The PMGKY will not allow declarants to use claims made for refunds for advance taxes paid, tax deducted at source and tax collected under the scheme.

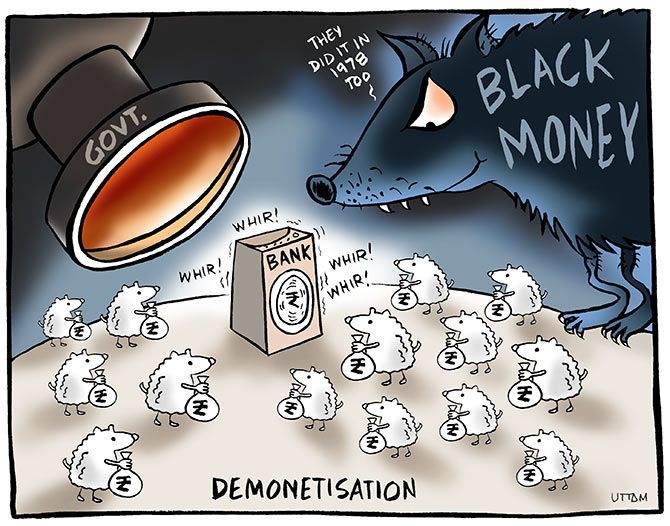

Illustration: Uttam Ghosh/Rediff.com.

Unlike its first variant, the second edition of the government's hidden income disclosure scheme, the Pradhan Mantri Garib Kalyan Yojana, will not allow declarants to use claims made for refunds for advance taxes paid, tax deducted at source and tax collected under the scheme.

This was stated on Wednesday in answers to a second set of 'Frequently Asked Questions' on the scheme, issued by the Central Board of Direct Taxes.

PMGKY has a tax incidence of 50 per cent, including the penalty. And, a four-year lock-in of a quarter of the disclosure amount. The scheme allowed payment using old currency notes till December 30, even as the window is open till March 31.

Individuals who have deposited cash from November 8 (when demonetisation was announced) may go to their bank and fill the proforma regarding the 50 per cent tax and deposit of 25 per cent. Then, attach this and the deposit receipt with the income declaration form, sent to the income tax department.

Amounts deposited or repaid against an overdraft account, cash credit account or any loan account maintained with a bank or any specified entity are eligible for being declared under the scheme.

It was announced after the November 8 decision. The window opened on December 17.

Only unaccounted domestic cash holding may be declared through it and not jewellery, stocks, immovable property or accounts abroad. Under IDS-1, one was allowed to declare undisclosed assets, including jewellery and property.

On the issue of a person against whom a search and survey operation has been initiated, CBDT said such a person was still eligible to file a declaration under the scheme.

Not declaring hidden money under the scheme now but showing it as income in the tax return form would lead to a total levy of 77.25 per cent in taxes and penalty. If the disclosure is not made in the return, too, a further 10 per cent penalty on tax will be levied, followed by prosecution.

The disclosure scheme is part of The Taxation Laws (Second Amendment) Act, approved by the Lok Sabha on November 30 and receiving the President's formal assent last month.

CBDT further said: "Undisclosed income represented in the form of deposits in a foreign bank account is not eligible for the scheme."

A disclosure window was provided earlier for hidden money or assets abroad, which closed in September 2015.