'What we have to think about is, how to improve the efficiency of public sector banks.'

'You have to make decision-making more prudent, and free from government intervention.'

With the release of the National Council of Applied Economic Research policy paper by NCAER Director-General Poonam Gupta, a member of the Economic Advisory Council to the Prime Minister, and Columbia University Professor and former NITI Aayog vice-chairman Arvind Panagariya, privatisation of public sector banks has once again become a topic of debate in India.

The NCAER paper recommends privatisation of all public sector banks except the State Bank of India.

Professor Ashwani Mahajan, co-convenor of the Swadeshi Jaagran Manch, warns that this is an ill-advised move.

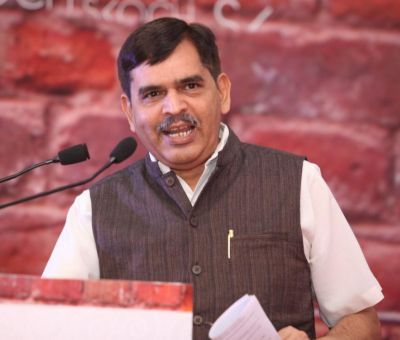

"In a country like India, public sector banks are necessary for financial inclusion," Professor Mahajan, below, left, tells Rediff.com's Shobha Warrier in the concluding segment of a two-part interview.

We have seen that when a private sector bank fails, it is taken over or bailed out by public sector banks. Then, how can you say privatisation is what is needed in the banking sector?

Exactly. This could happen because we had strong public sector banks.

If the private sector banks are more profitable than the public sector banks, it is because public sector banks have to think of social inclusion.

It is like saying Indian Railways is not profitable. But it provides affordable transportation for millions of Indians. That is the policy of the government.

Similarly, to implement the policies of the government, public sector banks are essential.

Profit has never been the criterion for public sector banks till now.

In support of privatisation, the NCAER report says that private banks have emerged as credible alternative to public sector banks with substantial market share. Do you agree?

Definitely, their market share has increased but whether they are credible is questionable.

If you look at the history of private sector banks, for example the number one private bank, the ICICI Bank, it was saved a number of times.

Lakshmi Vilas Bank failed recently, and it was handed over to DBS of Singapore.

Yes, because of their aggressive business practices, their market share has increased.

Another argument in favour of privatisation is that public sector banks have lost deposits and advances of loans to private banks...

While an average citizen may prefer to bank with a public sector bank, big corporates and other institutions go with private banks. I am not blaming anyone.

In a country like India, public sector banks are necessary for financial inclusion.

Many public sector banks incurred losses when they opened non-profitable rural branches all over the country.

But you have to do it for social welfare and social inclusion.

What we have to think about is, how to improve the efficiency of public sector banks.

You have to make decision-making more prudent, and free from government intervention through bureaucrats.

For this, the government can reduce its share from 51% to a lower percentage.

Through IPO, the shares of the public sector banks can be given to the general public.

Let the public own the public sector banks, not foreigners.

Does reform mean handing over public sector undertakings to private people?

Ownership does not make any undertaking efficient or not efficient.

What is needed is professional management of an institution.

I will give you the example of ITC, a government owned company.

It is a professionally managed company which does not follow the dictates of the bureaucrats.

The success of ITC shows that if you bring in professionals to manage a company, you can get good results. That's why it is the number one FMCG company.

It shows you can make a company successful without handing it over to private corporate hands or foreigners, but by running it professionally.

Feature Presentation: Aslam Hunani/Rediff.com