After 13 days of hardship for customers, Yes Bank said it has resumed all banking services as the moratorium imposed on the lender was lifted on Wednesday evening.

Besides, the lender would extend banking time for three days starting Thursday.

Soon after the lifting of the 13-day moratorium at 6 pm, some customers took to social media complaining that they were not able to access certain services, including internet and mobile banking.

'Our banking services are now operational. You can now experience the full suite of our services. Thank you for your patience and co-operation. #YESforYOU @RBI @FinMinIndia,' the lender said in a tweet.

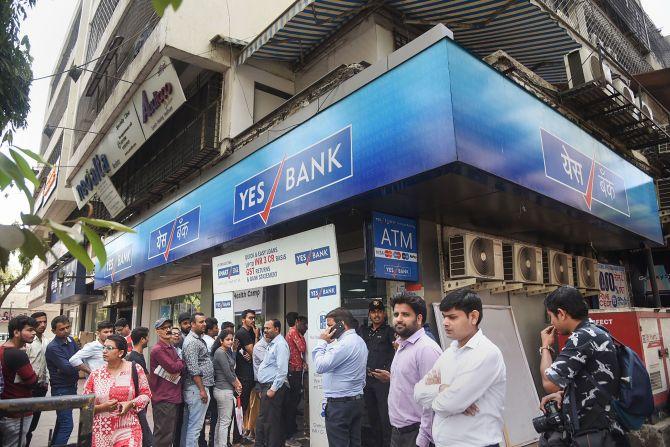

There are also concerns in certain quarters that Yes Bank could see significant amount of deposit withdrawals.

'To serve you better, our branches will open one hour earlier at 08:30 hours from March 19 to 21, 2020. We have also extended banking hours across branches for our senior citizen customers, from March 19 to March 27, 2020, 16:30 hours to 17:30 hours,' the bank said in another tweet.

On March 5, the Reserve Bank of India had imposed a moratorium as well as superseded the board of the then struggling Yes Bank.

Deposit withdrawals were capped at Rs 50,000 per account apart from other restrictions.

Under the Yes Bank reconstruction scheme, the State Bank of India and seven financial institutions, including private sector lenders, have infused around Rs 10,000 crore in the bank.

Yes Bank's deposit base eroded by Rs 72,000 crore to Rs 1.37 lakh crore as of March 5, 2020. The same was at Rs 2.09 lakh crore as of December 31, 2019, as per data shared by the bank last Friday.

On Tuesday, then Yes Bank CEO-Designate Prashant Kumar said the private sector lender has taken adequate steps to ensure availability of funds for customers.

"All our ATMs are full with cash. All our branches have adequate supply of cash. So, from the Yes Bank side, there is absolutely no issue on the liquidity front," Kumar had said.

With the lifting of the moratorium, Kumar is now the Yes Bank CEO.

However, certain customers of the bank vented their grievances on Twitter after the moratorium was lifted.

Some of them indicated that they might shift their money from the lender and posted their grievances tagging the bank's Twitter handle.

Replying to some of the tweets, the bank apologised for the inconvenience caused to the customers and said it was 'facing intermittent issues'.

The private sector lender has got support from its largest investor State Bank of India (SBI), which holds 48.21 per cent stake in the bank.

SBI alone has invested Rs 6,050 crore into the bank.

ICICI Bank and HDFC (Rs 1,000 crore each), Axis Bank (Rs 600 crore), Kotak Mahindra Bank (Rs 500 crore), Bandhan Bank and Federal Bank (Rs 300 crore each) and IDFC First (Rs 250 crore) have invested in Yes Bank.