Even as the semiconductor shortage has limited the demand for new cars, the pre-owned car segment is seeing a surge.

A preference for personal mobility, availability of multiple organised online platforms, including e-commerce channels, aggregators, and classifieds, have been fuelling growth.

The growth rate of the pre-owned car market is expected to be 1.5x that of the new car market over the next five years.

It was 1.4x in 2020-21 (FY21), according to a recent OLX-CRISIL Auto study.

It envisages the share of the organised players to increase from 20-22 per cent in 2021-22 to 30 per cent by 2025-26.

“When it rains, it pours,” says Sandeep Aggarwal, founder and chief executive officer (CEO) at Droom Technologies, alluding to the brisk sales momentum seen in the last one and a half years.

The online automobile marketplace is the latest among start-ups rushing to tap into the capital markets for a public listing worth around Rs 1,000 crore, according to media reports.

"Since its inception seven years ago, Droom has had seven rounds of capital-raising.

"It was valued at $1.2 billion after the seventh round of fund-raising earlier this year," said Aggarwal.

The monthly sales at Droom have surged to 15,000 units, from 8,000-9,000 units in the pre-Covid phase.

The increase in volume has translated into a higher monthly gross merchandise value (GMV) for the start-up.

It soared from $93 million in February 2020 to $175 in monthly GMV.

“The chip shortage has indeed played a role,” said Aggarwal.

Also, the pandemic hit the shared economy segment hard and all those who were earlier commuting by Ola or Uber came into the market to buy a car, he added.

Concurs Amit Kumar, CEO, OLX Autos.

According to Kumar, many of these are first-time buyers. Such buyers now account for 40-45 per cent.

The digital classified has seen a 30 per cent growth in the number of users responding to used cars advertisements on the platform in FY21.

Others, too, are seeing traction. Mahindra First Choice Wheels, the multi-brand used car business of Mahindra Group, said on Wednesday that the company had record 1,028 units delivered on Dhanteras.

These deliveries were spread across 1,100-plus dealerships in 300 cities.

“This year’s festival season has been remarkable as the brand registered 40 per cent growth,” said Ashutosh Pandey, CEO and managing director, Mahindra First Choice Wheels.

The company’s e-commerce platform carandbike.com contributed 25 per cent to the overall sales this festival period.

Pandey expects demand to continue to surge till the end of the financial year. Tier 2 markets are driving the wave with 3x higher demand, compared to the metros, he added.

Some like Droom are looking to make the most of the festival season by offering attractive schemes.

The technology start-up is giving Rs 50,000 off on used vehicles, along with a buyer surety of up to Rs 50 lakh for six months.

It is also offering up to Rs 30,000 cashback on new vehicles, alongside exciting dealer offers, such as cash discounts, exchange bonuses, corporate discounts, and free vehicle accessories.

Meanwhile, mirroring the trend in the new car market, used car sellers are seeing demand heavily skewed towards demand for hatchbacks and sport utility vehicles, especially with automatic transmission.

The share of utility vehicles has increased in the pre-owned car space from 18 per cent in 2017-18 to 20 per cent in FY21, according to OLX-CRISIL study.

During the FY15-FY20 period, new car sales increased at a subdued pace of 1.3 per cent compound annual growth rate (CAGR), whereas the pre-owned car industry recorded an exceptional growth of 13 per cent CAGR.

But the used car market, too, had its share of woes.

In FY21, the new car industry saw a marginal drop, but an increased need for personal mobility, supply constraints in the new car market, as well as restricted operations amidst a lockdown, contracted the pre-owned car industry, dragging the pre-owned-to-new car sales ratio down to 1.4, according to the OLX-CRISIL study.

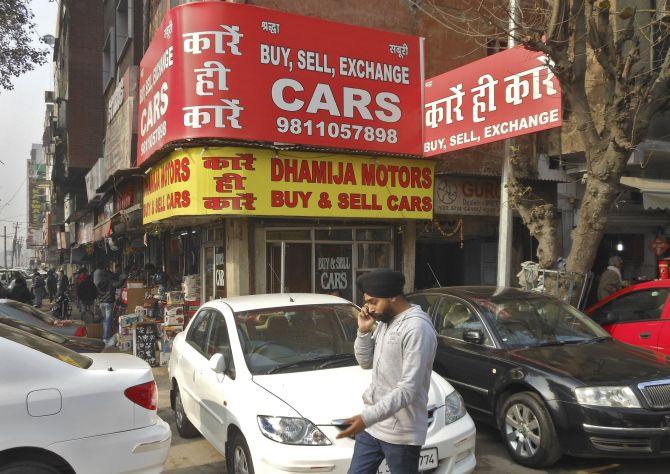

Photograph: Aditya Kalra/Reuters