The government plans to bring down its stake to 26 per cent in these two banks, which are yet to be identified.

This may not come in the way of getting investors for these banks, provided the government is willing to step back rather than run them the way it had been doing for over five decades since these banks were nationalised, points out Tamal Bandyopadhyay.

Yet another year, marked by pandemic, has ended.

A fortnight ago, a sharp drop in the rupee against the dollar must have given the regulator a few anxious moments, but the fall has been arrested and the local currency has bounced back even as foreign fund outflows continue. Meanwhile, the bond yields have been on the rise.

Let's do some crystal ball gazing for the trends and challenges for the financial sector in 2022.

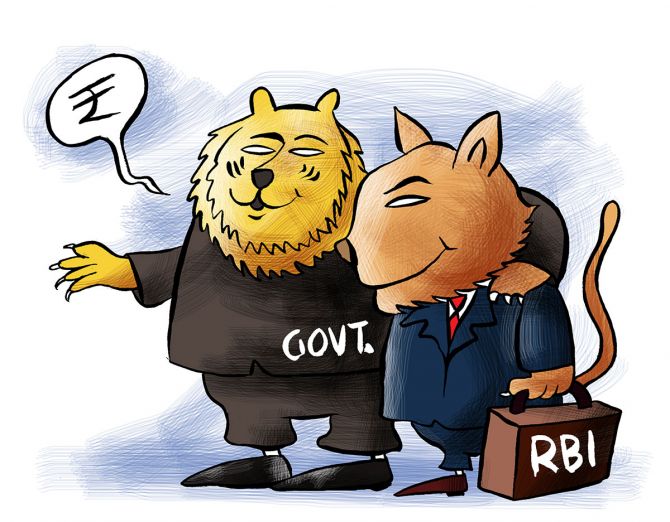

The Reserve Bank of India kept the policy rate unchanged in its last monetary policy of the year in December; its stance remains accommodative.

The 10-year bond yield dropped from 6.39 per cent to 6.34 per cent after the announcement. But it has been rising since, to touch 6.48 per cent -- up more than half a percentage point since the beginning of the 2021. It closed at 6.455 per cent on December 31.

Though a rate hike may still be a while away, market rates can only go up. The headline inflation could range between 5 and 5.5 per cent this year. Technically, it is still within the RBI's target (4 per cent within a band of +/- 2 per cent) but the goal post seems to have shifted (to 6 per cent). The market will extract the price.

This means, the cost of government borrowing in FY2023 will rise even though there is delay in the rate hike.

In the best case scenario, the size of the borrowing programme this year could remain the same as in FY2022 -- Rs 12.5 trillion -- but it won't be a cakewalk for the government unless the RBI extends a helping hand.

Of course, things will be different if India makes it to the global bond indices. Its inclusion in JP Morgan's global emerging market bond index could prompt $25 billion of inflows from foreign investors, a report says.

India could be included in two major global bond indices early this year, leading to the flow of foreign money into the bond market, lifting their prices and lowering the borrowing cost of the government. This will also have a positive impact on the stock market, corporate bonds and local currency.

The rupee, which traded at 72.27 a dollar in the second half of February last year, dropped to 76.31 on December 16, before bouncing back to 74.29.

The repo rate, at which the RBI infuses liquidity, was kept unchanged at 4 per cent in the central bank's last monetary policy committee meeting for the ninth time in a row, and the reverse repo rate, at which it sucks out liquidity, was at 3.35 per cent. But the RBI has strengthened the normalisation process, which started in October.

It has been using the variable reverse repo rate (VRRR) auctions to drain out liquidity. The amount of such auctions has been progressively increased and, from January onwards, liquidity absorption will be undertaken mainly through this route. Simply put, the RBI is making the 3.35 per cent reverse repo rate redundant. All short-term rates have been moving up.

As most global central banks have started tightening, India cannot remain insulated from this trend. First, there will be a reverse repo hike to bridge the gap between the two rates, and a repo hike will follow. Looking at the likely inflation and growth trajectory, there could be a couple of rate hikes this year.

The RBI has kept its real GDP growth estimate unchanged at 9.5 per cent for 2021-2022. Going beyond securing growth on a sustainable basis, the RBI wants to make it 'broad-based'.

Incidentally, almost every banker has started seeing demand for credit. Till September 2021, credit growth was mute and banks did not see any demand beyond retail loans.

Now, the trend is changing; corporations have started lifting money. The trend will strengthen in the coming months as the fence-sitters are in the process of giving final touches to their investment plans.

Since the December 2015 quarter, when the RBI initiated the asset quality review of banks to clean up their balance sheets, the September 2022 quarter has been the best, both for public sector and private banks in terms of earnings. This was possible because of a sharp drop in the provisions for bad loans. Once the great growth picks up, their earnings will only get better.

Most banks could afford to set aside less for bad loans since the bad loan pile has started shrinking, fresh slippages have been arrested and the bulk of such loans has already been provided for.

Barring a few exceptions, almost every bank was able to bring down both the gross and net non-performing assets in the September quarter. The scene is far better than what the RBI had estimated.

Will the trend continue? Let's wait and watch. Not all banks will have a good time in 2022. The RBI's latest health-check report indicates a rise in bad loans this year.

Some may face an existential crisis as the digital disruption intensifies. Nimble-footed non-banking financial companies and fintechs will create new markets where many old banks will fear to tread. Unless they change the way they function, these banks run the risk of becoming irrelevant.

At the same time, some NBFCs will see their bad loans rise as the RBI has tightened the screws. No more soft-touch regulations; they are being treated almost on a par with commercial banks.

In 2022, we may see the RBI opening the doors for new banks. The licence for both universal and small finance banks has been on tap, and there are a few seekers in the queue. With bank ownership norms fine-tuned, the central bank's expert committee may give its nod to a few.

Will we see the privatisation of two public sector banks this year, as promised in the February 2021 Budget? The work is on.

The government plans to bring down its stake to 26 per cent in these two banks, which are yet to be identified. This may not come in the way of getting investors for these banks, provided the government is willing to step back rather than run them the way it had been doing for over five decades since these banks were nationalised.

Finally, will the cryptocurrency conundrum be solved? Though the RBI would rather allow cryptocurrency over its dead body, the government is under pressure from different quarters to not ban it.

All agree that it's not a currency. Is it an asset? Is it a commodity? Who will be the regulator? Many are asking these questions, while the industry is smartly selling the idea of cryptocurrency to policymakers, gift-wrapping it in its underlying technology, the blockchain.

The RBI, meanwhile, is busy preparing the roadmap for the central bank digital currency -- a wallet that is not a competition to crypto.

Tamal Bandyopadhyay, a consulting editor with Business Standard, is an author and senior adviser to Jana Small Finance Bank Ltd.