About 24 fund houses saw a decline in their debt AUMs in the past one year.

Ashley Coutinho reports.

2018 was a mixed bag for the mutual fund industry.

While equity assets continued to grow at a healthy clip, the debt segment saw a de-growth primarily due to the risk-aversion triggered by the IL&FS crisis.

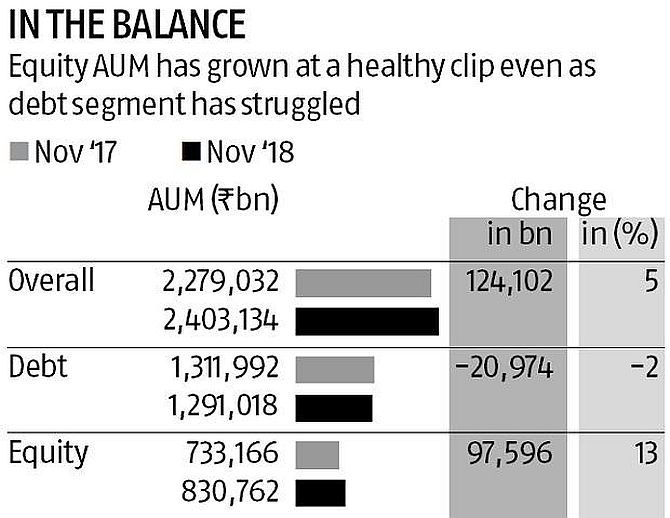

Overall, the mutual fund industry reported a 5% growth in assets under management (AUM) to Rs 24 trillion at the end of November (November 2017-November 2018 period) from Rs 22.8 trillion a year earlier.

Equity AUMs grew at 13% to Rs 8.3 trillion while debt AUMs declined by 2% to Rs 13.11 trillion.

About 24 fund houses saw a decline in their debt AUMs in the past one year.

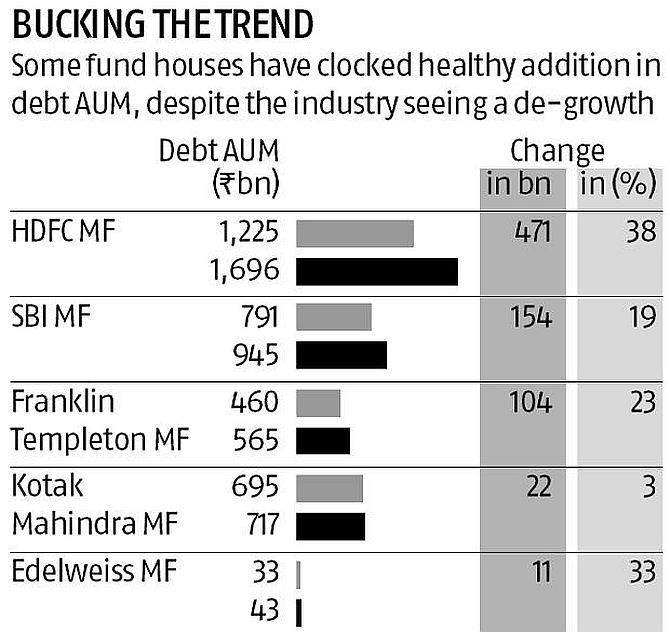

However, some fund houses bucked the trend.

HDFC MF, SBI MF and Franklin Templeton MF saw the highest addition in debt assets in the year ended November 30, 2018, data from Value Research shows.

They added assets to the tune of Rs 470 billion, Rs 154 billion and Rs 104 billion, respectively.

Among the smaller and mid-sized fund houses, Edelweiss MF and Mirae Asset MF saw the most addition in debt assets at Rs 10.8 billion and Rs 10.7 billion, respectively.

Debt assets are less sticky than equity assets.

Besides, fees for managing debt schemes are lower and can range from 5 to 100 bps compared with 100 to 150 bps for equity schemes.

In October 2018, investors had pulled out money parked in liquid schemes amid fears of contagion risks from the IL&FS crisis.

Note: Debt AUM includes income, liquid and gilt scheme; Equity AUM includes Pure equity, arbitrage and ELSS schemes.