'This fall is nothing. We could see worse if everybody hits the panic button.'

Spooked by geo-political tensions between NATO and Russia over Ukraine, the 'news' of introduction of wealth tax and increase in long term capital gains (LTCG) tax from 10 per cent to 15 per cent, Foreign Institutional Investors (FIIs) continued with their relentless selling at the beginning of 2022.

In the first 16 trading days of January 2022 beginning January 3, FIIs remained net buyers only on five occasions resulting in the Nifty rising from a low of 17,383 on January 3 (the first trading day of January 2022) to a high of 18,350 on January 18 from when the slide began to a low of 16,999 on January 24.

FIIs have dumped stocks worth Rs 18,711 crore (Rs 187.11 billion) in the entire month till January 24, shaving almost 7.3 per cent in five trading sessions since last Tuesday, January 18, the day FII selling intensified.

The fall would have been steeper had it not been for Indian institutional investors bringing in the money to somewhat stem FII selling, buying Rs 7,699 crore (Rs 76.99 billion) worth of equity shares in January 2022 till January 24.

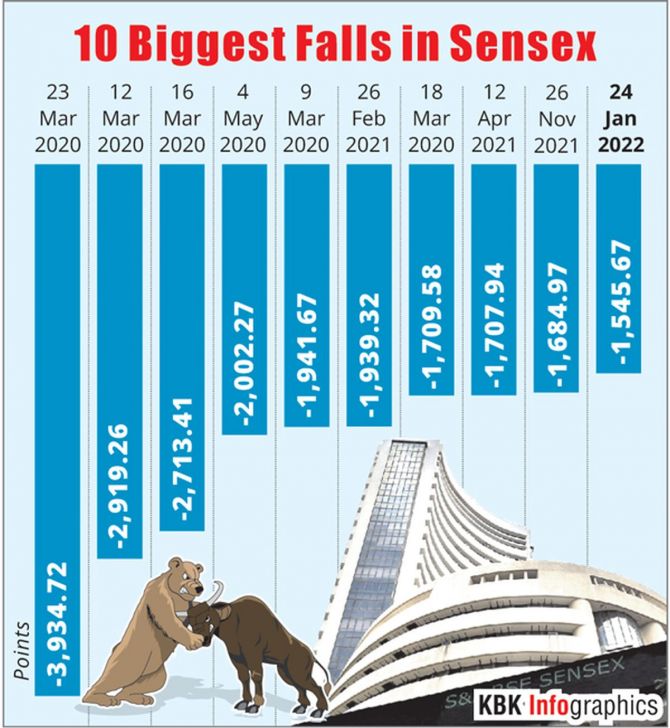

While the Nifty closed 150 points above its low of the day at 17,149, the BSE Sensex witnessed one of the top 10 crashes in the market since March 23, 2020.

As the drop of 1352 points in five trading sessions indicates, FIIs have intensified their selling since January 18 and till January 24 -- five trading sessions -- they have dumped stocks worth Rs 14,935 crore (Rs 149.35 billion), which make up almost 80% of their total net selling in the entire month of January till the 24th.

So, what is driving the Indian equity markets lower in the New Year?

Rahul Sharma, founder Equity 99, and independent market expert Amabreesh Baliga give Prasanna D Zore/Rediff.com their take on what's spooking Indian equity markets in the New Year.

Rahul Sharma: 'Investors better keep their positions light if they have a short-term investment horizon'

Were you expecting such a sharp cut in the Indian markets even as US markets showed signs of recovery on Monday morning? Were you surprised by the intensity of selling?

The Dow Jones was in the positive zone when we opened (in the morning). But as trading began we opened the gap down and soon started breaching important support levels because of the uncertainty over the Union Budget announcements and geo-political tensions in Europe over Ukraine. We soon saw FII selling intensifying with markets falling more than 3 per cent intra-day.

This was also due to high uncertainty over the US Fed meeting which is happening over the next two days (to consider how soon and by how much to raise interest rates).

Also, Covid cases are increasing across the country.

Over and above this mix, we were also getting some 'news' about escalating tensions between the US and Russia over Ukraine. That also added to the concerns before the Fed meeting.

The benchmark Nifty has now fallen almost 1,350 points in the last four-five sessions. What should retail investors do now?

Retail investors ought to be very cautious till we have the Union Budget all out in the fine print.

Retail should expect huge volatility, huge price swings both ways till this event is over and clarity emerges around how the US Fed is likely to go on a rate-hiking spree.

Panic would definitely set in among retailers if important support levels get breached on the downside.

In the Nifty, investors should watch out for important support levels at 17,000, also a huge psychological figure, and then 16,930 and 16,840 or 16,800 where Nifty was at the starting of this month. Then there is yet another important low of 16,400 which we made in December 2021.

On the upside, Nifty can face resistance at 17,250, 17,356 and 17,420 levels.

If the US Fed announces its intention to hike interest rates in the US at a faster pace, then there will surely be flight of dollars out of India in search of safe havens like dollar-denominated assets and gold. Equity investments in such an environment will be highly risky.

If that happens, expect FIIs to liquidate their investments from risky assets and move to safer assets.

What are those Union Budget-related concerns spooking FIIs?

The biggest concern right now in the market is the 'news' of introduction of wealth tax and increase in LTCG from 10 to 15 per cent. The market is already in a panic mood because of the same and FIIs too have US Fed and geo-political concerns to take care of. The FIIs will be keenly watching out for all these concerns in the days ahead.

When do you think will the FII selling lose steam? Do you see another 1,000 points off Nifty till the Budget?

No, no. No. I don't think Nifty will fall another 1,000. I think maximum right now Nifty could hit 16,400-level. So, maybe another 600 to 700 points fall is possible.

There would be sudden spikes in volatility though, with markets swinging from 300 plus to 300 minus points within hours or intra-day.

Algo trading will be in full force to take advantage of volatility. Machines don't understand market sentiments, they understand only numbers. If these algos see heavy FII selling numbers they too will kick in leading to panic and more selling.

In such a scenario, retail investors better keep their positions light if they have a short-term investment horizon. Long-term investors could accumulate good stocks if market falls further and build solid portfolios.

What sectors, stocks would be on your radar if you were retail investor?

Select picks from both private and PSU banks can be added if market declines further. While private banks would offer good momentum on the upside, PSU banks might show a little slack on the momentum front.

SBI, HDFC Bank, ICICI Bank could be good picks if markets correct from here. Axis Bank would also be a good bet.

Auto sector too will outperform other sectors considering EVs have become a huge play in Indian markets.

Ambareesh Baliga: 'I have been telling retail investors to book profits if they have made good money since the last three-four months'

Are the markets witnessing pre-Budget jitters?

I think the market is jittery over the likelihood of increase in LTCG and there is this new rumour about introduction of wealth tax in Union Budget 2022-2023. This has been the new normal since the last two-three Budgets.

I doubt if the government would like to rock the applecart (by introducing new taxes or hiking existing ones).

Would the government not want to become popular with populist measures like a wealth tax just before elections to five states?

Introduction of wealth tax is no brainer. It won't find any place in the Union Budget. It won't have the same electrifying impact on voters in Uttar Pradesh as the positive impact of demonetisation.

Most voters won't understand what wealth tax is and it won't appeal to them as much as say the event of demonetisation. That generated huge political capital. Introduction of 1 per cent, 5 per cent or 10 per cent wealth tax won't much impact on how voters at the grassroots will cast their vote.

What then explains the sharp selloff in the markets since last five days?

It's a mix of geo-political tensions in the Middle East, Ukraine and also the pace at which US Fed goes about hiking interest rates in order to rein in inflation in America.

Earnings (quarterly results of Indian companies) so far too have been a mixed bag.

In this scenario, are you expecting FII selling to continue unabated?

In the past when FIIs were selling hands down, there was decent amount of support from retail investors. This time around a lot of retail investors have been stuck in way too many stocks at way too high prices.

In the last four-five months you have had number of stocks shooting up, distribution happening (institutional and high net worth individuals selling stocks at higher prices to retail investors) and stocks coming down (after retail investors buy at higher prices). Many of such stocks have lost 20 to 30 per cent easily in just a few trading sessions.

The latest and the most visible stock is TTML (In September 2021, the stock was quoting at Rs 34. Then it hit Rs 290 on January 11, 2022 and since then has been hitting lower circuits to close at Rs 183 on January 24). There are number of other stocks like this one with huge retail participation.

Typically, retail investors enter at higher levels, then distribution happens, and stock gets back to lower levels. Just because the broader markets were doing well, the indices were going up, retail money poured in and that further kept fueling the market boom.

And now, you have all kinds of worries and concerns surfacing and this keeps repeating in every bull market cycle. The pain point for retail investors remains the same.

What have you been advising them and what would be your advice for them now?

I have been telling retail investors to book profits if they have made good money since the last three-four months. I had asked them to sit on the sidelines for a while.

Of course, they should never sell 100 per cent of their winners in the market. But sit on cash if you have made good money. One doesn't see such kind of rallies every day.

I think the last such rally was seen after 2008-2009 but that too was spread over three-four years. Today, you were making all that money in just about 18 months.

Do you expect the selling to continue till the Budget unfolds?

I expect it should. We have already lost over 7 per cent and if this pace continues for a couple of days we would have corrected more than 10 per cent and that is when everybody will start panicking.

Earlier, we would see only three-four per cent correction over time followed by a solid rally that would erase all the losses. It was a given then that if the market corrects it was a buying opportunity.

Buy on dips and the markets rewarded you by going up. Now, if this trend stops working, retail investors would start panicking. Market is never different (behaviour of market participants is never different). It is always the same.

What would be your value picks if the carnage on Dalal Street continues till the Budget?

Value picks are always present in the market, but one should abstain from buying these when you are in a falling knife kind of situation.

As of now we are not there. This fall is nothing. We could see worse if everybody hits the panic button.

What levels would you consider safe for buying value picks?

If the carnage continues, then I see the level between 15,000 and 16,000 on Nifty as a solid buying zone. But if that breaks too, then I don't know (where the Nifty would settle).

Between these levels retail investors can start picking up quality stocks.

Just to give an idea, these could be HDFC Life, HDFC AMC, Kotak Bank, Dr Reddy's, Infosys, Maruti could be good picks.