A national rollout will take place after the pilot test in which SBI, PNB, Axis Bank, Bank of Maharashtra, Canara Bank, Kotak Mahindra Bank, IndusInd Bank, ICICI Bank, HDFC Bank, Indian Overseas Bank and Punjab & Sind Bank are participating.

Telecom service providers, in partnership with 11 major banks, will begin sending out messages to a small set of customers who can digitally review, manage, and revoke the consents they had previously given for promotional communications, the Telecom Regulatory Authority of India (Trai) said on Wednesday.

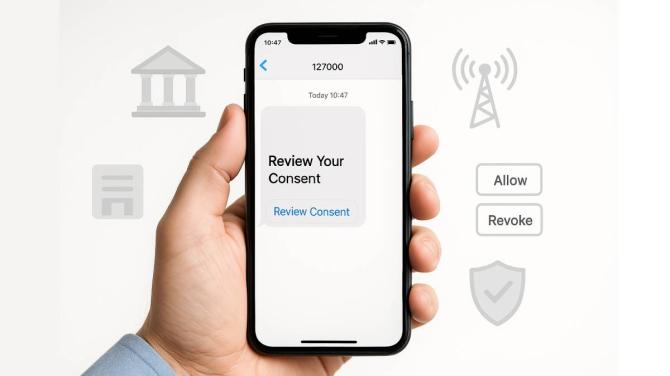

The messages, as part of system testing, will begin with a short code of 127000 and are likely to be received by customers whose old consents have been uploaded by the banks on the digital platform.

Calling it the digital consent acquisition (DCA) pilot, being conducted by Trai and the Reserve Bank of India to digitise and standardise consent for promotional communications, the telecom regulator said the move will be the first step towards a unified digital consent management platform, which will ensure that promotional communications are discontinued if customers revoke their consents.

This will also address the issue of spam.

At present, the Telecom Commercial Communications Customer Preference Regulations, 2018 allows customers to block promotional calls and messages on the basis of categories of callers belonging to different sectors.

Users can selectively allow promotional communications from specific businesses and entities as per their choice.

Businesses can use the Digital Consent Registry for recording customer consents for receiving promotional communications.

But this system has now become dated and does not provide customers with the means to view or revoke the legacy consents or consents that they have given to various business entities.

The pilot will test the readiness of the platform across telcos, banks, and the consent registry.

Each message received will contain a standard advisory along with a secure link, directing the customer to the authorised consent management page of the telco.

Through this portal, customers will be able to view the consents recorded by these 11 banks against their mobile numbers, and decide whether they wish to continue, modify, or revoke any of these consents.

'No personal or financial information will be sought at any stage, and customers are advised to act on the SMS received only from the 127000 short code,' Trai stated.

'Action on these SMSes by the customers will be optional,' Trai added.

A national rollout will take place after the pilot test in which SBI, PNB, Axis Bank, Bank of Maharashtra, Canara Bank, Kotak Mahindra Bank, IndusInd Bank, ICICI Bank, HDFC Bank, Indian Overseas Bank, and Punjab & Sind Bank are participating.

'The banks have now begun uploading sample sets of old consents onto the shared digital platform established for the pilot,' Trai said.

'Besides, the new consents acquired by the participating banks will also be uploaded onto the digital platform.'

Feature Presentation: Ashish Narsale/Rediff