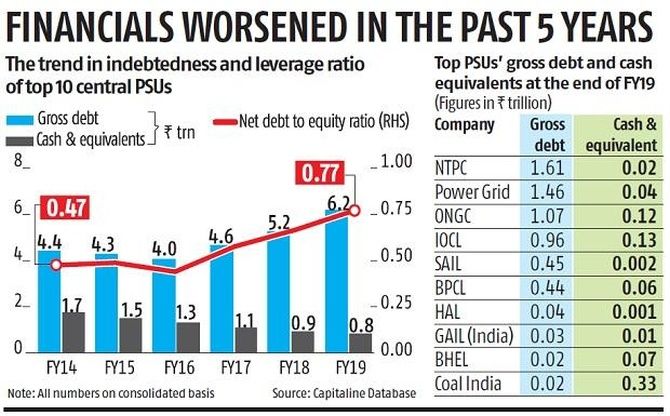

The combined gross debt of the country’s 10 biggest PSUs by revenue is up nearly 40 per cent in the past five years from Rs 4.38 trillion at the end of March 2014 to Rs 6.15 trillion at the end of March this year.

India’s leading public sector undertakings (PSUs), which form the backbone of the country’s infrastructure, are facing financial headwinds themselves.

Most of the large non-financial PSUs are in stress either because of poor demand in their industry or because of the financial burden imposed on them by the government’s disinvestment programme.

While the former is causing financial grief to PSUs in the capital goods and metals space such as Bharat Heavy Electricals (BHEL) and Steel Authority of India (SAIL), companies such as Oil and Natural Gas Corporation (ONGC) made fresh borrowings to acquire another PSU, Hindustan Petroleum Corporation.

“The government has its preference to go for disinvestment in the current form -- public sector company buying stake in another public sector firm, higher dividend payout, and bonus to withdrawing capital from existing public sector units. Bold strategic privatisation may yield more dramatic results and genuine private participation,” said Debasish Mishra, leader, energy, resources and industrials, Deloitte India.

There has also been a sharp dip in cash reserves available with PSUs because many of them spend cash on paying liberal dividends and share buybacks despite poor profitability. The combined result has been a steady rise in their indebtedness. (See graphic below)

The combined gross debt of the country’s 10 biggest PSUs by revenue is up nearly 40 per cent in the past five years from Rs 4.38 trillion at the end of March 2014 to Rs 6.15 trillion at the end of March this year.

In the same period, their net debt (net of cash and cash equivalent on their books) doubled to Rs 5.33 trillion at the end of March this year against Rs 2.65 trillion five years ago.

As a result, the net debt to equity for these 10 firms increased to a record high of 0.77x at the end of March 2019 from 0.47x at the end of March 2014.

In the same period, the cash and cash equivalent on the books of these companies was down 53 per cent to a little over Rs 82,000 crore at the end of FY19 from Rs 1.74 trillion at the end of FY14 because many of them made hefty dividend payouts or buybacks.

ONGC’s gross debt has more than doubled in the last five years on a consolidated basis to Rs 1.07 trillion at the end of March 2019 against Rs 49,000 crore at end of March 2014. Though the increase in debt is also because now it accounts for HPCL’s Rs 28,191 crore, 26 per cent of ONGC's consolidated debt. ONGC’s cash and cash equivalent (current liquid assets) has fallen by 21 per cent to Rs 12,893 crore at the end of FY19.

Adjusted for a dip in its cash reserves in the period, the company’s net debt has nearly quadrupled in the last five years to around Rs 95,000 crore at the end of March this year from around Rs 24,000 crore five years ago.

A major reason for the rise in ONGC’s debt is its purchase of HPCL from the government in January 2018. ONGC funded the purchase of 51.1 per cent government equity in HPCL through Rs 24,991 crore debt and Rs 11,924 crore of its reserves. It had earlier acquired the KG basin gas block of Gujarat State Petroleum Corporation for Rs 7,740 crore in 2017.

“Three-four years back, ONGC had cash reserves of over Rs 50,000 crore. Then, the GSPC and HPCL deals happened, which increased its debt and reduced cash reserves drastically,” said an oil industry official. However, he added that for a company like ONGC with a good cash flow and good repayment capacity, it was not yet an alarming situation.

For Coal India Ltd (CIL), however, the situation is not so smooth. It has seen its debt increase with its cash reserves and market cap falling in the last five years. Rising labour cost, delays in supply chains, the burgeoning cost of opening new mines, surging rehabilitation expenses -- are all denting the balance sheet of Coal India, according to the company’s annual report for 2018-19.

Despite this, the company was asked by the central government to undertake two share buybacks in FY18 and FY19. The Union government got Rs 3,400 crore, cumulatively. Besides, the Centre received Rs 3,287 crore from CIL as interim dividend in December 2018 out of a total payout of Rs 4,500 crore to shareholders.

GAIL is among the outliers which reduced its net debt by 87 per cent during the period to Rs 3,467 crore in 2018-19. A senior official said the debt was higher earlier because the company funded its petrochemical and pipeline projects.

In the manufacturing space, heavy equipment maker BHEL and SAIL are losing dominance in the market along with slowing revenue and profits. The order book of BHEL has remained stagnant at around Rs 1 trillion for the last four financial years. The share of new orders has come down by 70 per cent in FY19 over the previous year, revealed its financial results.

“BHEL has been late in moving in the new businesses and there are already established players in those businesses,” IDFC Securities said in a July report.

Other PSUs with a sharp rise in their net debt in the last five years include NTPC (up 160 per cent), Steel Authority of India Ltd (up 100.4 per cent), Power Grid Corp (up 80.2 per cent), and Bharat Petroleum Corporation (up 52.5 per cent).

While the private power generation companies face liquidation fears, NTPC has been on an expansion spree. It has planned 20,000 Mw of coal-based and 10,000 Mw of renewable power generation for the coming three years.

During FY18, Power Grid Corp had the highest ever capex of Rs 25,791 crore. It plans to invest a similar amount this year. Its gross fixed assets grew at a compound annual growth rate of 16.4 per cent to Rs 1.77 trillion.