'Companies are being forced to pay higher salaries to retain and hire employees due to a big rise in attrition in the industry.'

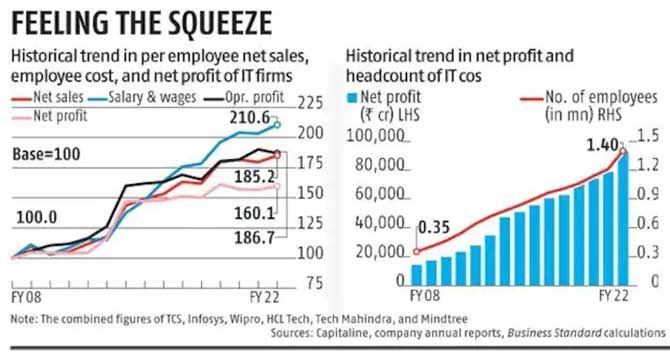

There has been a surge in hiring and revenue growth in IT services companies in recent years, but the industry's earnings are not keeping pace with rising employee costs.

The result has been a steady decline in margins and subpar growth in profits.

The analysis is based on the annual finances of the top six IT services companies: Tata Consultancy Services, Infosys, Wipro, HCL Technologies, Tech Mahindra, and Mindtree.

Over the last five years, the IT companies' average salary and wage costs per employee are up 19.7 per cent compared to a 13.6 per cent rise in net sales per employee in the period.

The six IT services firms, on average, earned net sales of around Rs 38 lakh (Rs 3.8 million) per employee in FY22, up from Rs 33.5 lakh (Rs 3.35 million) in FY17 and Rs 37.3 lakh (Rs 3.73 million) in FY20.

In comparison, their salary and wage costs per employee increased from Rs 17.3 lakh (Rs 1.73 million) in FY17 to Rs 20.1 lakh (Rs 2.01 million) in FY20 and further to Rs 20.7 lakh (Rs 2.07 million) in FY22.

As a result, the industry's operating profit per employee grew by only 10.3 per cent between FY12 and FY22 while net profit per employee inched up by just 5.6 per cent in the period.

Faster growth in salary and wage costs has adversely affected the companies' earnings growth. (Plese see charts.)

The IT companies' average operating profit per employee grew from Rs 9.2 lakh (Rs 920,000) in FY17 to a high of Rs 10.4 lakh (Rs 1.04 million) in FY22 but then declined to Rs 10.2 lakh (Rs 1.02 million) in FY22.

Growth in net profit has been even lower.

The industry's net profit per employee declined to Rs 6.65 lakh (Rs 665,000) in FY22 from a high of Rs 6.71 lakh (Rs 671,000) in FY19 and Rs 6.3 lakh (Rs 630,000) in FY17.

Net sales and other finances are for the respective financial year.

Per employee financial parameters are based on the average headcount of the companies.

IT companies report their headcount at the end of every financial year.

The combined headcount of the six IT firms in our sample grew from 968,000 in FY17 to 1.404 million in FY22.

The industry headcount was up 15.5 per cent year-on-year in FY22, the best since FY12, when it grew 18.3 per cent.

In all the six companies added a record 189,000 people on their rolls in FY22.

The combined net sales of these six IT firms were up 19.1 per cent in FY22 while their salary and wage bill was up 19.5 per cent in the same financial year.

Growth in operating and net profit was lower at 13.3 per cent and 15.5 per cent, respectively, in FY22.

The average operating profit margins of these six companies declined to 26.23 per cent of their income in FY22 from 27.57 per cent a year earlier and 26.62 per cent in FY17.

The industry margins have taken a further hit in the first quarter because the cost savings out of work from home have ended.

The average operating margins of the companies declined to a decade-low of 23.2 per cent in Q1FY22 and industry earnings growth was flat during the quarter on a YoY basis.

An analyst attributes the decline in margins largely to higher wage costs rather than poor employee productivity in the industry.

"Companies are being forced to pay higher salaries to retain and hire employees due to a big rise in attrition in the industry and a general rise in wages in the United States, their prime market," says Dhananjay Sinha, head of strategy and research at Systematix Group.

According to him, this is part of the cycle in the IT industry and wage pressure and its adverse effect on the margins will start abating in FY24.

The margin pressure and poor earnings growth in the first quarter have, however, triggered earnings downgrades for IT companies for FY23.

Feature Presentation: Ashish Narsale/Rediff.com