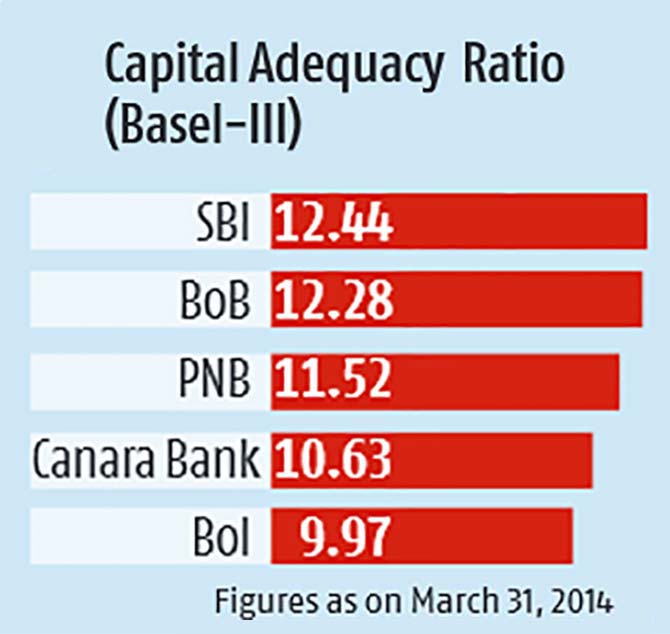

Capital for banks

The interim Budget allocated around Rs 11,200 crore (Rs 112 billion) for capital infusion in state-run banks.

It was expected banks could meet their additional requirement from the capital markets but deteriorating financials, mainly due to non-performign assets, resulted in poor valuations, making it difficult for banks to take that route.

As a result, the government will have to allocate more resources for banks in the budget.

As a result, the government will have to allocate more resources for banks in the budget.

…

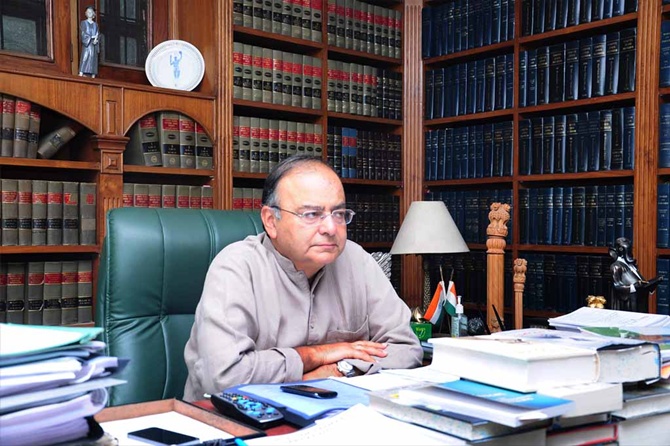

6 immediate tasks for the new finance minister

Image: Finance Minister Arun Jaitley.Photographs: Courtesy, Arun Jaitley's website

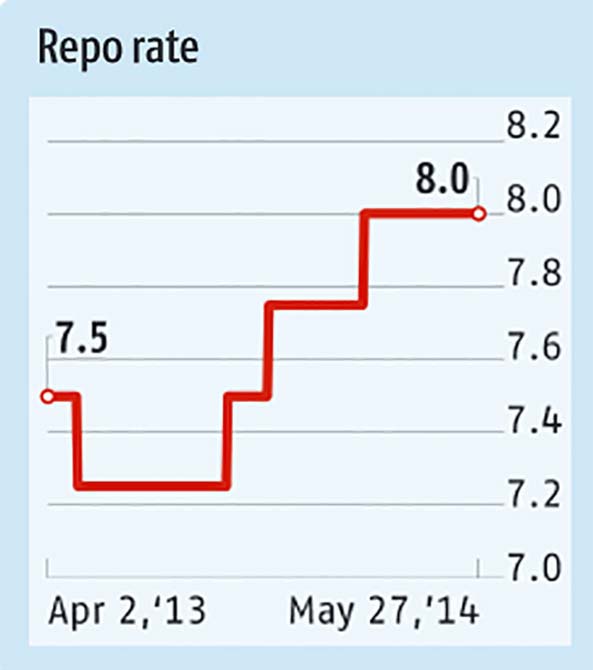

Monetary Policy

A new monetary policy framework, as suggested by RBI Deputy Governor Urjit Patel, with the singular objective of inflation-targeting and setting up of a monetary policy committee which will be accountable for meeting the target, will need the finance minister’s comfort for implementation.

…

6 immediate tasks for the new finance minister

Photographs: Reuters

Appointments

Some of the CMD/ED posts in public sector banks are still vacant, like the CMD’s post in Kolkata-based United Bank of India (UBI) which went through financial turmoil and then its chairperson resigned before completing her term.

…

6 immediate tasks for the new finance minister

Photographs: Reuters

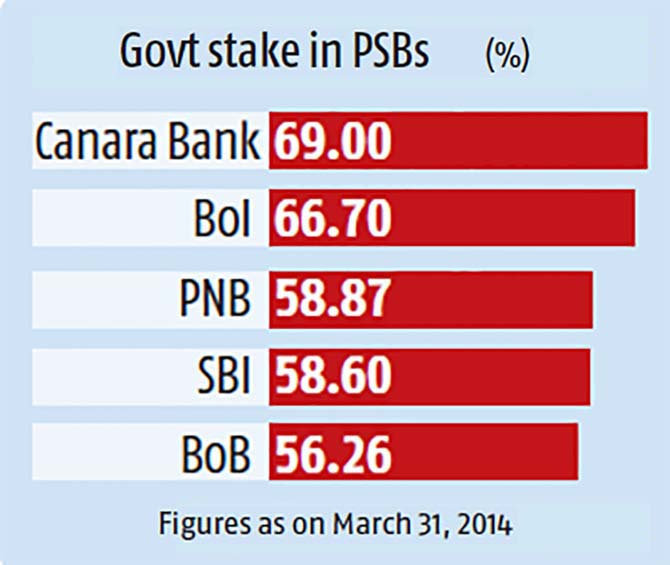

Giving up control in state-run banks

As suggested by the RBI-appointed P J Nayak committee, the government needs to cut its stake in public sector banks (PSBs) to below 51% and also revamp the banking architecture.

…

6 immediate tasks for the new finance minister

Photographs: Reuters

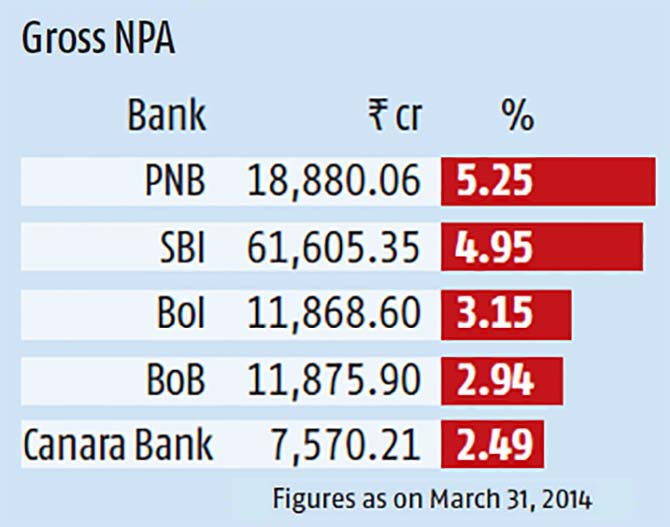

Asset Quality

Bankers have demanded a law which will not allow defaulters to challenge Sarfaesi Act/Debt Recovery Tribunal, to help in early resolution of an account and improve recoveries.

…

6 immediate tasks for the new finance minister

Photographs: AroundTheGlobe/Wikimedia Commons

Banks as insurance brokers

The finance ministry had proposed that all public sector banks become brokers to sell insurance products.

After a protest from bank-promoted insurers, this proposal’s implementation was delayed.

The new minister will have to take a stand on whether or not to mandate this.

article