The share of foreign investors was lower than domestic institutions across key sectors, including commodities, consumer discretionary, financial services and industrials.

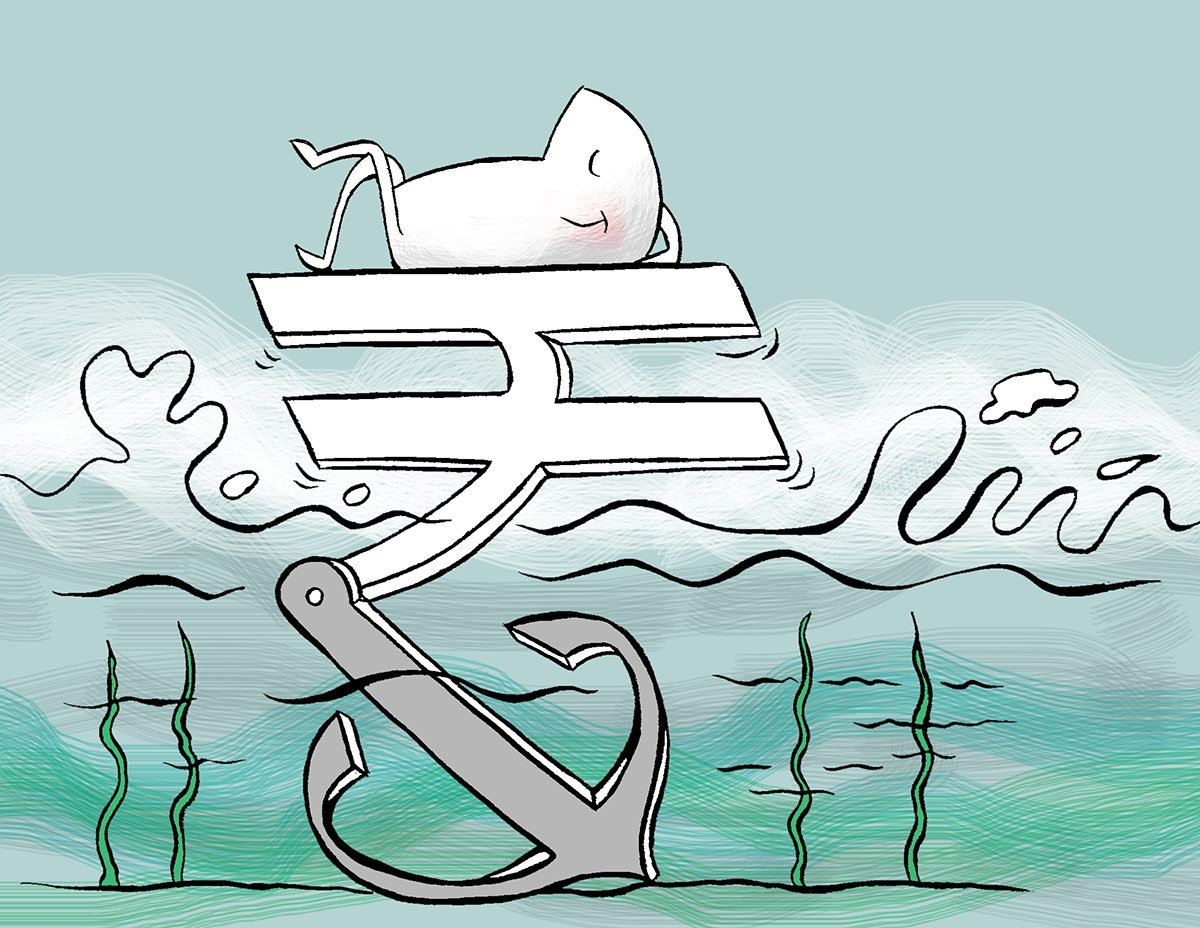

Foreign ownership of the Indian stock market has declined to the lows last seen in 2012.

The decline in foreign ownership comes amid rising domestic investor participation and lower relative attractiveness of the Indian market, despite higher earnings growth.

The average monthly flows into Indian markets were lower in the three months leading into the 2024 general elections than in the preceding six months.

While external factors affect foreign flows, 2019 and 2014 witnessed higher foreign investment leading into elections (chart 1).

Domestic institutions have continued to buy. The gap in ownership between domestic and foreign investors has now narrowed to its lowest point since at least 2009 (chart 2).

However, the absolute value of holdings continues to increase for both domestic and foreign institutional investors.

This has meant that institutions (foreign and domestic combined) now hold a greater proportion of the stock market than a decade ago (chart 3).

Private sector promoters, or majority owners, among listed companies continue to hold on to their shares.

While the government promoter stake is down 3.5 percentage points to 10.4 per cent (March 2024) compared to a decade ago, private sector promoters held a bigger stake in their companies in March 2024 (41 per cent) compared to 37.8 per cent in March 2014 (chart 4).

The share of foreign investors was lower than domestic institutions across key sectors, including commodities, consumer discretionary, financial services and industrials (chart 5).

Relative attractiveness can play a role in foreign flows. Earnings continue to grow at a strong double-digit rate in India, significantly higher than most emerging markets.

However, the valuation relative to earnings is significantly higher, especially when compared to markets like Brazil, which have comparable or better earnings growth (chart 6).

Feature Presentation: Aslam Hunani/Rediff.com