'So, what does one believe -- just 6 stocks that are pushing the indices higher or the 600 scrips that are reflecting economic pain?'

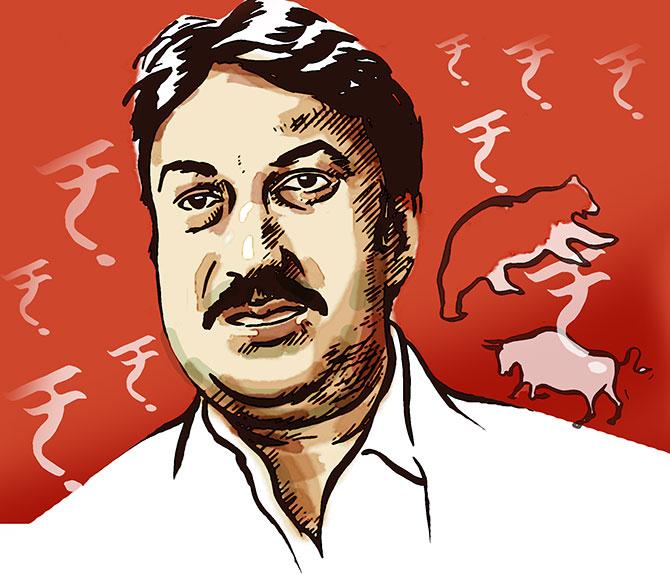

At a time when the S&P BSE Sensex and the Nifty50 have hit new highs, Shankar Sharma, vice chairman and joint managing director at First Global, cautions that these two indices, by any stretch, are not representative of the entire market.

Over the past few years, they have become a six-stock measure, he tells Puneet Wadhwa.

After the rally in 2019, do you think the Sensex & the Nifty can now undergo a time-wise and price-wise correction?

India is a strange market where we don't usually see a time-wise correction.

It (the market) always corrects price-wise and is driven by a lot of volatility.

So, assuming there will be a correction in the Sensex and the Nifty, it will only be price-wise.

The problem is that only a handful of stocks have been running up and nothing else has contributed much.

The question is how long these five-six stocks will continue to push the Sensex and the Nifty higher.

How concerned are you about the shallowness of the rally?

I am very concerned.

This performance divergence is worrisome and such things don't end well.

Though the divergence can last quite a while, the ending is usually not happy.

In 1998, we had the tech rally and only IT (information technology)-related stocks moved up and propelled the index to new highs.

In 2007, it was the financials.

While I don't have a problem with narrow rallies, one needs to be extra vigilant in such situations.

Have the markets run ahead of fundamentals?

If you see the broader market, it has not gone anywhere, but down.

The Sensex and the Nifty, by any stretch, are not representative of the entire market anymore.

As it is, they were a very narrow measure with just 30 and 50 stocks, respectively.

Over the past few years, they have become a six-stock measure.

These two indices, by no means, indicate the problems in the real economy or the way key economic data is unfolding.

The broader market is telling us a very different story, as compared to the Sensex and the Nifty.

So, what does one believe -- just 6 stocks that are pushing the indices higher or the 600 scrips that are reflecting the economic pain?

So, will mid and small-caps grind lower in 2020 as they reflect the rising economic stress?

I don't think they have room to fall much from here as they have corrected -- both time-wise and price-wise.

We are now two years into the bear phase for the broader market, which started in January 2018.

In essence, we have a broad bear-market and a narrow bull-market.

This is a very interesting phenomenon as we have two different market phases co-existing.

To expect the broader market to fall further after a 35% to 40% cut since January 2018 is a bit unfair.

It will continue to meander along till something genuinely happens on the corporate earnings front led by the industrial and economic revival.

Where can investors park their money over the next 12-18 months?

It is a tricky market.

The data always talks and the rest are all stories.

The last 20-year Sensex and the Nifty return have been 11%, compounded in rupee terms.

Over its history of 40 years, they have returned 15%.

In the last five years, the return is just 5% to 6% CAGR.

What is worrying is that the return spectrum is degrading consistently and has been trending lower.

Compare this average return of 11% in equities over 20 years to an average fixed deposit rate of around 8% in the last 20 years.

In the last five years, the return has not even beaten the FD rates.

This is worrisome.

Even government securities would have returned around 7% during this period.

So, the case for equities as an investment class has been weakening over every 5 to 10 year period, which is a cause for concern.

So, the question is whether one should bear the risk and the volatility involved for a 5% to 7% return.

This is reflective of the fund flow we have seen in the mutual fund segment where the flows have thinned.

What's your view on the economic slowdown debate?

I don't think there is a debate anymore, as the data itself is speaking loud and clear.

Even with the quality of data we are getting, barring the crises years of 1991 or 2008, this is unprecedented.

Industrial production has not dived to such levels as seen now.

There is a crisis in the real economy.

While gross domestic product is a notional figure, the index of industrial production is a harder, concrete and a quantitative figure.

While a number of people have hypothesised when the growth rate will pick up, one needs to only look at the RBI which has been revising the growth forecast downward every single policy meeting since the past few months.

If the central bank is missing estimates within the same year, what forecasting one should believe!

Everyone is just shooting in the dark about a pick-up in growth.

Unless there is concrete action to show why the growth rate will pick up, one should not blindly buy into the logic.